Research And Development Tax Credit Form - Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Esd will issue a certificate of tax credit showing the amount of tax credit allowed and the tax year the credit may be claimed. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. As part of the process, they need to identify. It includes not only the calculation of the. Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return.

Esd will issue a certificate of tax credit showing the amount of tax credit allowed and the tax year the credit may be claimed. Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. It includes not only the calculation of the. As part of the process, they need to identify.

Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. As part of the process, they need to identify. Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. It includes not only the calculation of the. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Esd will issue a certificate of tax credit showing the amount of tax credit allowed and the tax year the credit may be claimed.

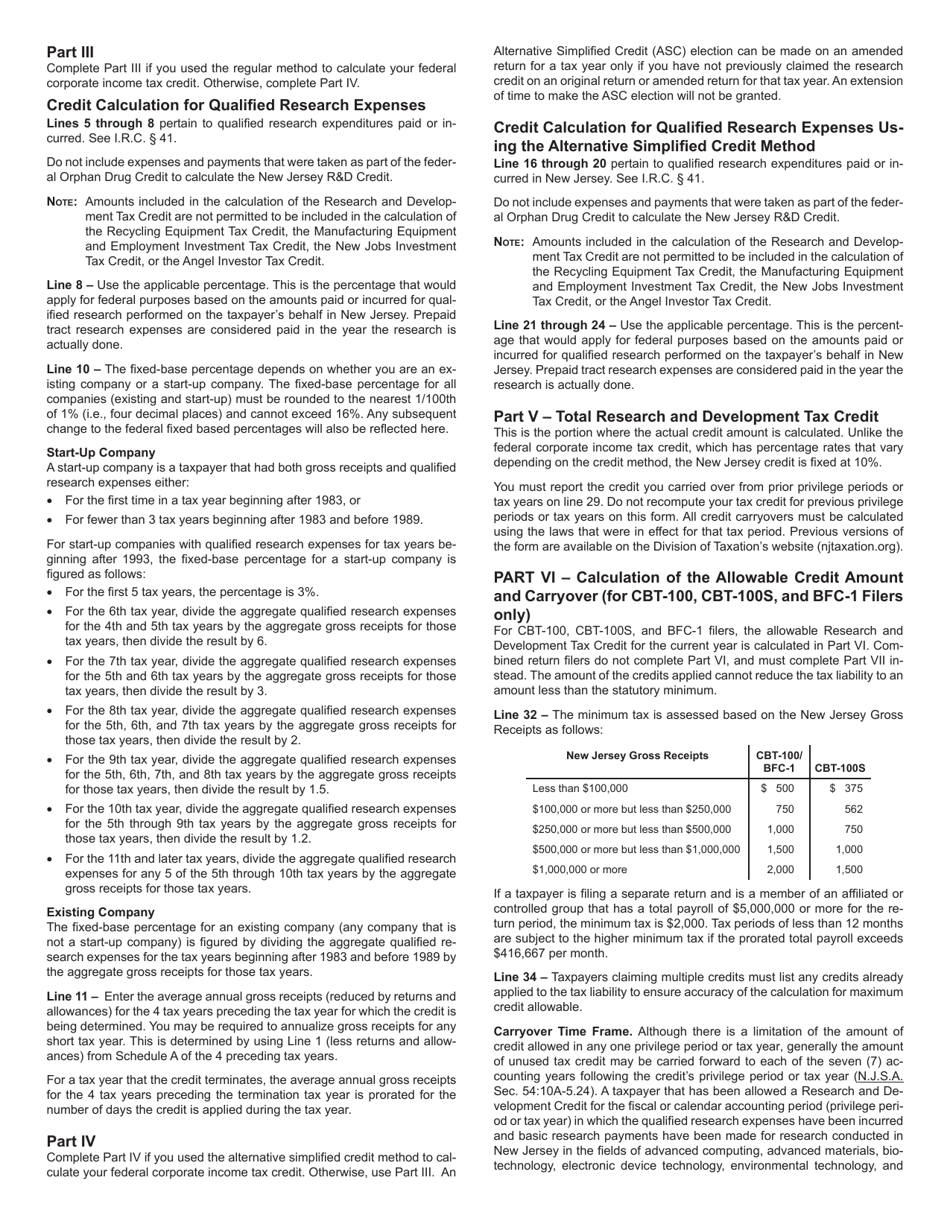

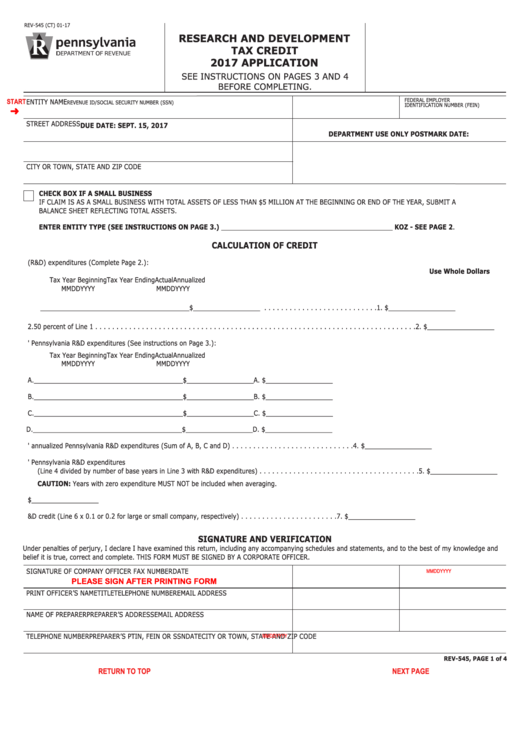

REV545 2015 Research and Development Tax Credit Application Free

Esd will issue a certificate of tax credit showing the amount of tax credit allowed and the tax year the credit may be claimed. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. It includes not only the calculation of the. Form 6765 is the official form for reporting.

