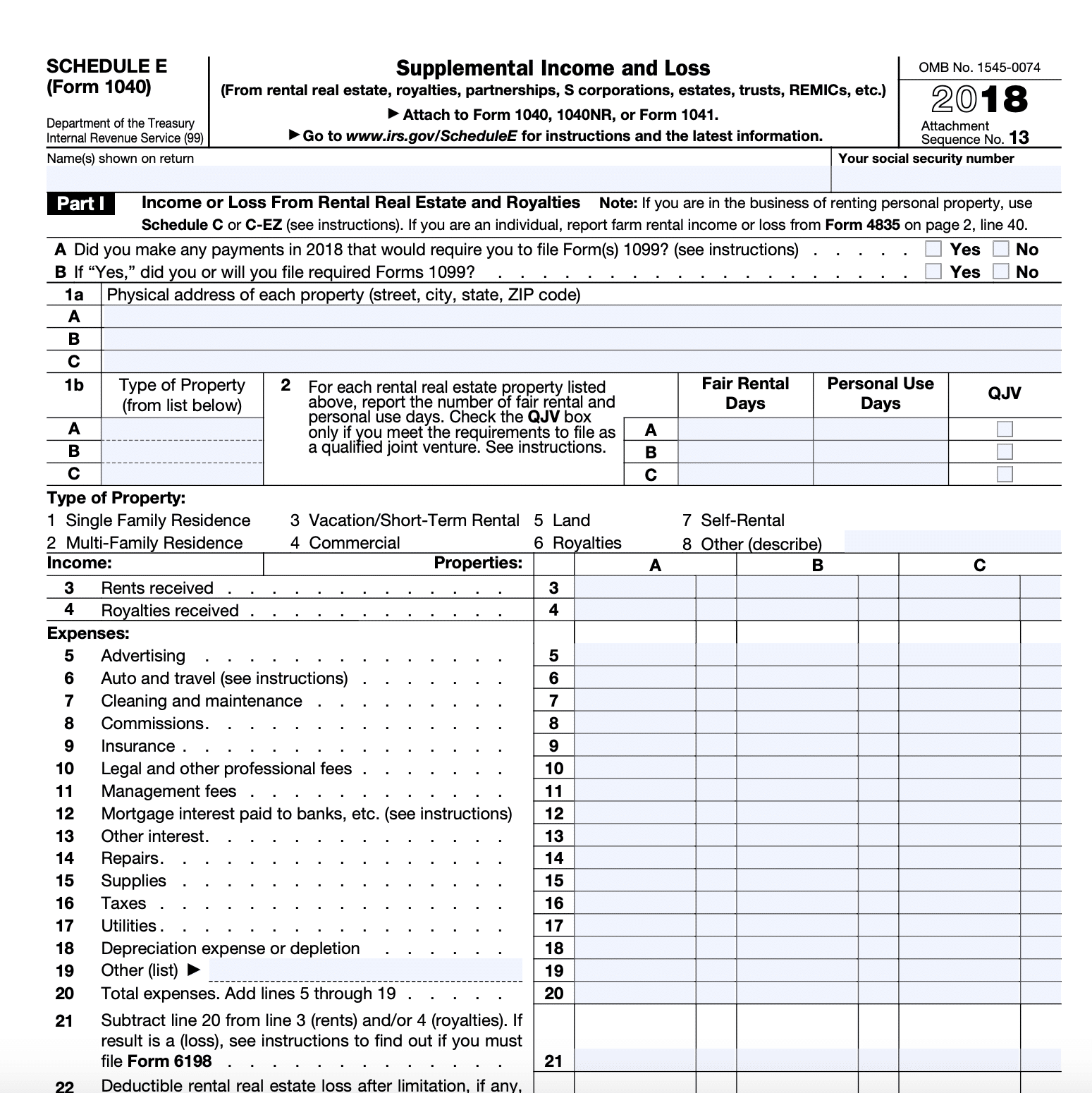

Schedule E Tax Form - Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Taxpayers need to complete a.

What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Taxpayers need to complete a. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and.

What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. Taxpayers need to complete a. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s.

Property Schedule Tax Benefits For Active And Passive Real

Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Taxpayers need to complete.

What Is 1040 Schedule 3 datadome

Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. Taxpayers need to complete a. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. What is.

