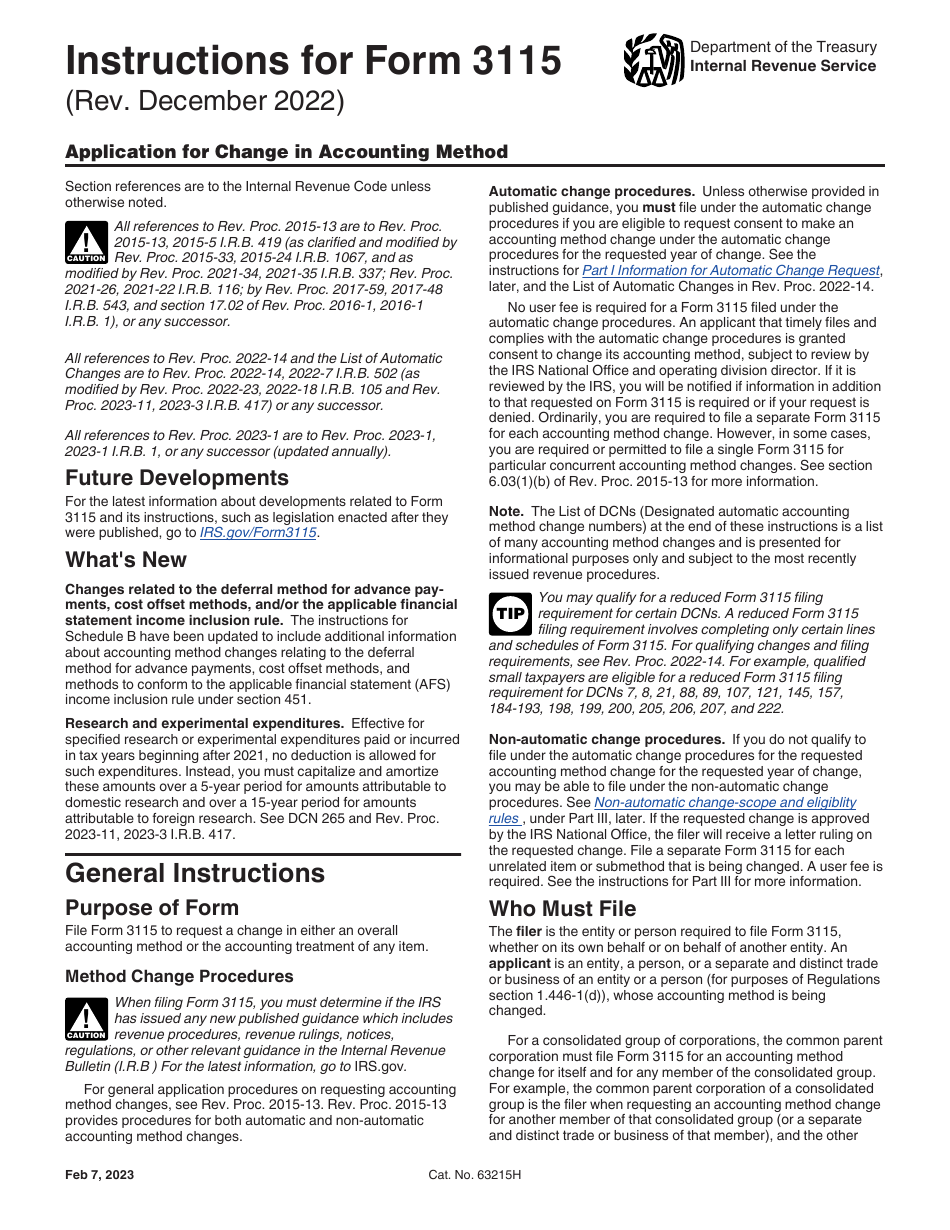

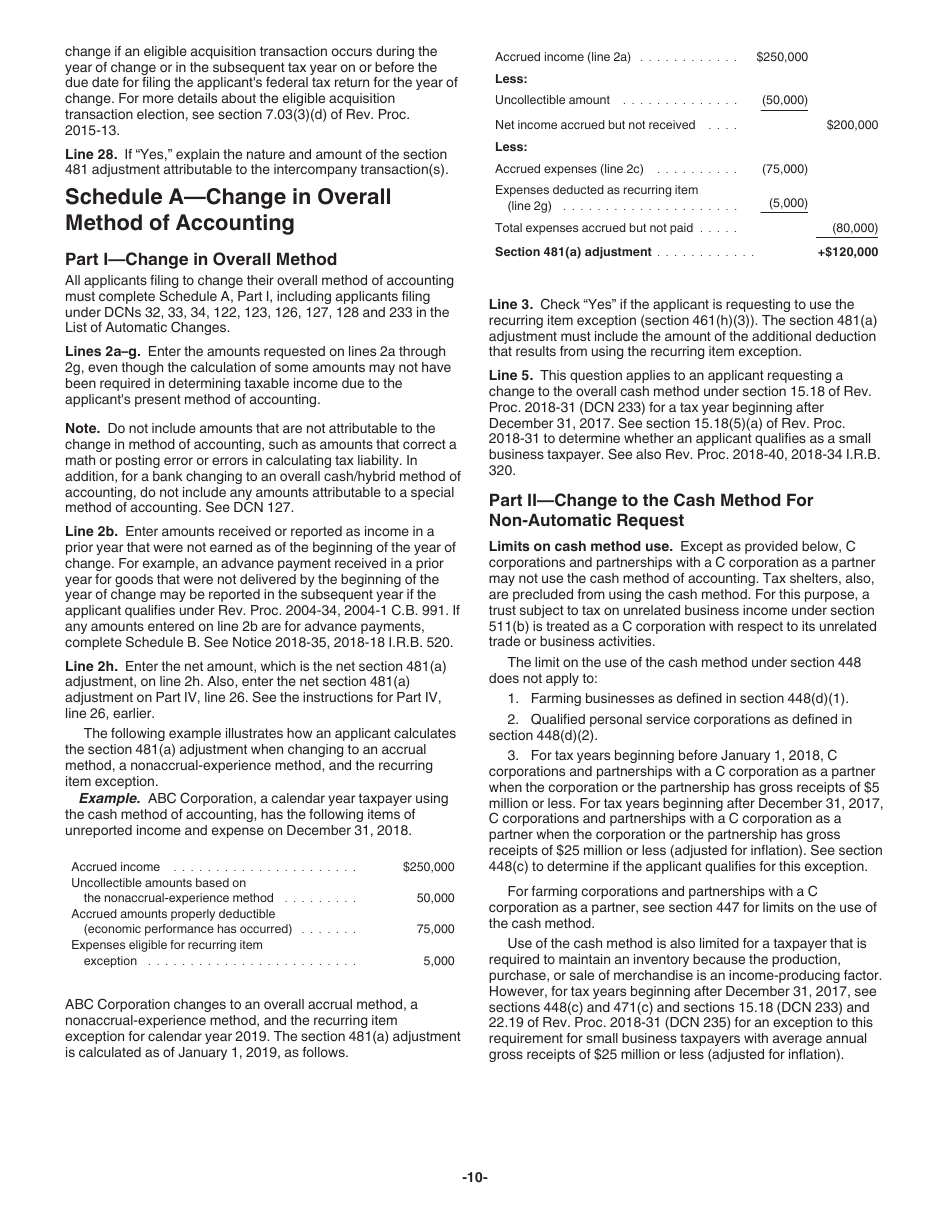

Form 3115 - Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. What dcn code on the form 3115 should i use if i want to change the completed project accounting method to the accrual method. I generally concur with @critter 's replies. In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into.