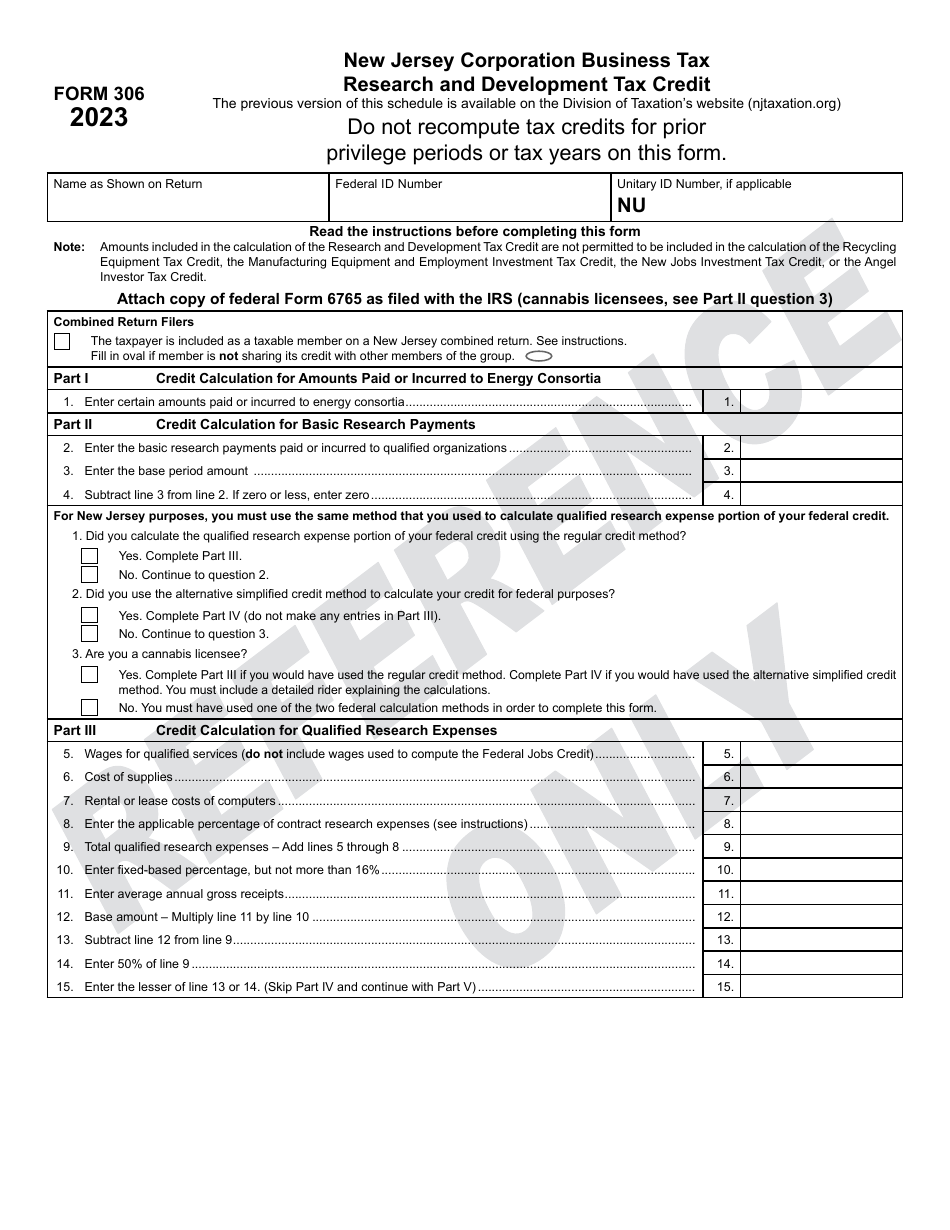

Form 306 Download Printable PDF or Fill Online Research and Development

Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. As part of the process, they need to identify. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Businesses that perform research and development (r&d) activities and would like to claim.

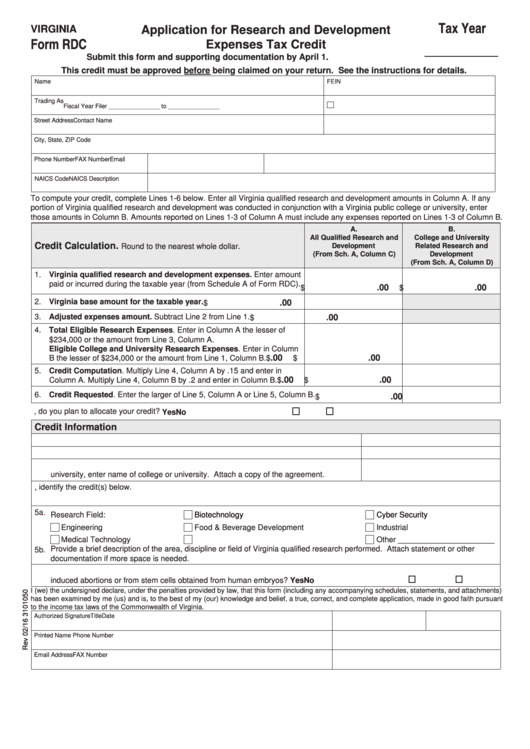

Fillable Form Rdc Application For Research And Development Expenses

Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. As part of the process, they need to identify. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Esd will issue a certificate of tax credit showing the amount of tax credit allowed.

Form 306 2021 Fill Out, Sign Online and Download Printable PDF, New

Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. It includes not only the calculation of the. Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. Information about form 6765, credit for increasing research activities, including recent updates,.

RDC RDC Research and Development Tax Credit Application Fill out

Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. It includes not only the calculation of the. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing.

Fillable Form Rev545 (Ct) Research And Development Tax Credit

Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. As part of the process, they need to identify. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Information about form 6765, credit for increasing research activities, including recent updates, related.

