What Is An I10 Form - What is an itin used for? Getting an itin does not change your immigration status or your right. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. When you file your federal tax return, you will enter your itin in the same space where the form asks for a social security number. An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. Check if you're eligible for these benefits as an itin applicant and how to claim them: Apply on or before your tax return due date.

What is an itin used for? An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. Check if you're eligible for these benefits as an itin applicant and how to claim them: Getting an itin does not change your immigration status or your right. When you file your federal tax return, you will enter your itin in the same space where the form asks for a social security number. Apply on or before your tax return due date.

An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. Getting an itin does not change your immigration status or your right. When you file your federal tax return, you will enter your itin in the same space where the form asks for a social security number. Apply on or before your tax return due date. Check if you're eligible for these benefits as an itin applicant and how to claim them: What is an itin used for? Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or.

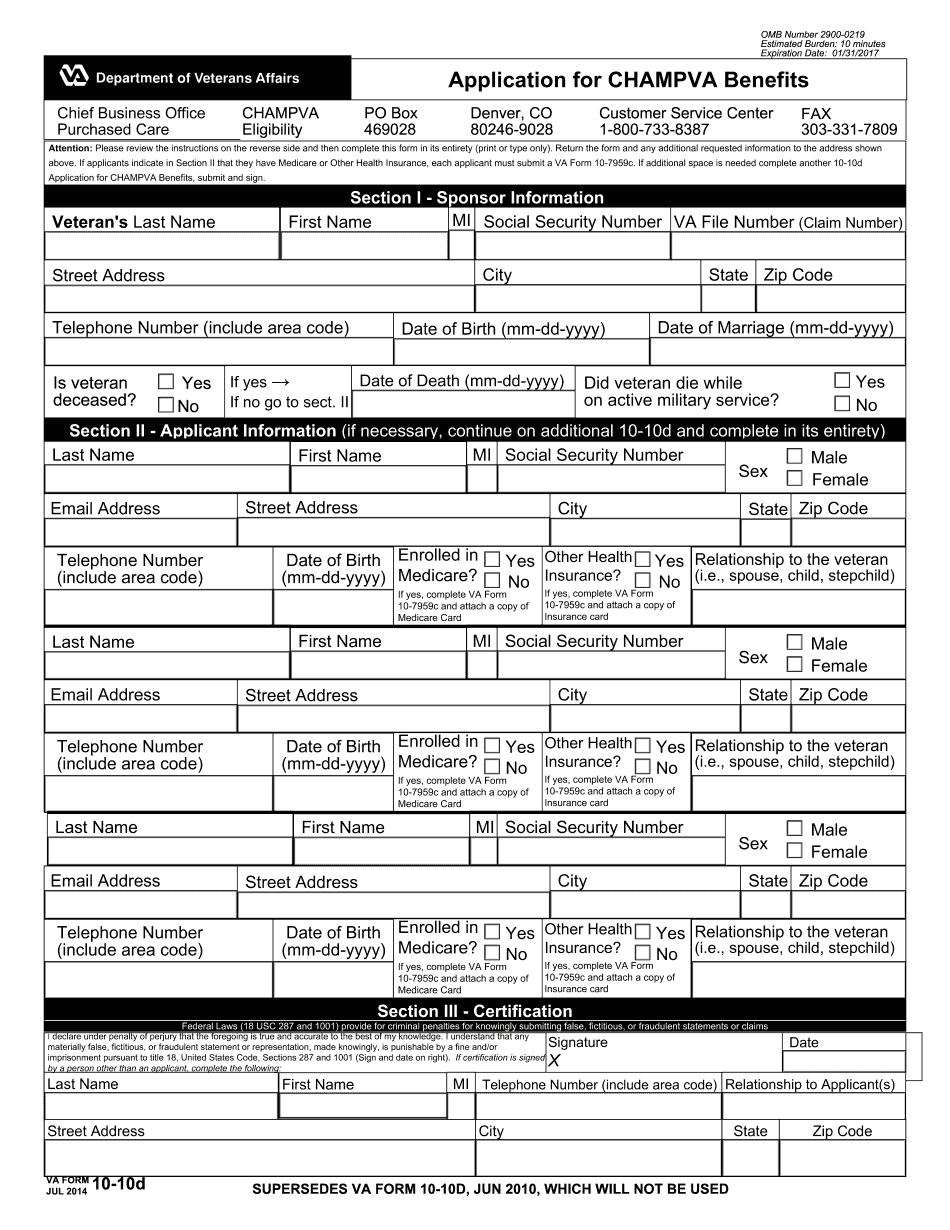

Form I10 10 Fillable Printable Forms and Tips

Getting an itin does not change your immigration status or your right. Check if you're eligible for these benefits as an itin applicant and how to claim them: Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. When you file your federal tax return, you.

Convert PDF To Fillable Va Form 10 10d And Keep Things Organized

What is an itin used for? When you file your federal tax return, you will enter your itin in the same space where the form asks for a social security number. Apply on or before your tax return due date. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual.

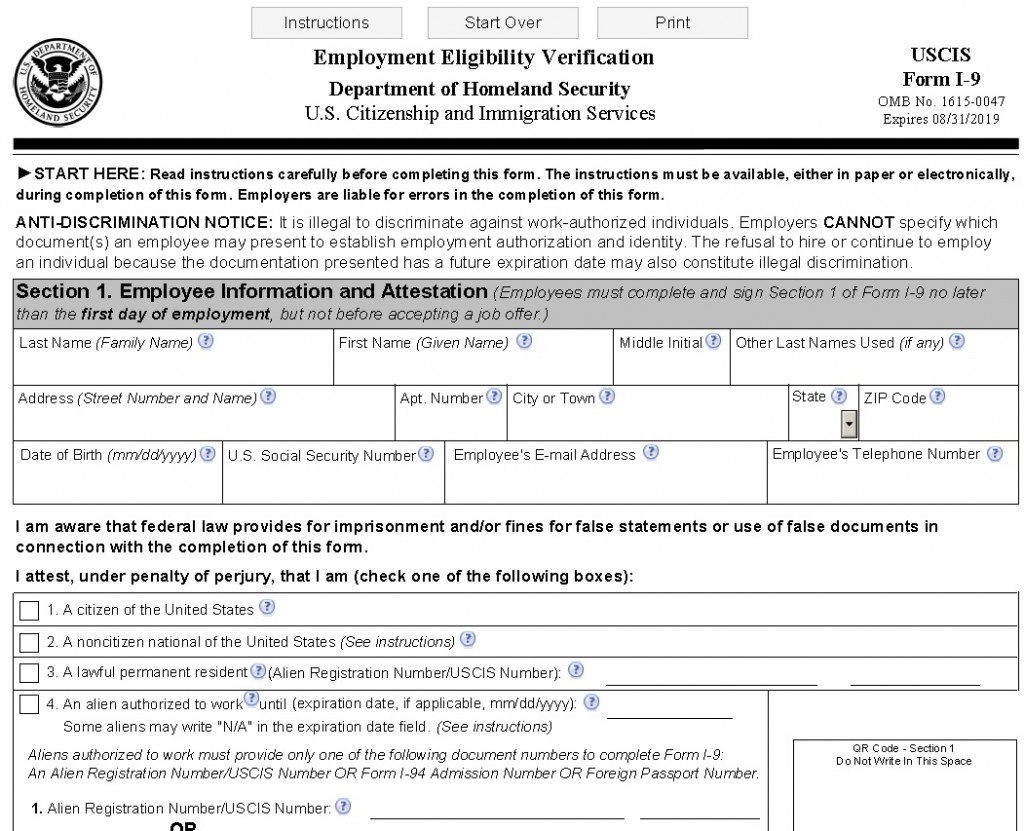

I 9 Forms 2025 Imran Faye

Check if you're eligible for these benefits as an itin applicant and how to claim them: Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. What is an itin used for? Apply on or before your tax return due date. An itin is mainly used.

