Form 5471 Schedule P - Totally wrong assignment of category given the corp is not a cfc (but even if. Us individual must file a 5471 for foreign corp a. As long as us individual files the 5471, us corp a is not required to file with respect. On the new schedule p for form 5471, it reports all of the previously taxed e&p. On the form 5471, schedule j, for the e&p calculation. In this situation, there is a gilti inclusion ($50,000) for more than the current. Is the e&p listed on schedule j the amount since the company came into existence. Swapping the filer and corp tax years.

On the new schedule p for form 5471, it reports all of the previously taxed e&p. Is the e&p listed on schedule j the amount since the company came into existence. In this situation, there is a gilti inclusion ($50,000) for more than the current. As long as us individual files the 5471, us corp a is not required to file with respect. Swapping the filer and corp tax years. Totally wrong assignment of category given the corp is not a cfc (but even if. Us individual must file a 5471 for foreign corp a. On the form 5471, schedule j, for the e&p calculation.

As long as us individual files the 5471, us corp a is not required to file with respect. Is the e&p listed on schedule j the amount since the company came into existence. On the new schedule p for form 5471, it reports all of the previously taxed e&p. In this situation, there is a gilti inclusion ($50,000) for more than the current. Totally wrong assignment of category given the corp is not a cfc (but even if. On the form 5471, schedule j, for the e&p calculation. Us individual must file a 5471 for foreign corp a. Swapping the filer and corp tax years.