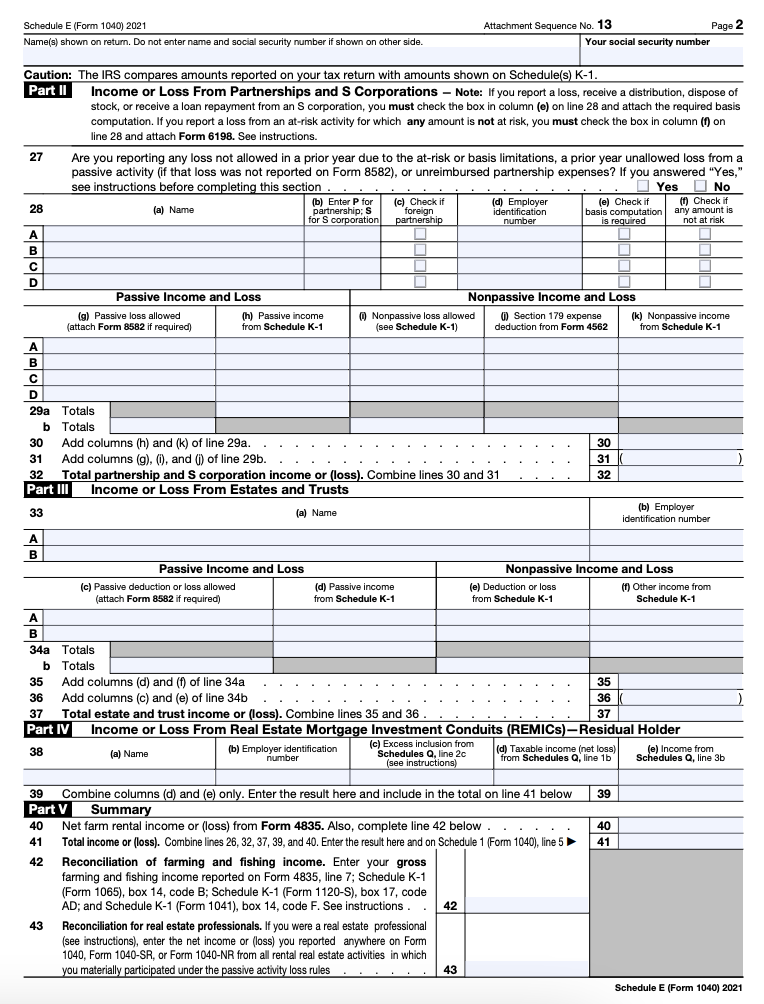

IRS Schedule E The Ultimate Guide for Real Estate Investors

Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Schedule e is a tax form used to report income or loss from less common sources.

