Iras Forms - Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Types of iras include traditional. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options.

Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Types of iras include traditional.

Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Types of iras include traditional.

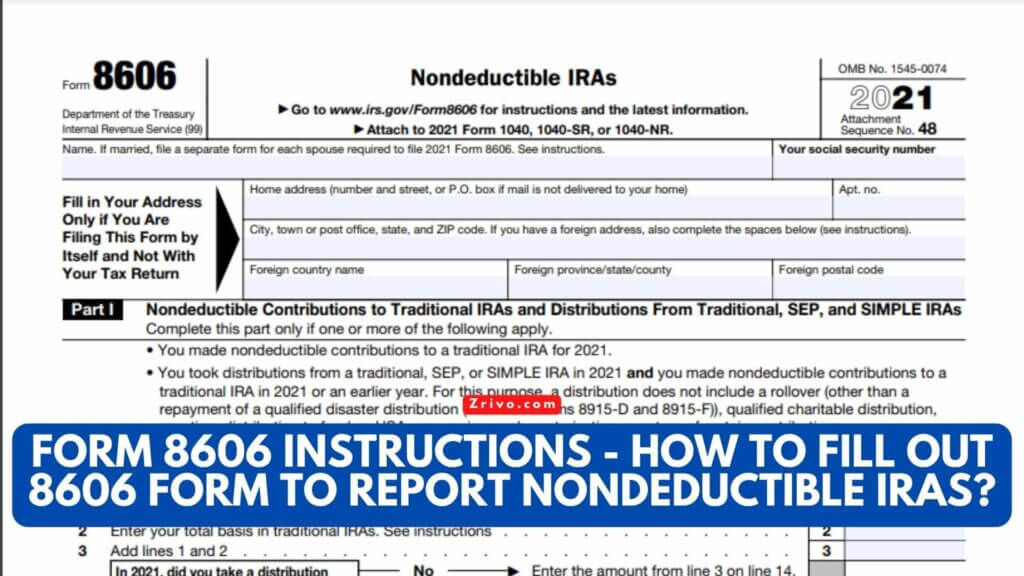

5 IRA Tax Forms Every SDIRA Holder Should Know

Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Types of iras include traditional. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options.

Payroll IRAS Tax forms for Employers eHR Payroll Payroll

Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Types of iras include traditional. Individual retirement accounts (iras) are retirement savings accounts with tax advantages.

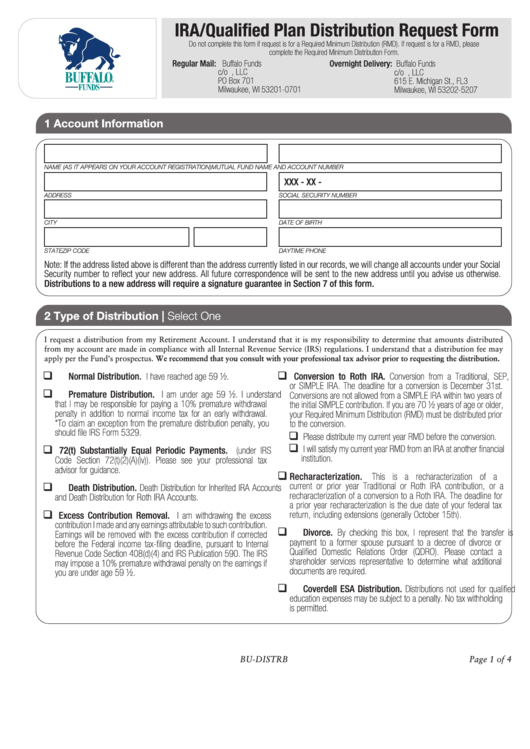

36 Ira Forms And Templates free to download in PDF

Types of iras include traditional. Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options.

Ira single form Fill out & sign online DocHub

Types of iras include traditional. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Individual retirement accounts (iras) are retirement savings accounts with tax advantages.

IRS Form 5498 A Guide to IRA Contributions

Types of iras include traditional. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Individual retirement accounts (iras) are retirement savings accounts with tax advantages.

2024 Form 8606 Instructions How To Fill Out 8606 Form To Report

Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Types of iras include traditional.

Payroll IRAS Tax forms for Employers eHR Payroll Payroll

Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Types of iras include traditional. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options.

Bank Ira Form ≡ Fill Out Printable PDF Forms Online

Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Types of iras include traditional. Individual retirement accounts (iras) are retirement savings accounts with tax advantages.