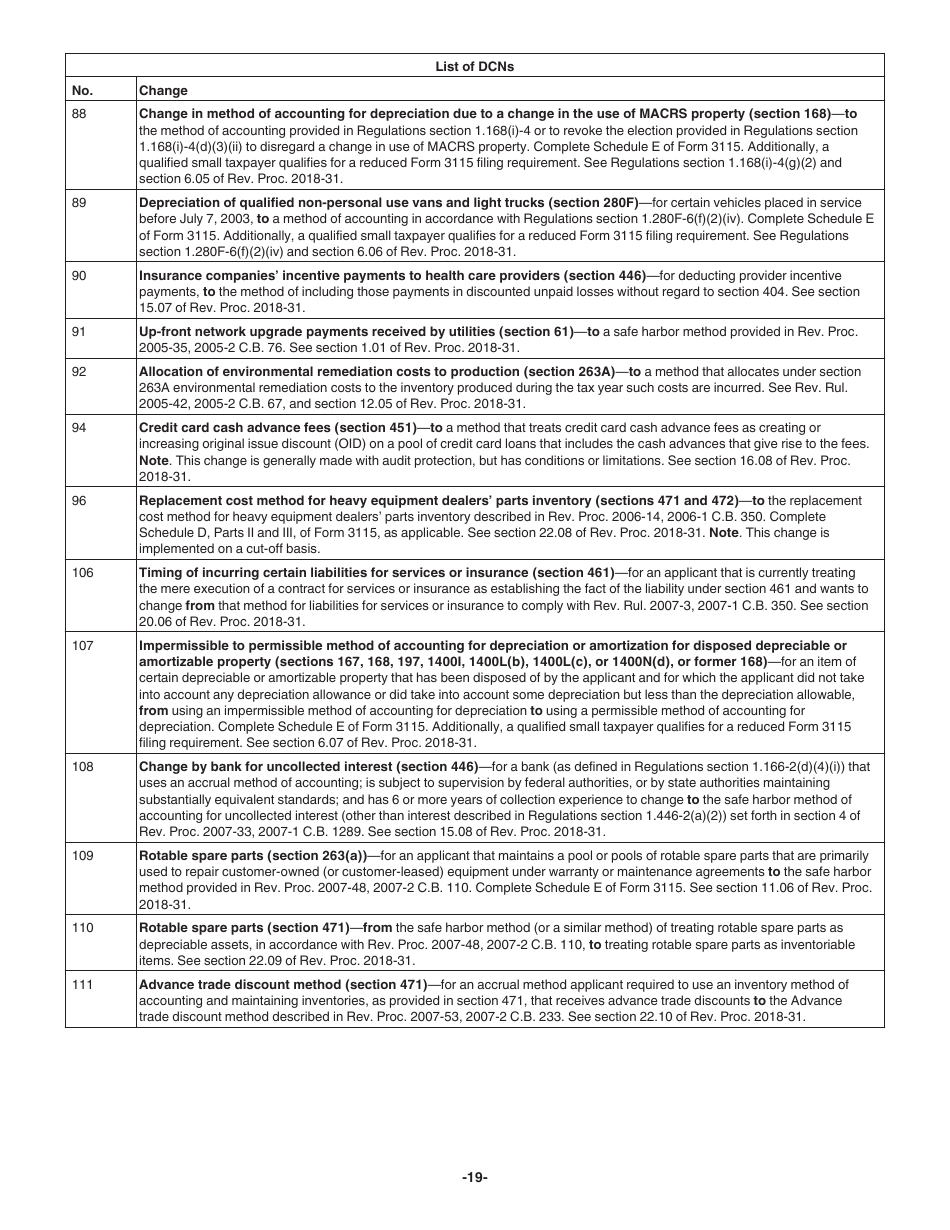

What dcn code on the form 3115 should i use if i want to change the completed project accounting method to the accrual method. Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. I generally concur with @critter 's replies. In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into.

In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. I generally concur with @critter 's replies. What dcn code on the form 3115 should i use if i want to change the completed project accounting method to the accrual method.