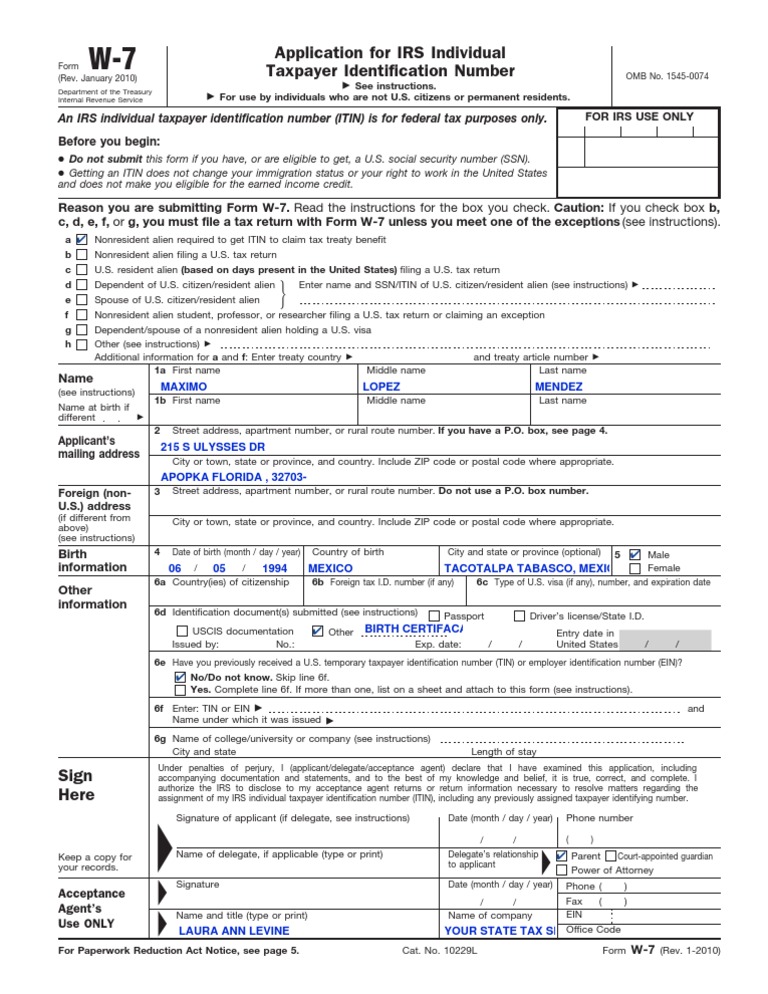

I10 FORM Tax Return (United States) Social Security Number

When you file your federal tax return, you will enter your itin in the same space where the form asks for a social security number. An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. Apply on or before your tax return due date. What.

Printable Id10t Form

Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. Check if you're eligible for these benefits as an itin applicant and how to claim them: Apply on or before your tax return due date. Getting an itin does not change your immigration status or your.

Examples Of Updated Form I9, 56 OFF

Check if you're eligible for these benefits as an itin applicant and how to claim them: What is an itin used for? An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. Anyone who needs to file a tax return and doesn’t have a social.

Fillable Immigration Forms PDFRun

Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. Apply on or before your tax return due date. An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. What is.