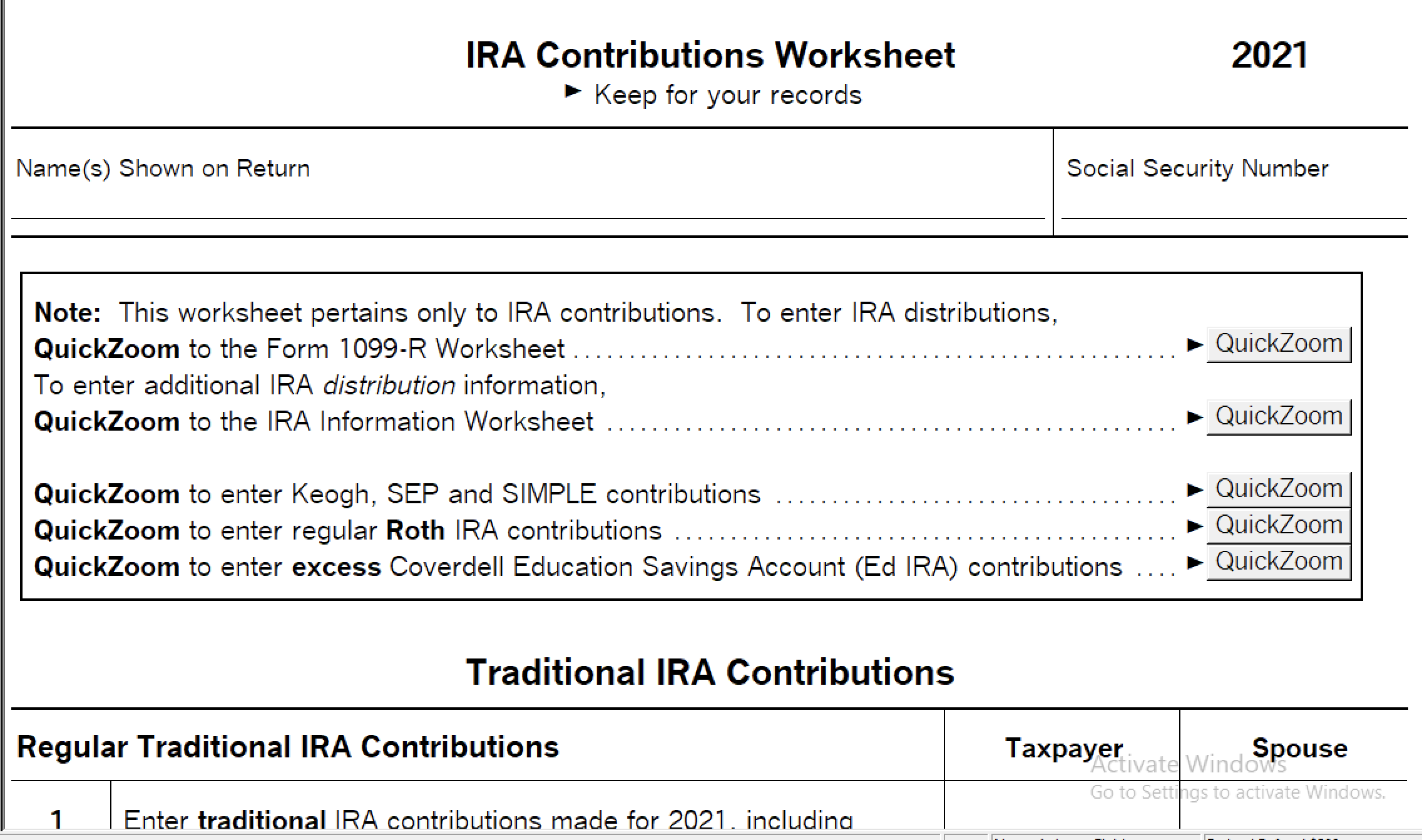

Entering IRA contributions in a 1040 return in ProSeries

Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Types of iras include traditional.

Traditional IRA Distribution Form Wolters Kluwer

Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options. Individual retirement accounts (iras) are retirement savings accounts with tax advantages. Types of iras include traditional.

Individual Retirement Accounts (Iras) Are Retirement Savings Accounts With Tax Advantages.

Types of iras include traditional. Individual retirement accounts (iras) are personal retirement savings plans that offer tax benefits and a range of investment options.