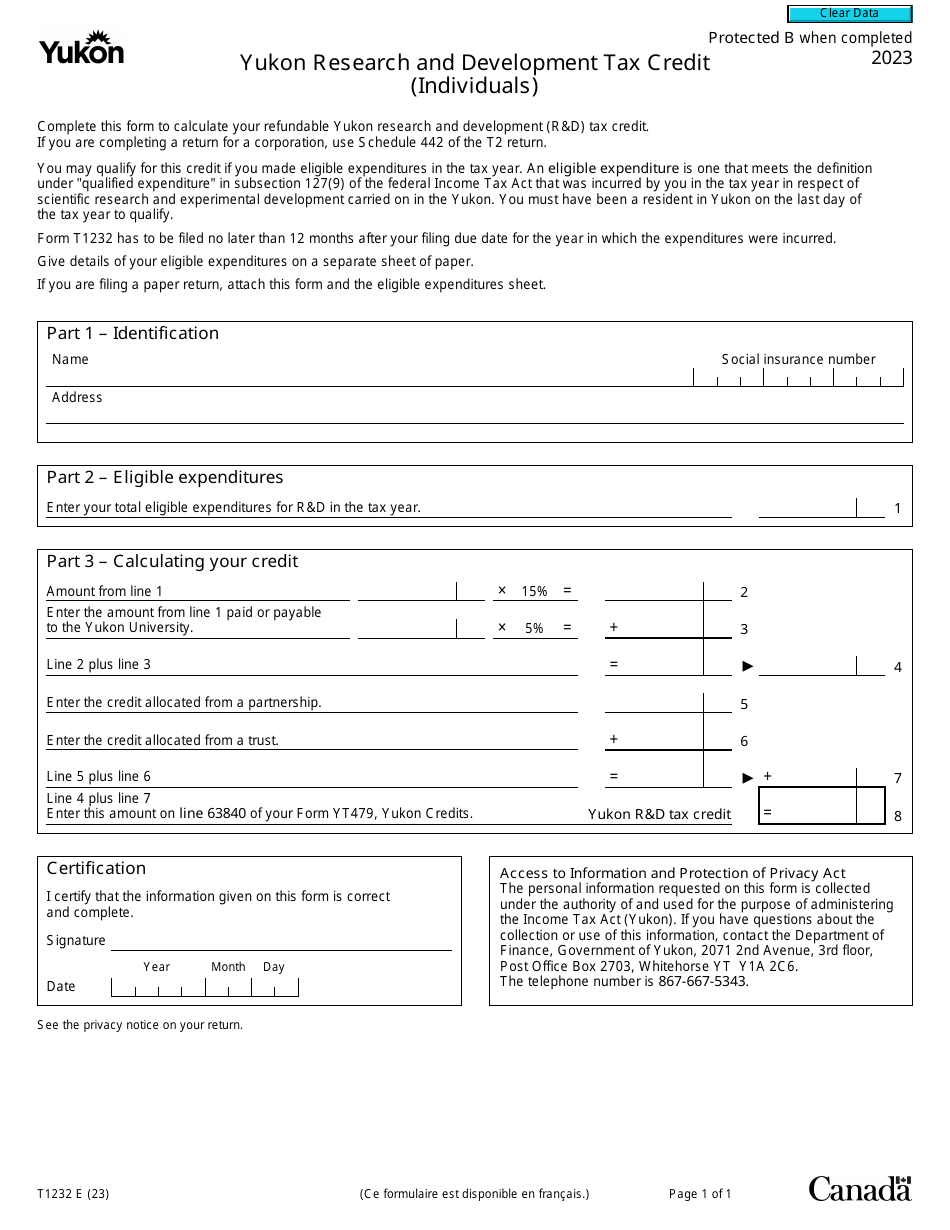

Form T1232 Download Fillable PDF or Fill Online Yukon Research and

As part of the process, they need to identify. It includes not only the calculation of the. Esd will issue a certificate of tax credit showing the amount of tax credit allowed and the tax year the credit may be claimed. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to.