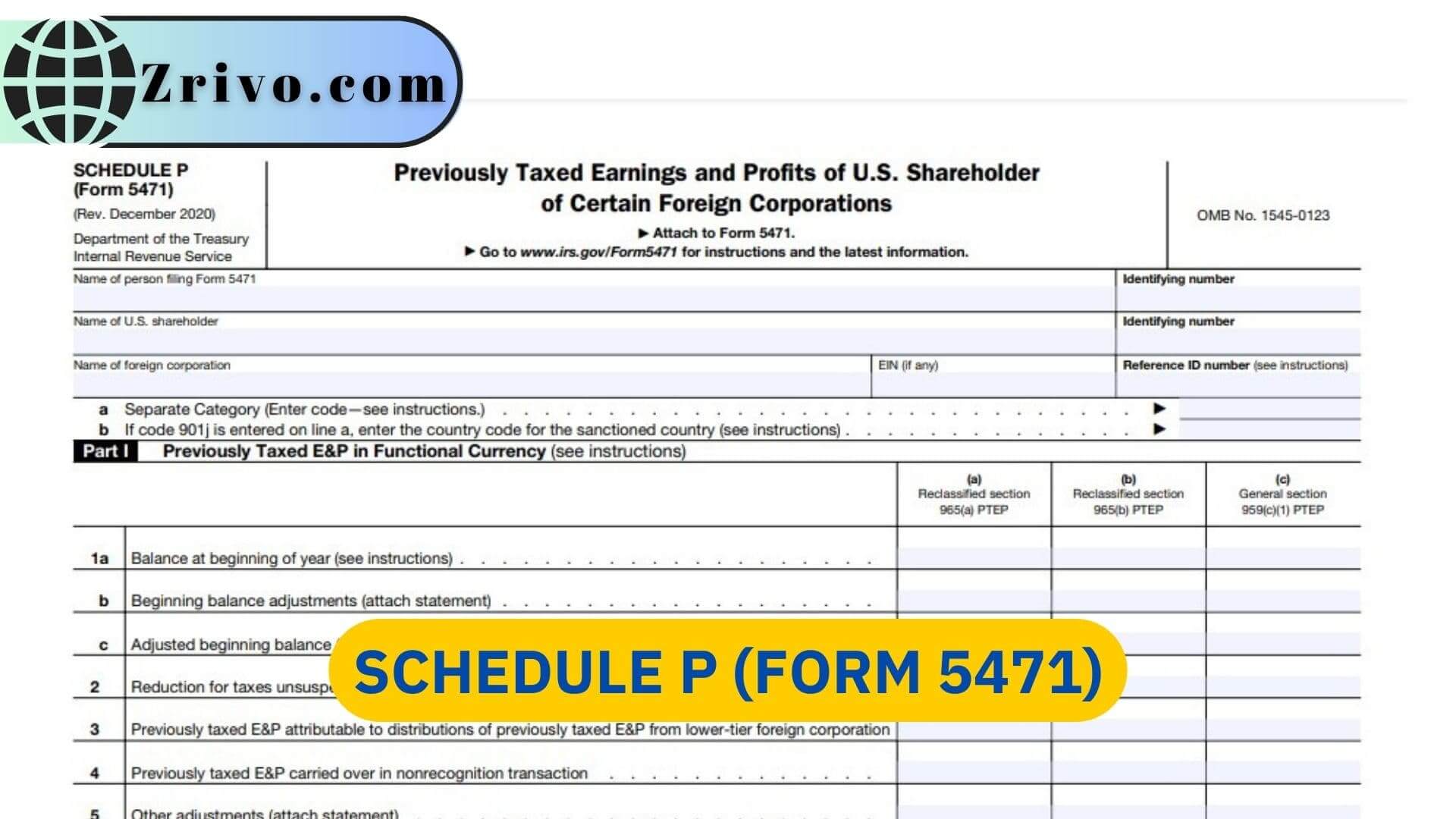

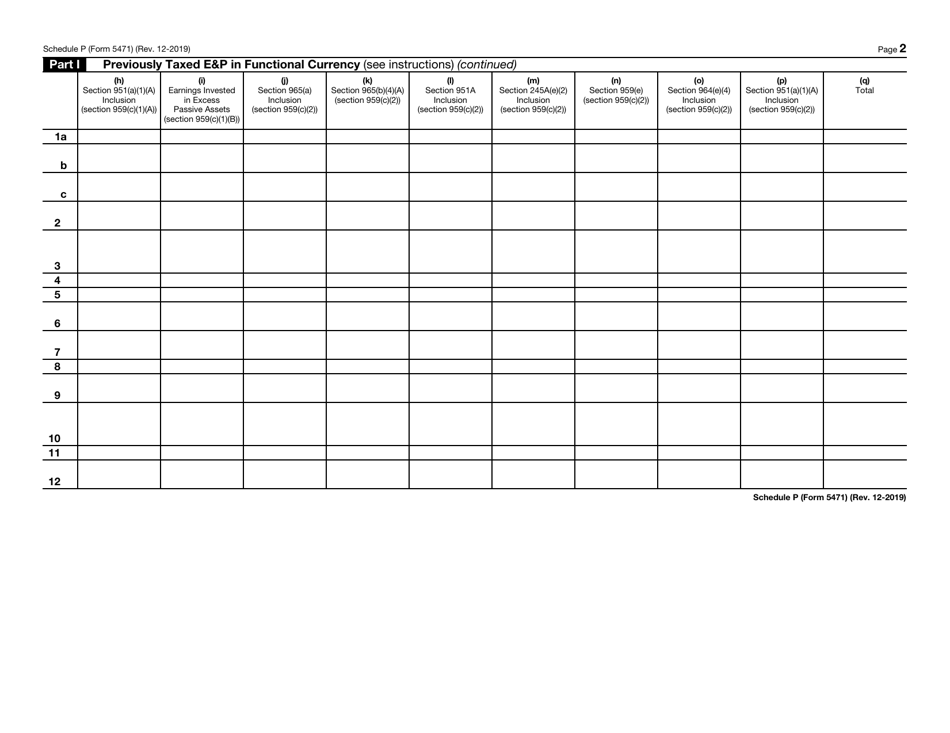

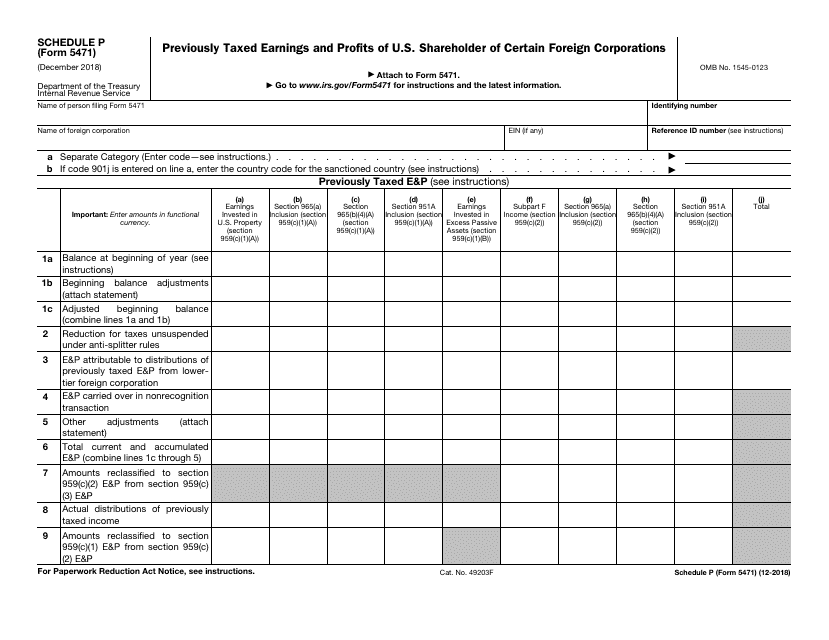

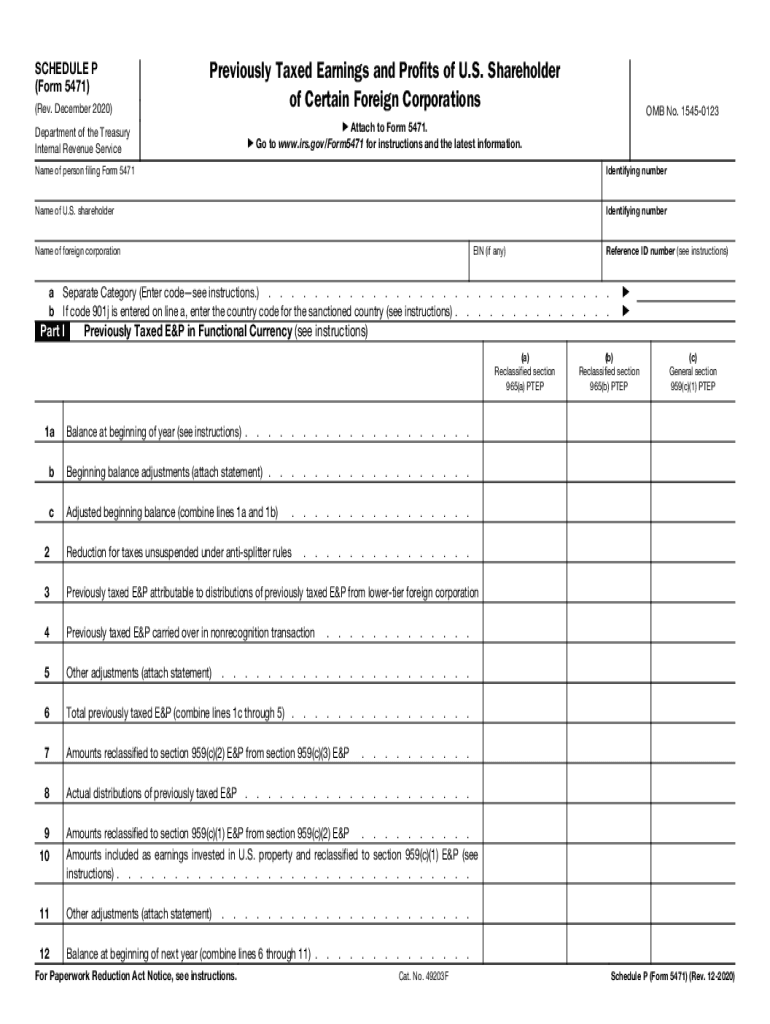

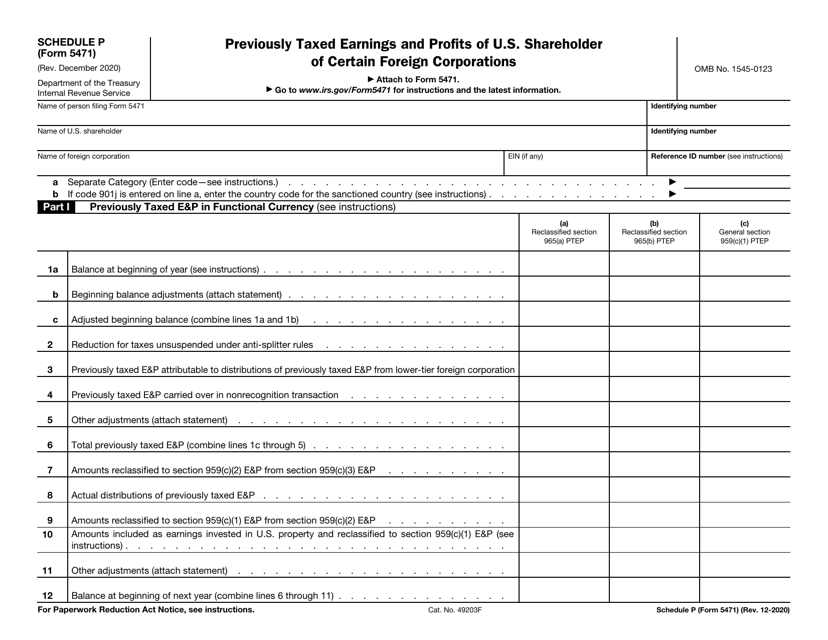

