Hawaii Form N-30 Instructions 2023 - Please see our hawaii tax forms (alphabetical listing). Our tax forms and instructions are designed to work optimally with adobe reader dc. For a real estate investment trust (reit). A combined return of a unitary group of. If you are using a browser to view the form, then. The department of taxation’s forms and instructions, as well as many.

Please see our hawaii tax forms (alphabetical listing). Our tax forms and instructions are designed to work optimally with adobe reader dc. A combined return of a unitary group of. The department of taxation’s forms and instructions, as well as many. For a real estate investment trust (reit). If you are using a browser to view the form, then.

A combined return of a unitary group of. The department of taxation’s forms and instructions, as well as many. Our tax forms and instructions are designed to work optimally with adobe reader dc. Please see our hawaii tax forms (alphabetical listing). If you are using a browser to view the form, then. For a real estate investment trust (reit).

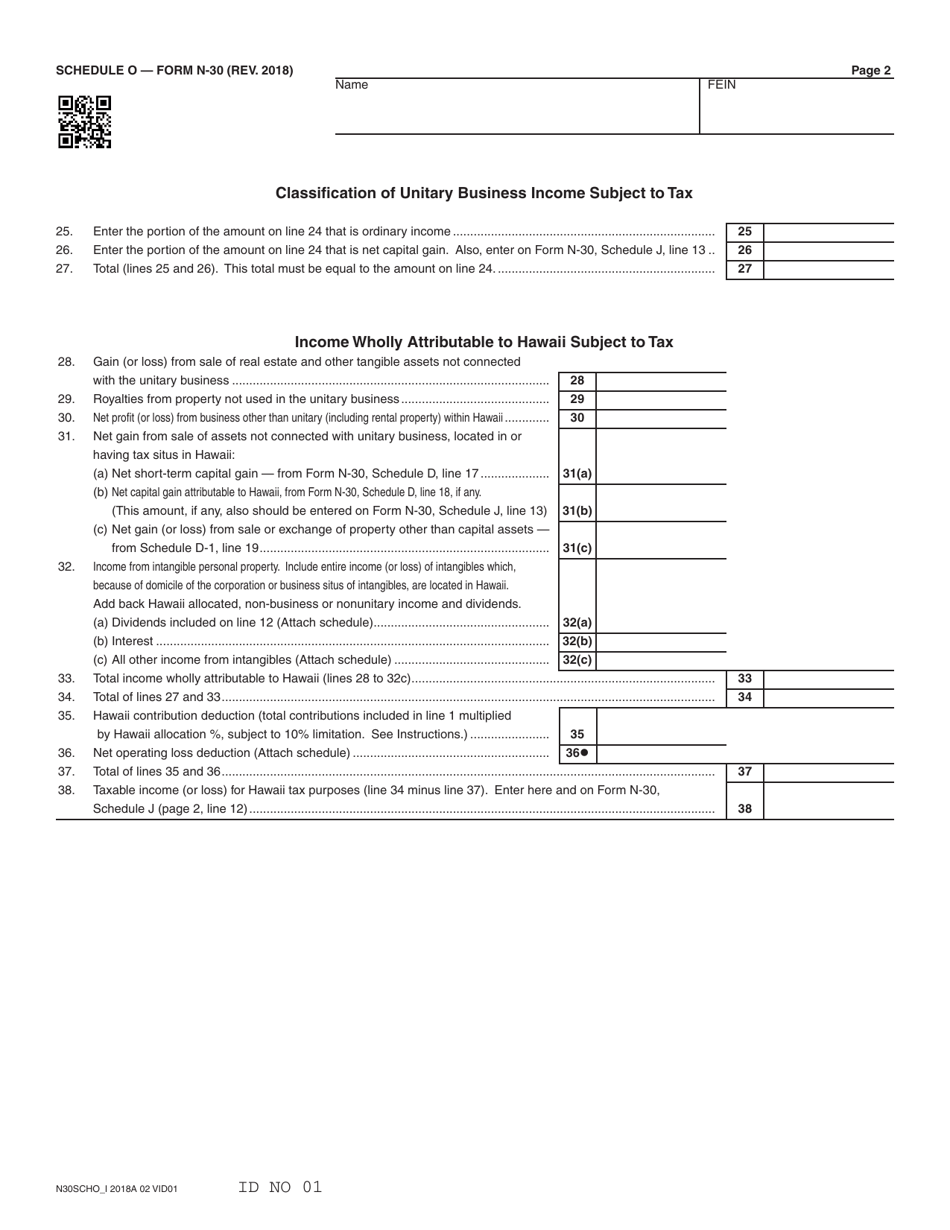

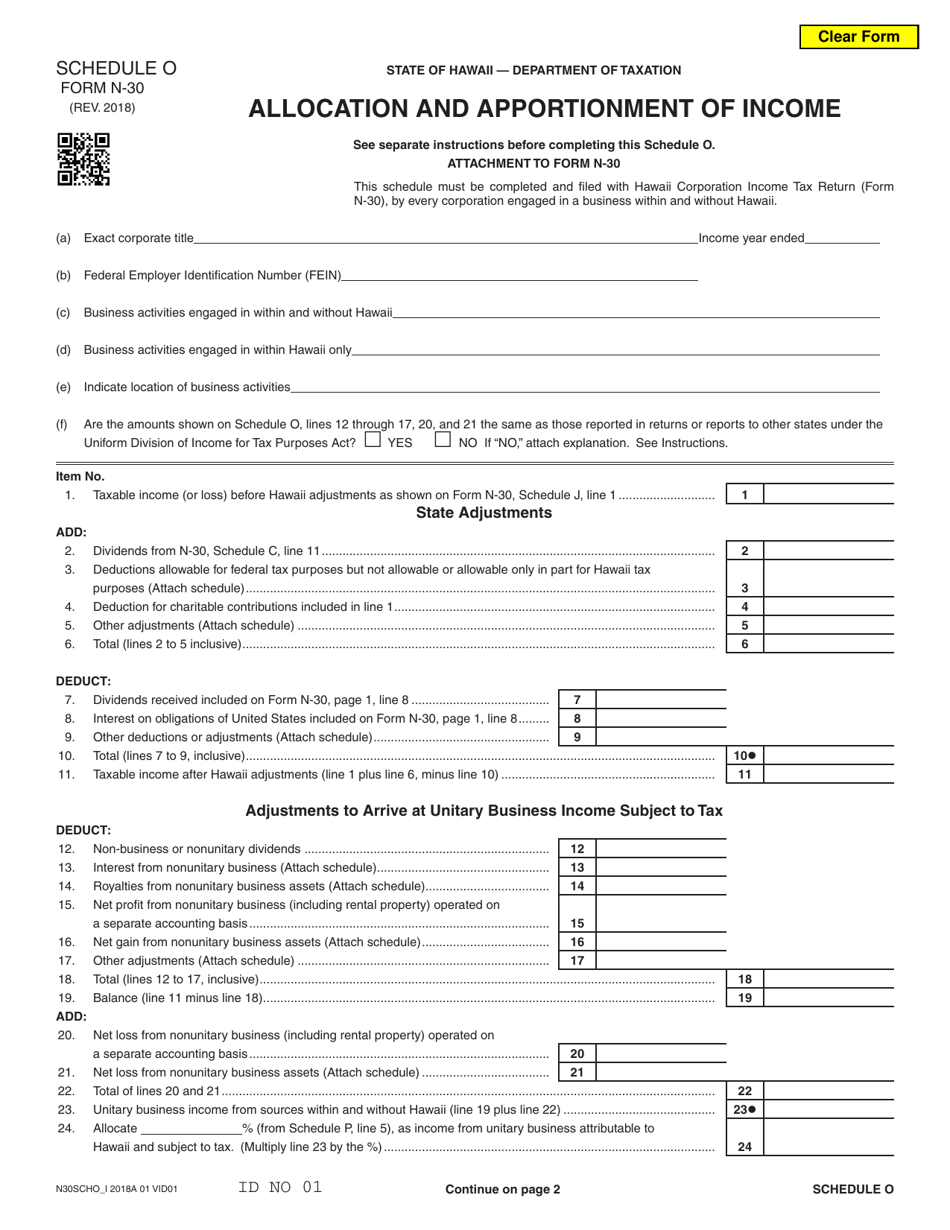

Form N30 Schedule O Download Fillable PDF or Fill Online Allocation

A combined return of a unitary group of. If you are using a browser to view the form, then. Our tax forms and instructions are designed to work optimally with adobe reader dc. Please see our hawaii tax forms (alphabetical listing). The department of taxation’s forms and instructions, as well as many.