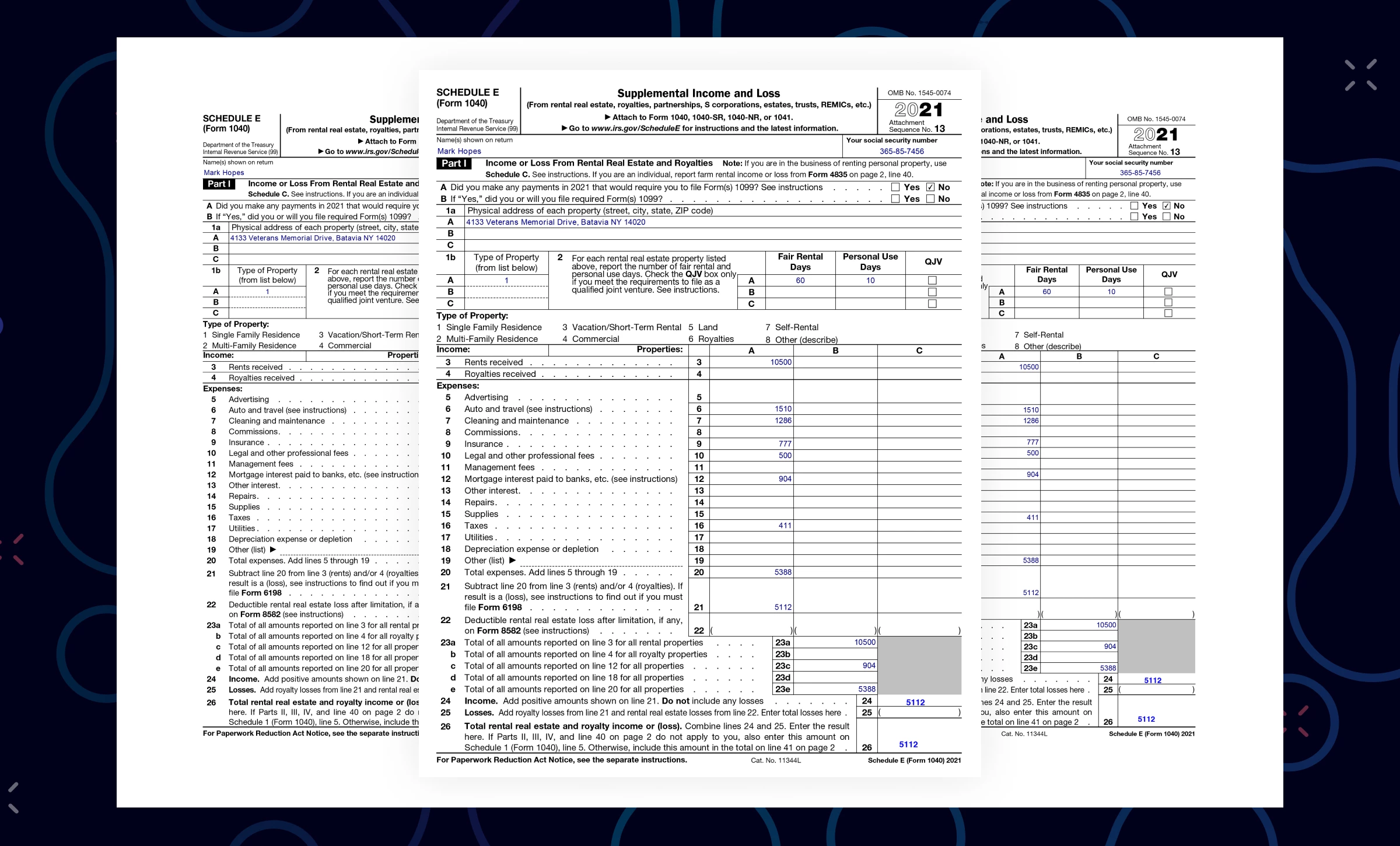

Form 1040, Schedule ESupplemental and Loss PDF

Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Taxpayers need to complete.

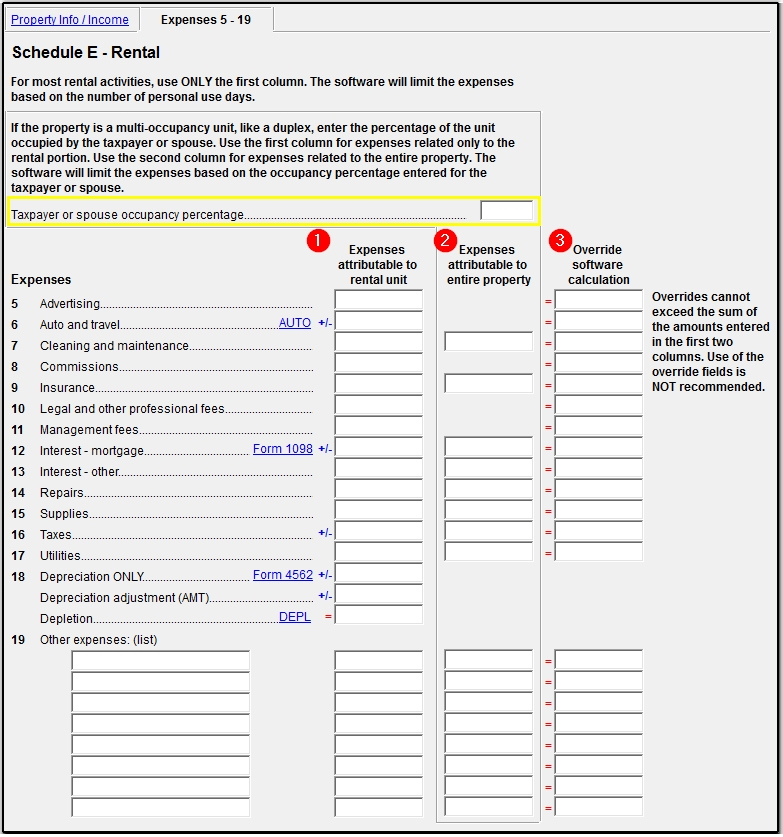

A Breakdown of your Schedule E Expense Categories

What is schedule e on form 1040 and how does it affect your taxes? Taxpayers need to complete a. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or.