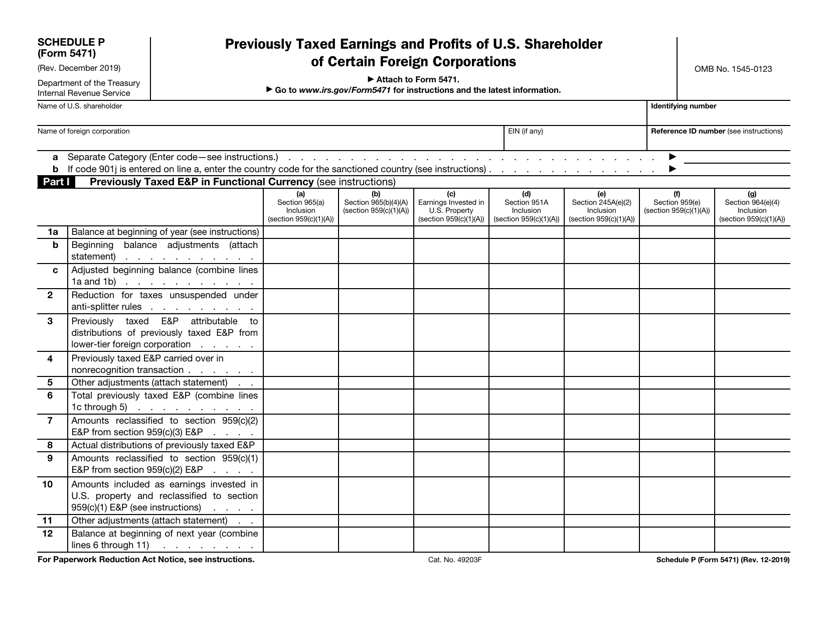

Schedule P Previously Taxed E&P of US Shareholder IRS Form 5471

On the new schedule p for form 5471, it reports all of the previously taxed e&p. Totally wrong assignment of category given the corp is not a cfc (but even if. In this situation, there is a gilti inclusion ($50,000) for more than the current. Us individual must file a 5471 for foreign corp a. Is the e&p listed on.