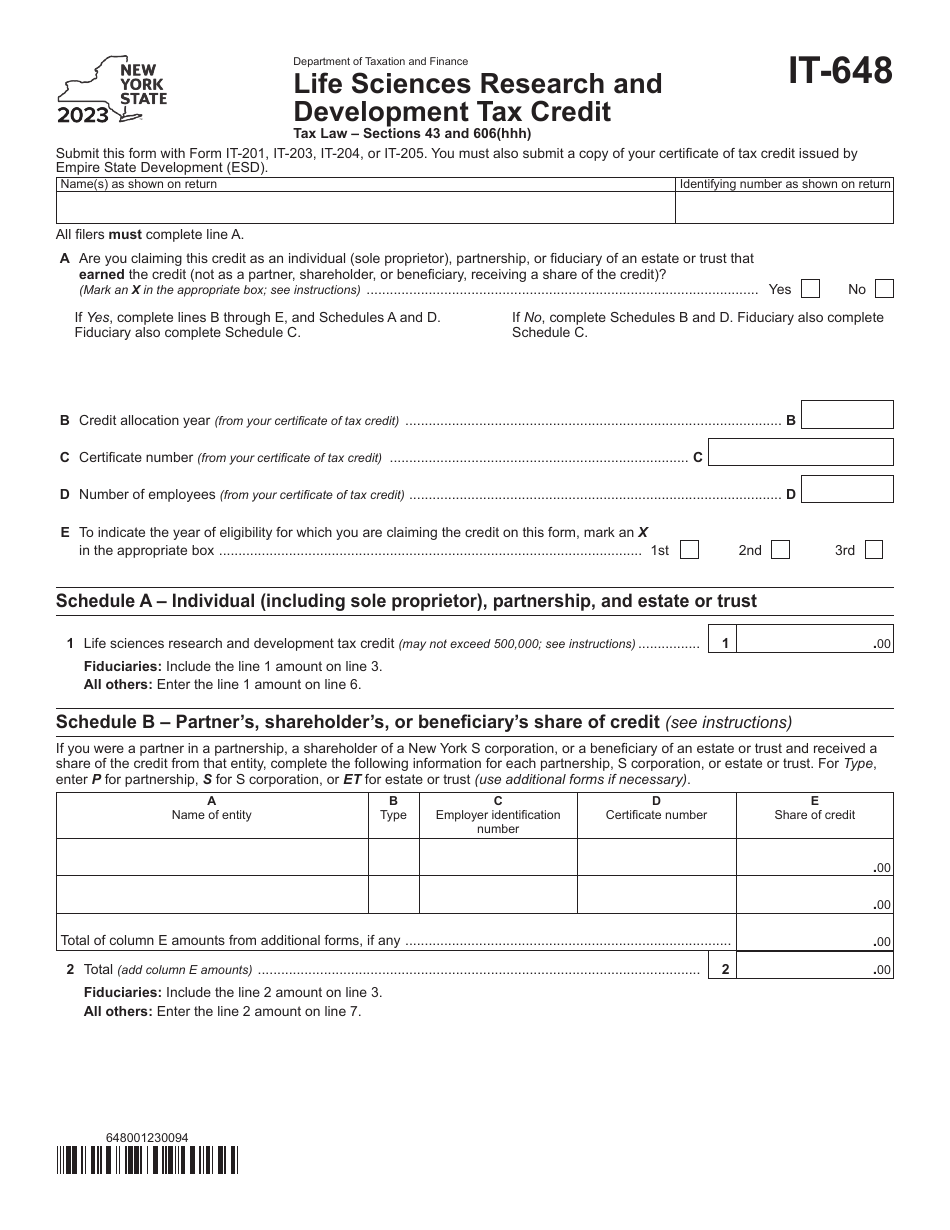

Form IT648 Download Fillable PDF or Fill Online Life Sciences Research

Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. As part of the process, they need to identify. Esd will issue a certificate of tax credit showing the amount.