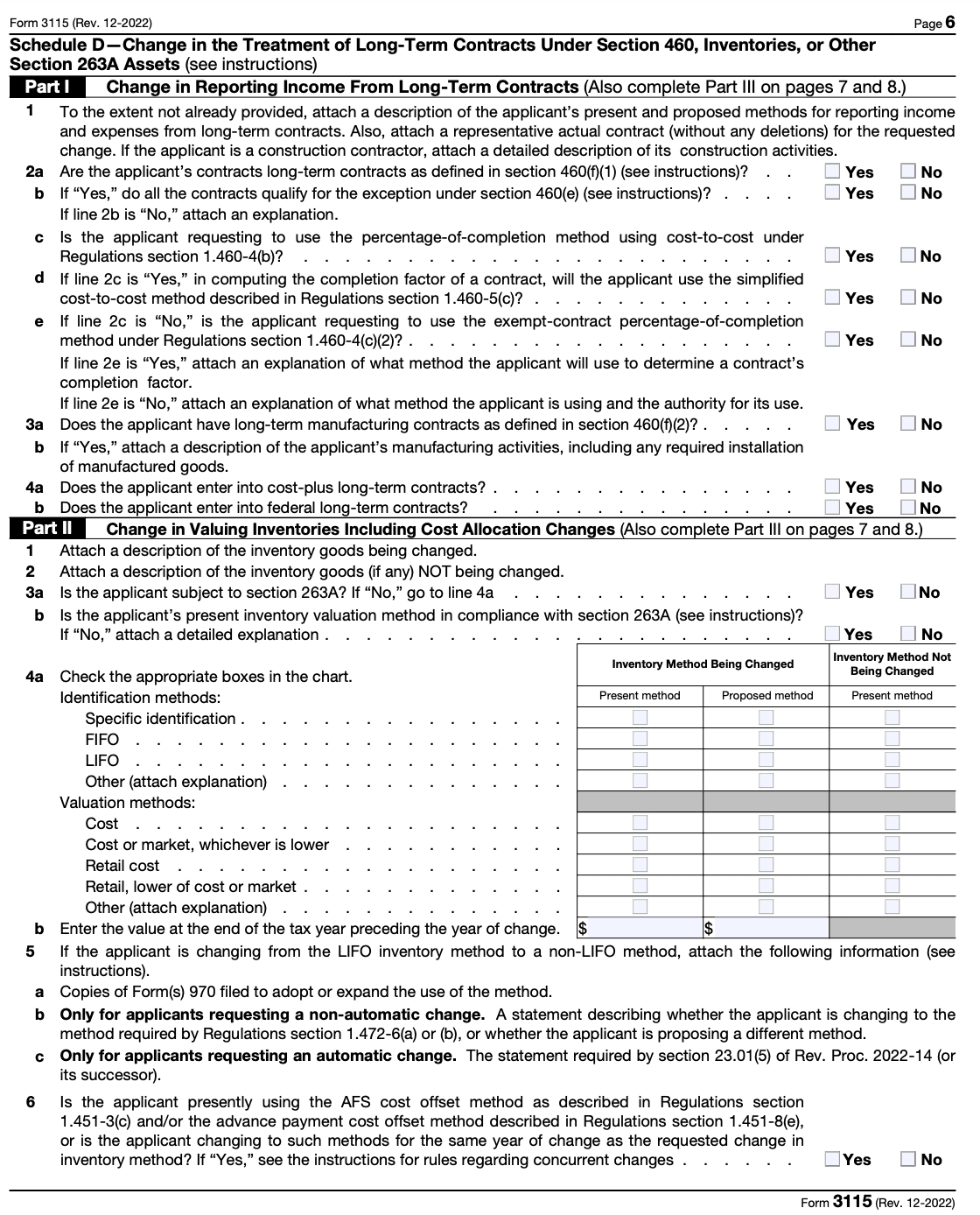

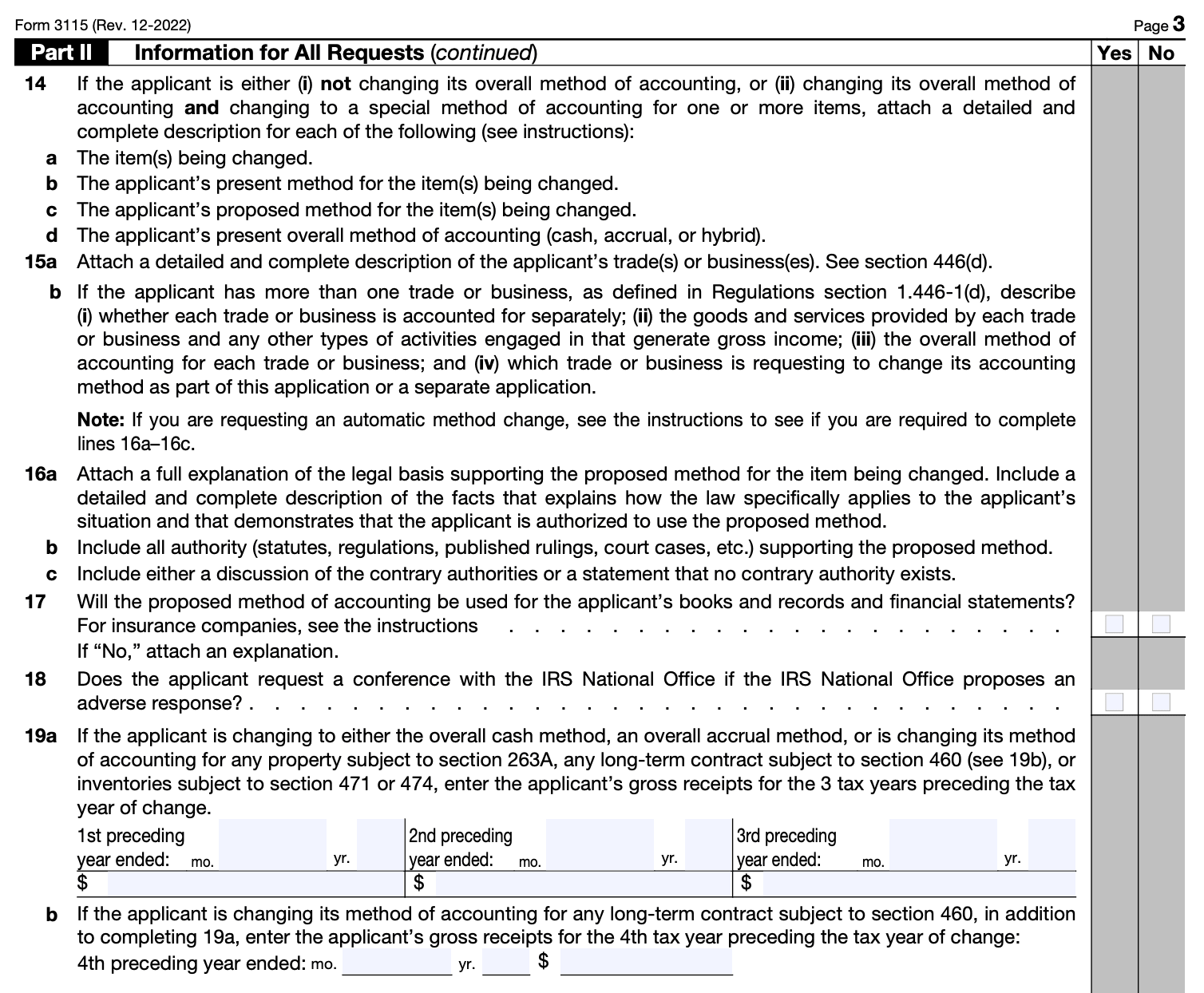

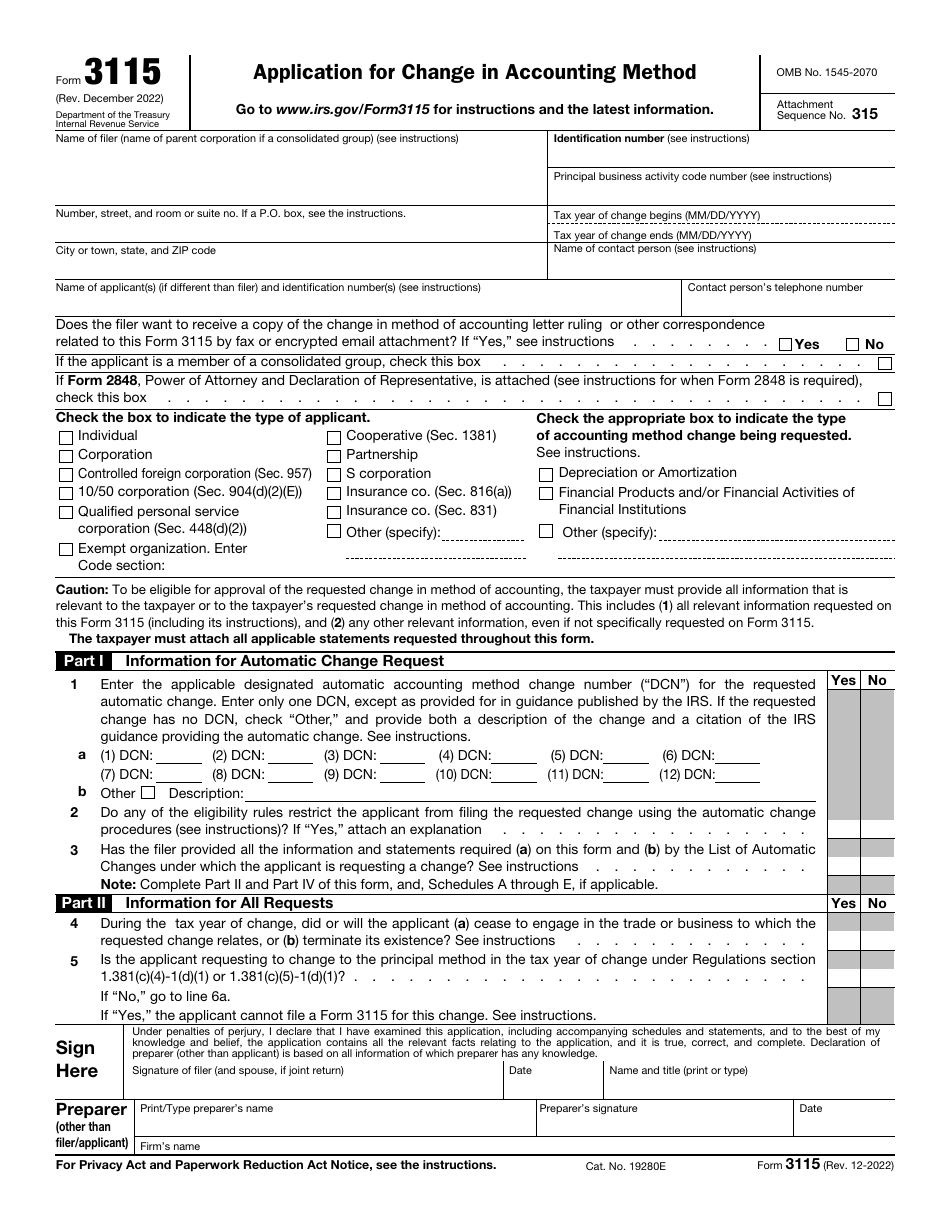

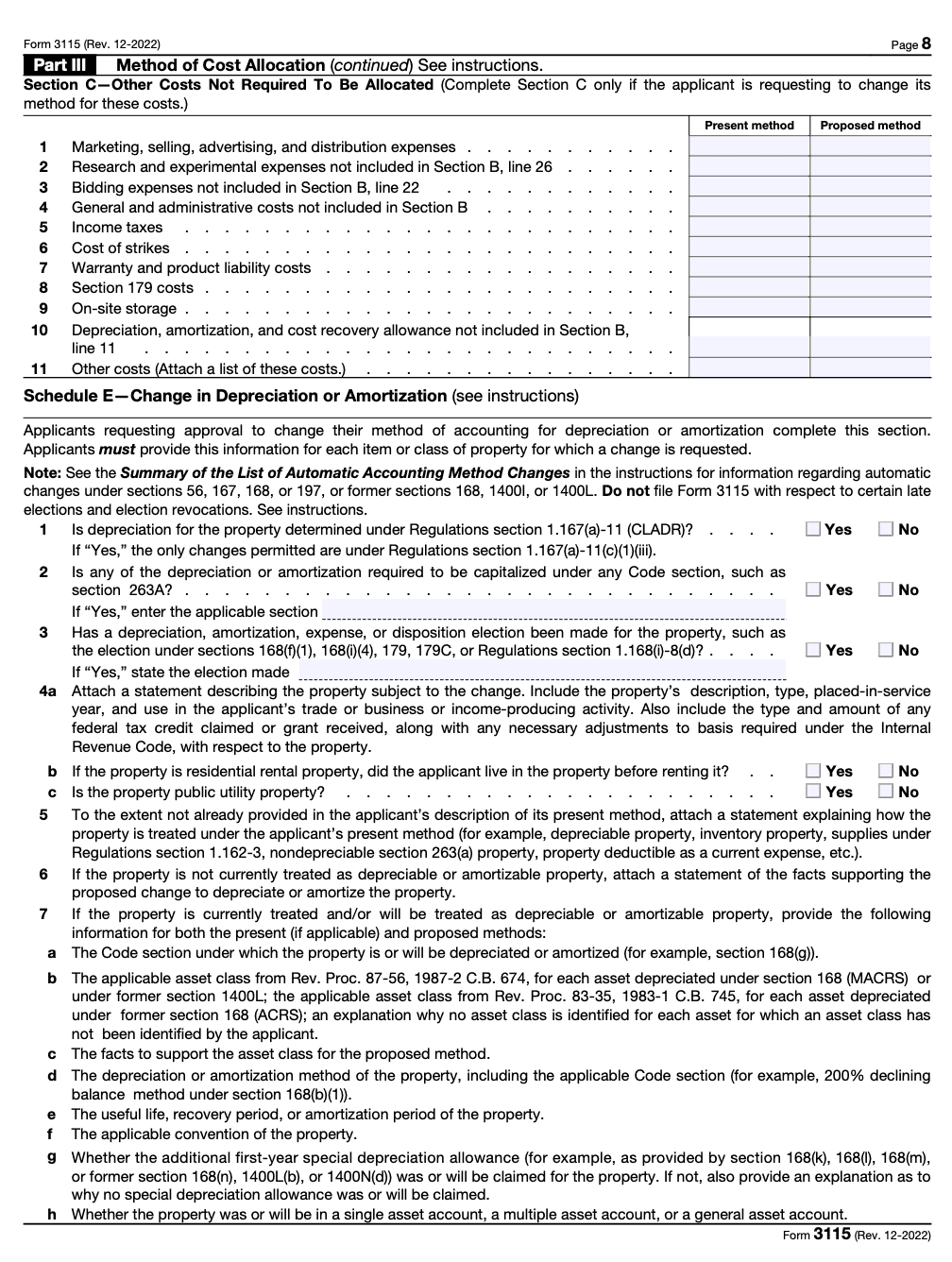

IRS Tax Form 3115 Filing Guide Change Accounting Methods

Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. What dcn code on the form 3115 should i use if i.

Form 3115 Source Advisors

Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. I generally concur with @critter 's replies. Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. What dcn code on the form 3115 should i use if i want.

IRS Tax Form 3115 Filing Guide Change Accounting Methods

In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. I generally concur with @critter 's replies. Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. Hello turbotax community, looking for.