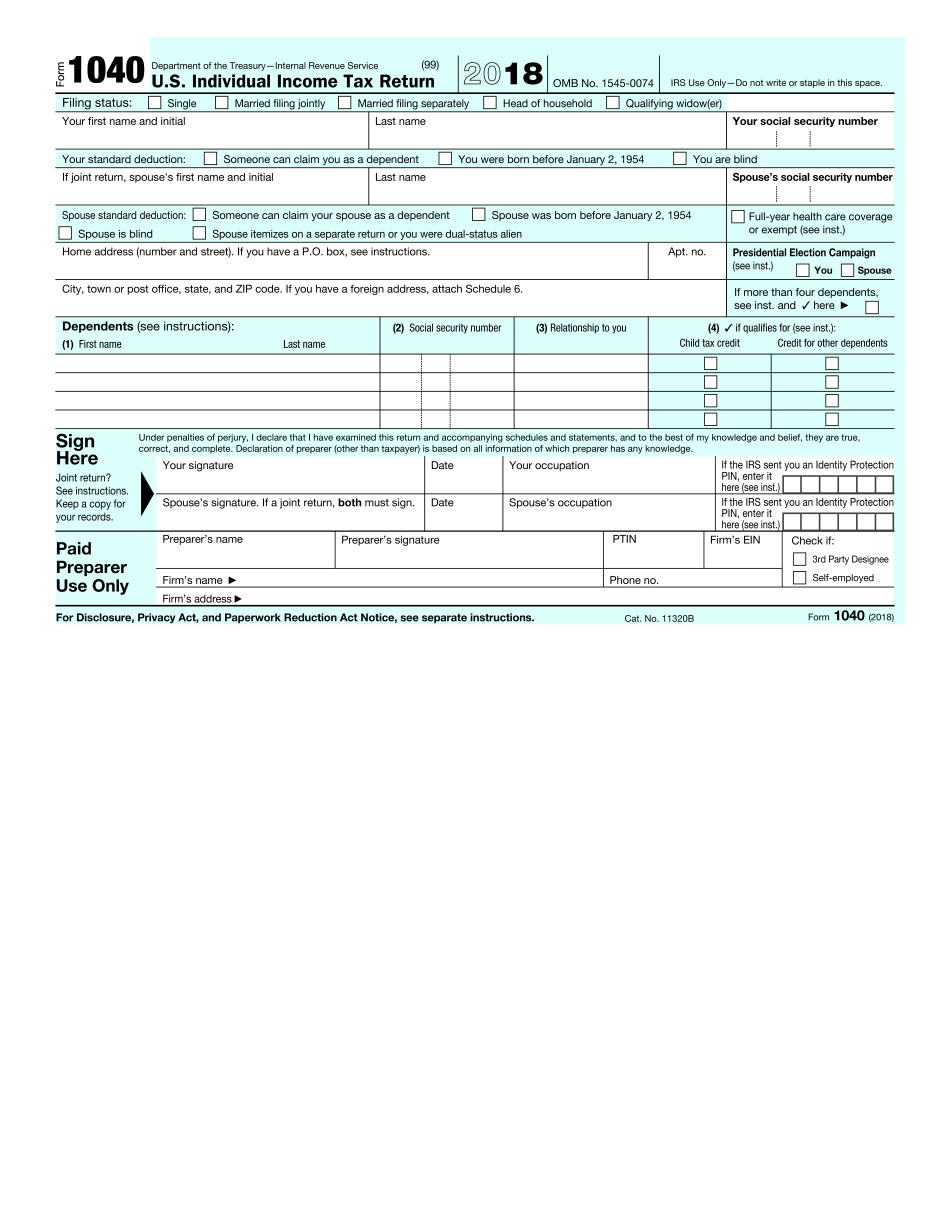

IRS 1040 Form Fillable & Printable in PDF

Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. Apply on or before your tax return due date. Check if you're eligible for these benefits as an itin applicant and how to claim them: When you file your federal tax return, you will enter your.

Examples of the 1099 Tax Form You Need to Know

An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. What is an itin used for? Check if you're eligible for these benefits as an itin applicant and how to claim them: Getting an itin does not change your immigration status or your right. Anyone.

U S Immigrant Form PDF Travel Visa Immigration

Apply on or before your tax return due date. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or. An itin is mainly used for filing tax returns, but it can also be used for other benefits, like opening a bank account at certain. When you.

Apply On Or Before Your Tax Return Due Date.

When you file your federal tax return, you will enter your itin in the same space where the form asks for a social security number. What is an itin used for? Check if you're eligible for these benefits as an itin applicant and how to claim them: Getting an itin does not change your immigration status or your right.

An Itin Is Mainly Used For Filing Tax Returns, But It Can Also Be Used For Other Benefits, Like Opening A Bank Account At Certain.

Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or.