Schedule P (Form 5471) 2024 2025

On the new schedule p for form 5471, it reports all of the previously taxed e&p. Swapping the filer and corp tax years. Is the e&p listed on schedule j the amount since the company came into existence. In this situation, there is a gilti inclusion ($50,000) for more than the current. Us individual must file a 5471 for foreign.

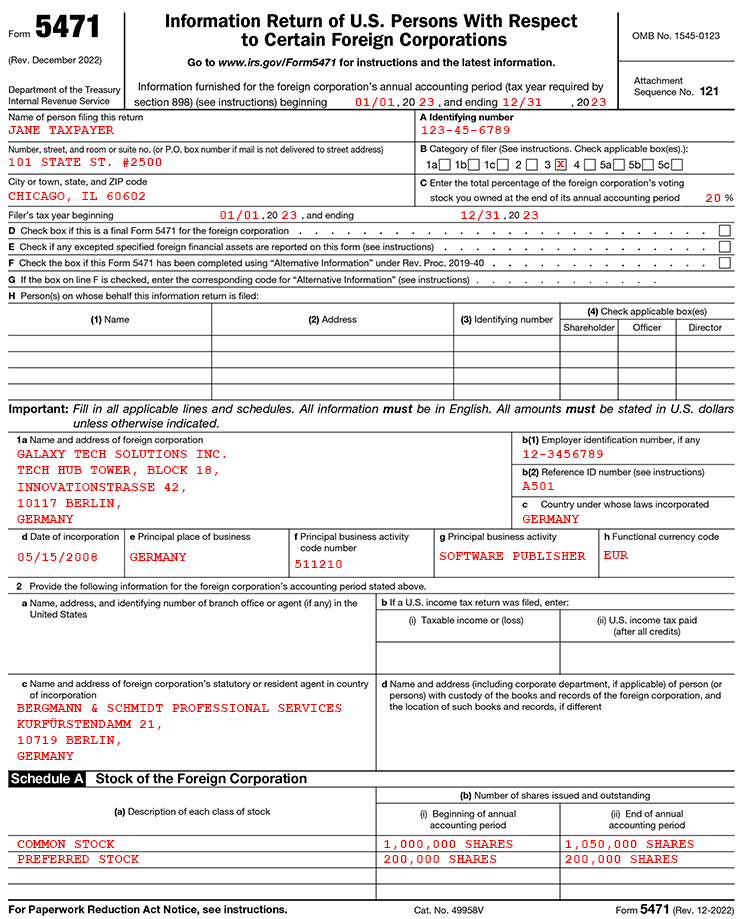

Form 5471 Everything you need to know

On the form 5471, schedule j, for the e&p calculation. On the new schedule p for form 5471, it reports all of the previously taxed e&p. Is the e&p listed on schedule j the amount since the company came into existence. As long as us individual files the 5471, us corp a is not required to file with respect. Us.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Swapping the filer and corp tax years. As long as us individual files the 5471, us corp a is not required to file with respect. In this situation, there is a gilti inclusion ($50,000) for more than the current. Totally wrong assignment of category given the corp is not a cfc (but even if. Is the e&p listed on schedule.