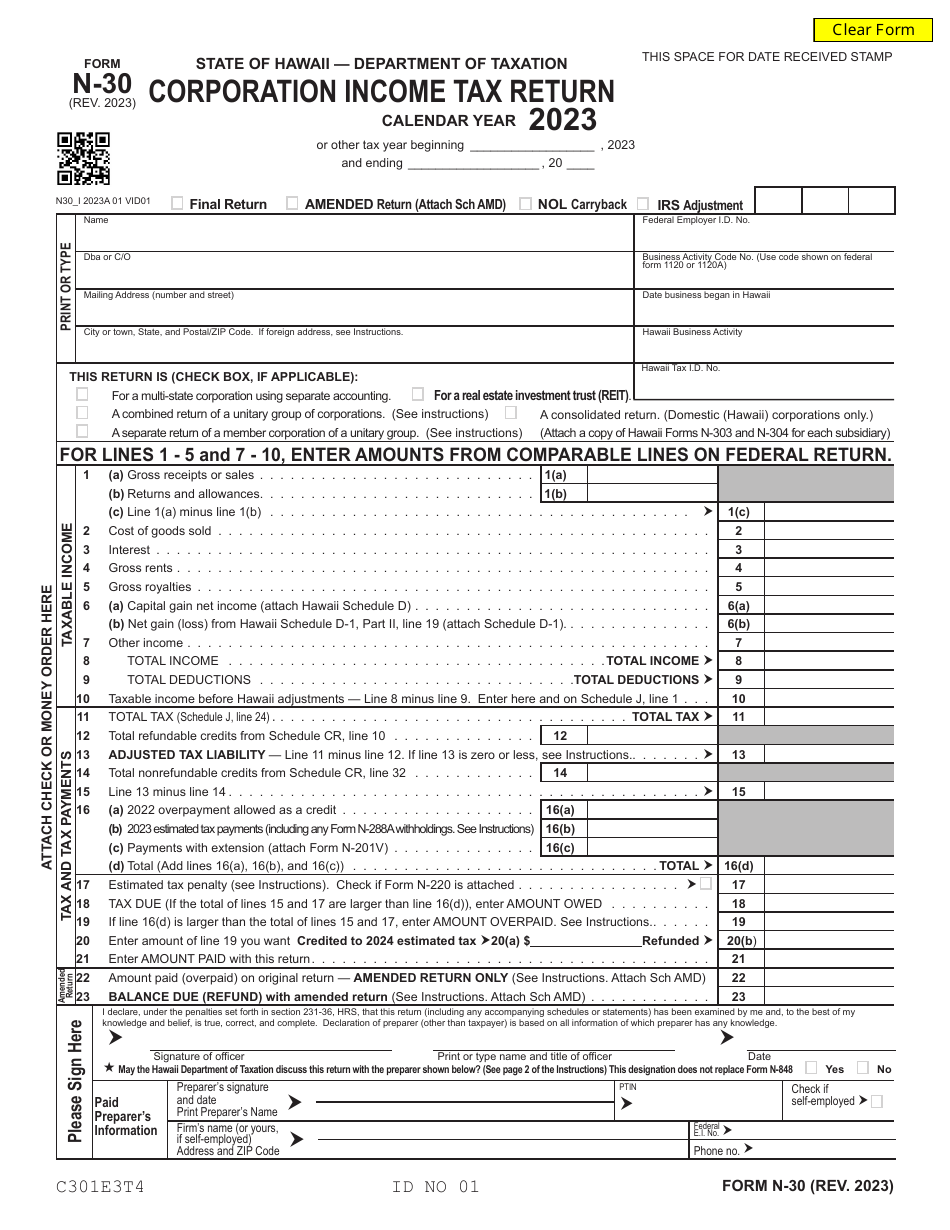

Form N30 Download Fillable PDF or Fill Online Corporation Tax

For a real estate investment trust (reit). A combined return of a unitary group of. If you are using a browser to view the form, then. Please see our hawaii tax forms (alphabetical listing). The department of taxation’s forms and instructions, as well as many.