IRS Form 3115 Download Fillable PDF or Fill Online Application for

Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the.

IRS Tax Form 3115 Filing Guide Change Accounting Methods

I generally concur with @critter 's replies. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. Using form 3115 to claim missed depreciation on a.

Download Instructions for IRS Form 3115 Application for Change in

I generally concur with @critter 's replies. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. What dcn code on the form 3115 should i use if i want to change the completed project accounting method to the accrual method. Using form 3115 to claim missed depreciation on a rental property.

Irs Form 3115 Fillable Printable Forms Free Online

In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. I generally concur with @critter 's replies. What dcn code on the form 3115 should i.

IRS Form 3115 Download Fillable PDF or Fill Online Application for

Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. What dcn code on the form 3115 should i use if i.

Download Instructions for IRS Form 3115 Application for Change in

What dcn code on the form 3115 should i use if i want to change the completed project accounting method to the accrual method. Using form 3115 to claim missed depreciation on a rental property hi, i just realized i didn't enter depreciation information in all. Hello turbotax community, looking for some advice on what's the best thing to do.

Download Instructions for IRS Form 3115 Application for Change in

In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. I generally concur with @critter 's replies. Using form 3115 to claim missed depreciation on a.

Using Form 3115 To Claim Missed Depreciation On A Rental Property Hi, I Just Realized I Didn't Enter Depreciation Information In All.

I generally concur with @critter 's replies. In accordance with the instructions for form 3115 (page 9 part iv), the general rule is that you take the full section 481 (a) adjustment into. Hello turbotax community, looking for some advice on what's the best thing to do with my tax situation. What dcn code on the form 3115 should i use if i want to change the completed project accounting method to the accrual method.