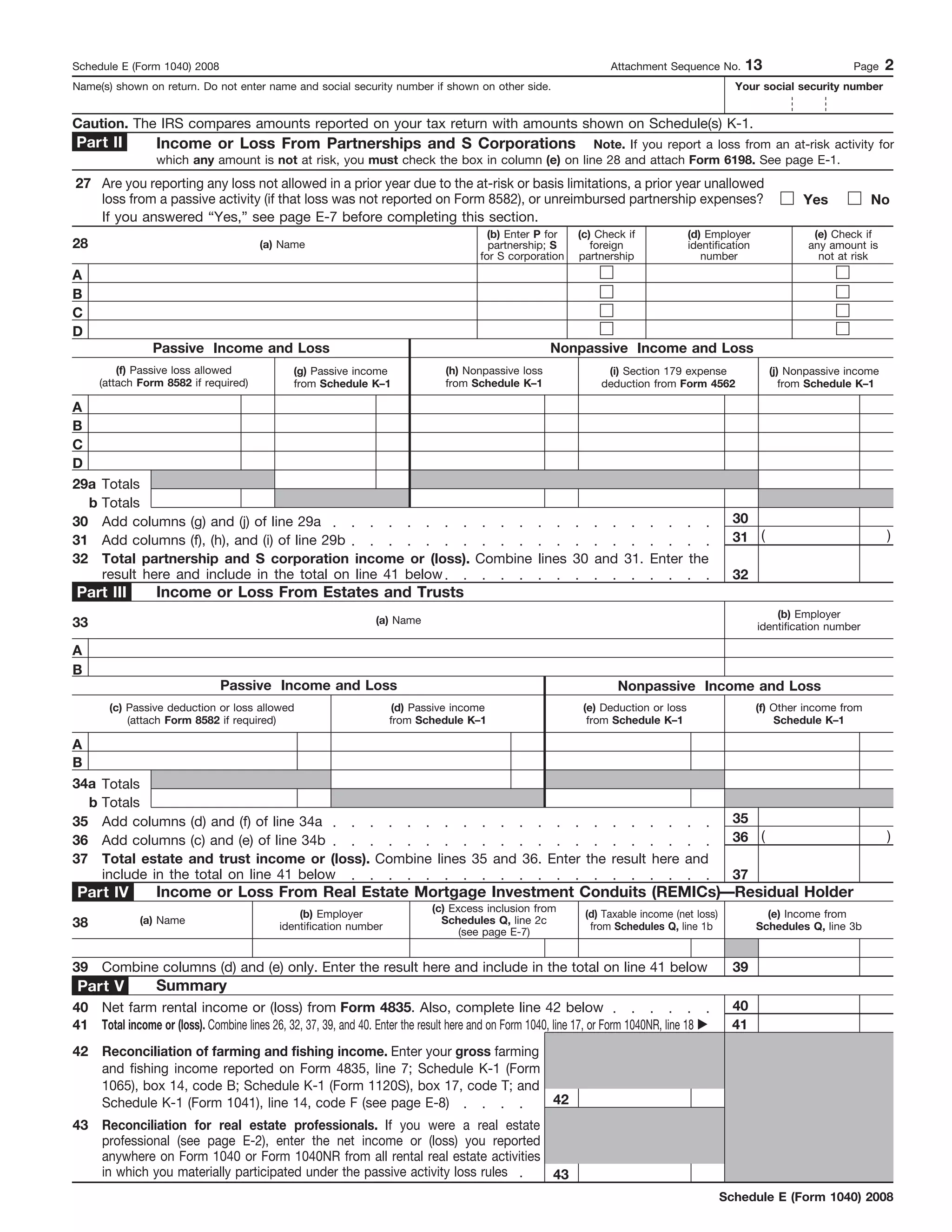

Printable Schedule E Tax Form Printable Forms Free Online

What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or loss from less common sources.