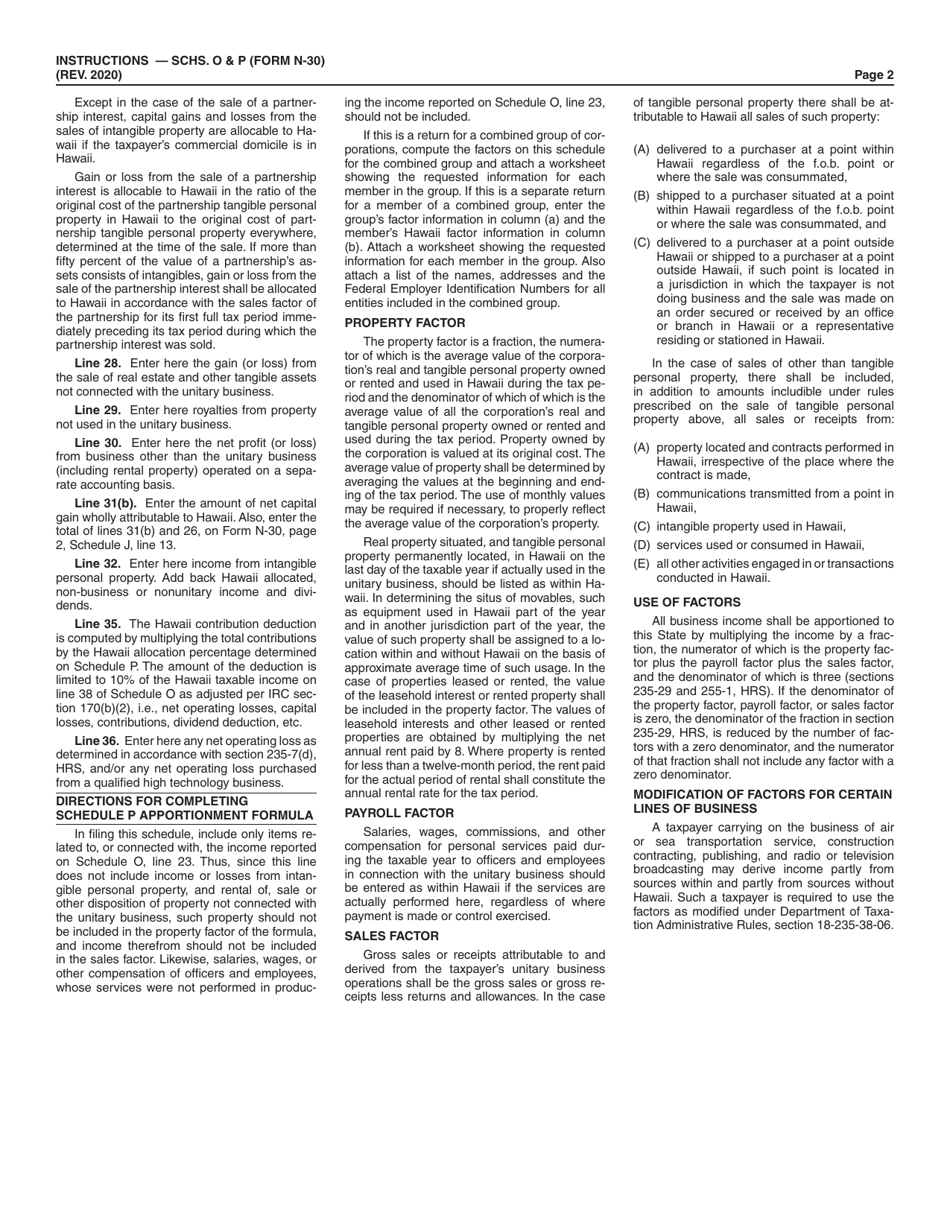

Download Instructions for Form N30 Schedule O, P Allocation and

Please see our hawaii tax forms (alphabetical listing). If you are using a browser to view the form, then. A combined return of a unitary group of. The department of taxation’s forms and instructions, as well as many. Our tax forms and instructions are designed to work optimally with adobe reader dc.

Download Instructions for Form N30 Corporation Tax Return PDF

For a real estate investment trust (reit). The department of taxation’s forms and instructions, as well as many. A combined return of a unitary group of. If you are using a browser to view the form, then. Please see our hawaii tax forms (alphabetical listing).

Form N30 Schedule O Download Fillable PDF or Fill Online Allocation

Please see our hawaii tax forms (alphabetical listing). The department of taxation’s forms and instructions, as well as many. Our tax forms and instructions are designed to work optimally with adobe reader dc. For a real estate investment trust (reit). If you are using a browser to view the form, then.

Download Instructions for Form N30 Corporation Tax Return PDF

If you are using a browser to view the form, then. Our tax forms and instructions are designed to work optimally with adobe reader dc. A combined return of a unitary group of. Please see our hawaii tax forms (alphabetical listing). The department of taxation’s forms and instructions, as well as many.