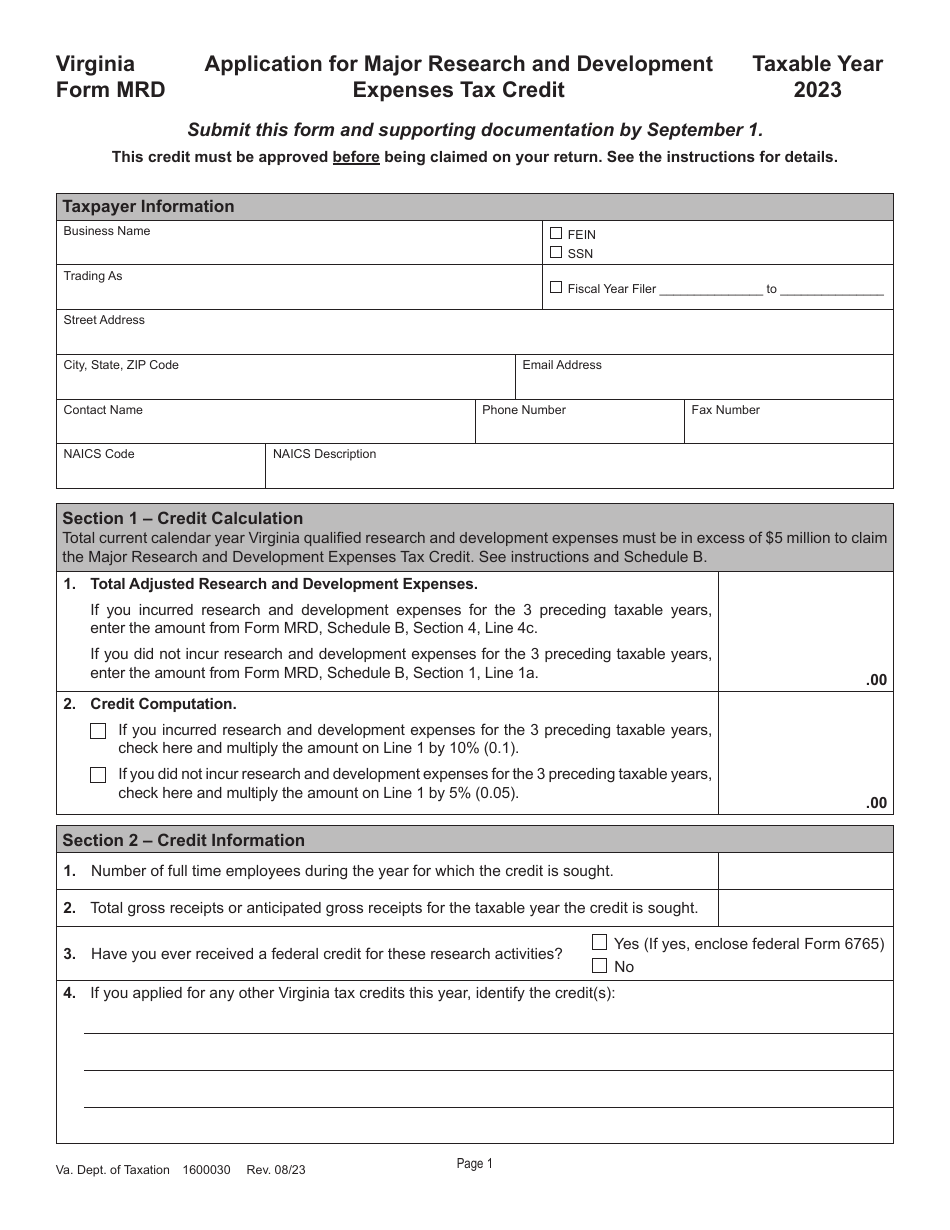

Form MRD Download Fillable PDF or Fill Online Application for Major

As part of the process, they need to identify. It includes not only the calculation of the. Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. Information about form.

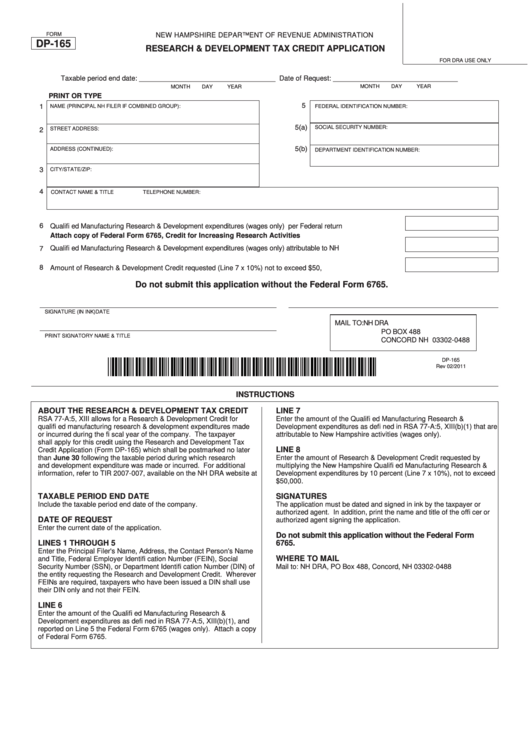

Fillable Form Dp165 Research And Development Tax Credit Application

Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. Businesses that perform research and development (r&d) activities and would like to claim a tax credit for those activities must file form. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file..

Businesses That Perform Research And Development (R&D) Activities And Would Like To Claim A Tax Credit For Those Activities Must File Form.

Form 6765 is the official form for reporting an r&d tax credit claim on a federal tax return. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. It includes not only the calculation of the. As part of the process, they need to identify.

Information About Form 6765, Credit For Increasing Research Activities, Including Recent Updates, Related Forms And Instructions On How To File.

Esd will issue a certificate of tax credit showing the amount of tax credit allowed and the tax year the credit may be claimed.