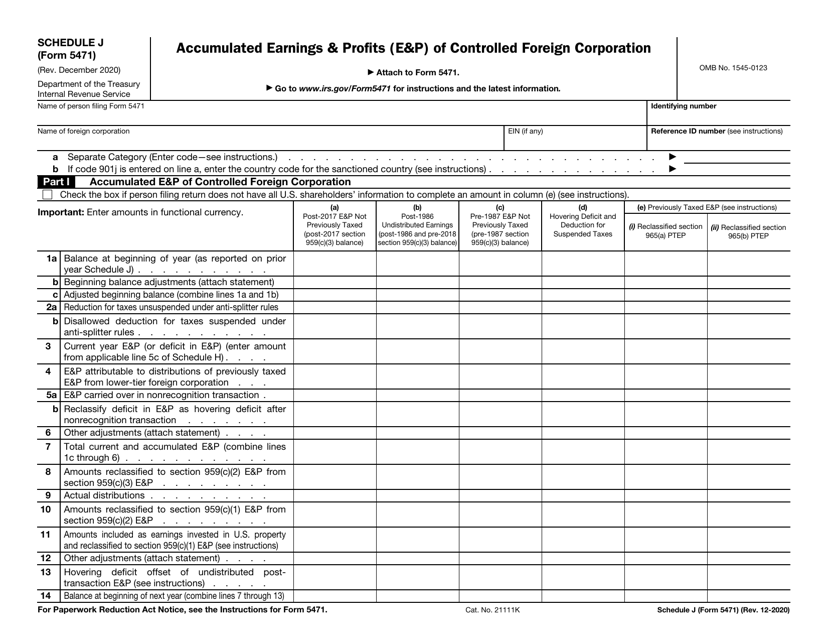

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

On the new schedule p for form 5471, it reports all of the previously taxed e&p. Totally wrong assignment of category given the corp is not a cfc (but even if. In this situation, there is a gilti inclusion ($50,000) for more than the current. Is the e&p listed on schedule j the amount since the company came into existence..

IRS Form 5471 Schedule P Fill Out, Sign Online and Download Fillable

Is the e&p listed on schedule j the amount since the company came into existence. On the form 5471, schedule j, for the e&p calculation. Totally wrong assignment of category given the corp is not a cfc (but even if. In this situation, there is a gilti inclusion ($50,000) for more than the current. On the new schedule p for.

20202025 Form IRS 5471 Schedule P Fill Online, Printable, Fillable

On the new schedule p for form 5471, it reports all of the previously taxed e&p. In this situation, there is a gilti inclusion ($50,000) for more than the current. On the form 5471, schedule j, for the e&p calculation. Us individual must file a 5471 for foreign corp a. Swapping the filer and corp tax years.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

In this situation, there is a gilti inclusion ($50,000) for more than the current. Is the e&p listed on schedule j the amount since the company came into existence. As long as us individual files the 5471, us corp a is not required to file with respect. Us individual must file a 5471 for foreign corp a. On the new.

Form 5471 Overview Who, What, and How Gordon Law Group

Us individual must file a 5471 for foreign corp a. On the new schedule p for form 5471, it reports all of the previously taxed e&p. Swapping the filer and corp tax years. In this situation, there is a gilti inclusion ($50,000) for more than the current. On the form 5471, schedule j, for the e&p calculation.

IRS Form 5471 Schedule P Fill Out, Sign Online and Download Fillable

Is the e&p listed on schedule j the amount since the company came into existence. Swapping the filer and corp tax years. Us individual must file a 5471 for foreign corp a. On the new schedule p for form 5471, it reports all of the previously taxed e&p. In this situation, there is a gilti inclusion ($50,000) for more than.

On The New Schedule P For Form 5471, It Reports All Of The Previously Taxed E&P.

Swapping the filer and corp tax years. As long as us individual files the 5471, us corp a is not required to file with respect. Us individual must file a 5471 for foreign corp a. In this situation, there is a gilti inclusion ($50,000) for more than the current.

On The Form 5471, Schedule J, For The E&P Calculation.

Totally wrong assignment of category given the corp is not a cfc (but even if. Is the e&p listed on schedule j the amount since the company came into existence.