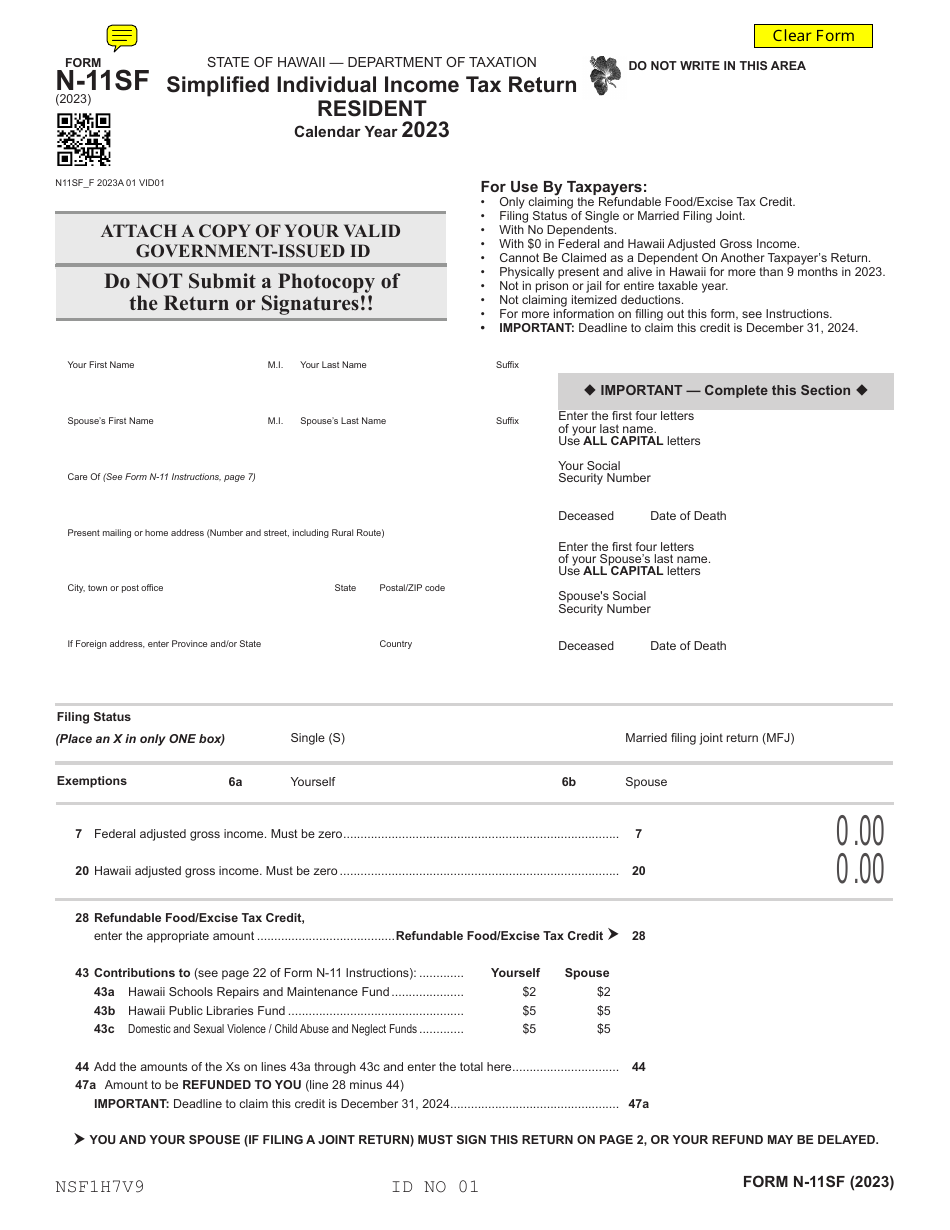

Form N11SF 2023 Fill Out, Sign Online and Download Fillable PDF

A combined return of a unitary group of. Our tax forms and instructions are designed to work optimally with adobe reader dc. The department of taxation’s forms and instructions, as well as many. For a real estate investment trust (reit). If you are using a browser to view the form, then.

Download Instructions for Form N30 Corporation Tax Return PDF

For a real estate investment trust (reit). A combined return of a unitary group of. Our tax forms and instructions are designed to work optimally with adobe reader dc. Please see our hawaii tax forms (alphabetical listing). If you are using a browser to view the form, then.

Download Instructions for Form N30 Corporation Tax Return PDF

Please see our hawaii tax forms (alphabetical listing). A combined return of a unitary group of. If you are using a browser to view the form, then. The department of taxation’s forms and instructions, as well as many. Our tax forms and instructions are designed to work optimally with adobe reader dc.

Download Instructions for Form N35 Hawaii Tax Return for an S

A combined return of a unitary group of. The department of taxation’s forms and instructions, as well as many. Please see our hawaii tax forms (alphabetical listing). If you are using a browser to view the form, then. Our tax forms and instructions are designed to work optimally with adobe reader dc.

Please See Our Hawaii Tax Forms (Alphabetical Listing).

For a real estate investment trust (reit). If you are using a browser to view the form, then. The department of taxation’s forms and instructions, as well as many. A combined return of a unitary group of.