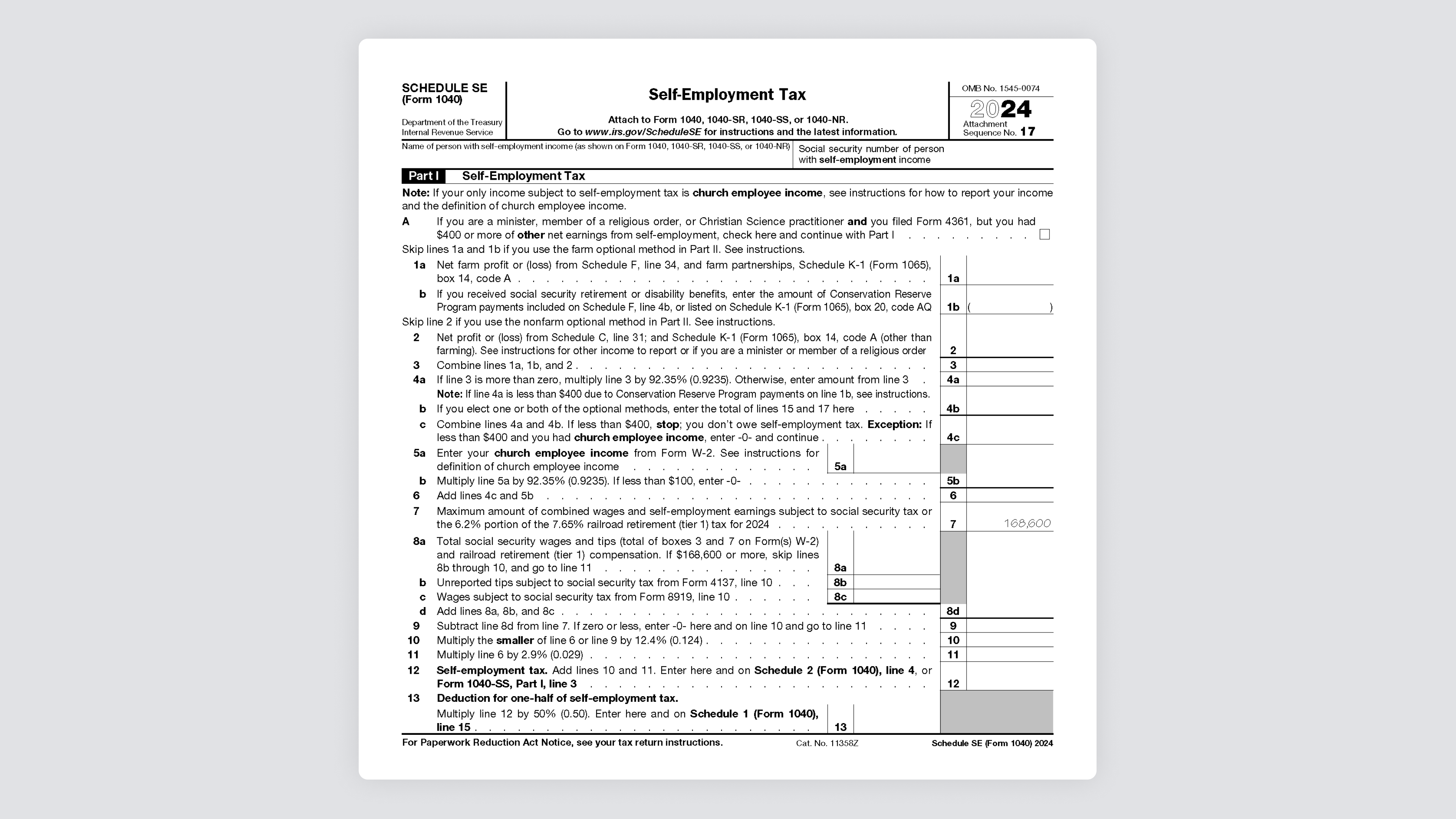

A StepbyStep Guide to the Schedule SE Tax Form

What is schedule e on form 1040 and how does it affect your taxes? Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Taxpayers need to complete a. Schedule e is a tax form that.

What Is A Schedule E For at John Rosado blog

Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Taxpayers need to complete a. What is schedule e on form 1040 and how does it affect your.

What Is Schedule E? Here’s an Overview and Summary!

Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s. Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040.

IRS Schedule E Instructions Supplemental and Loss

What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or loss from less common sources.

What Is Schedule E On Form 1040 And How Does It Affect Your Taxes?

Schedule e is a tax form that individual taxpayers must file to the irs along with their form 1040. Learn how schedule e on form 1040 reports supplemental income and. Taxpayers need to complete a. Schedule e is a tax form used to report income or loss from less common sources including rental real estate, royalties, partnerships, s.