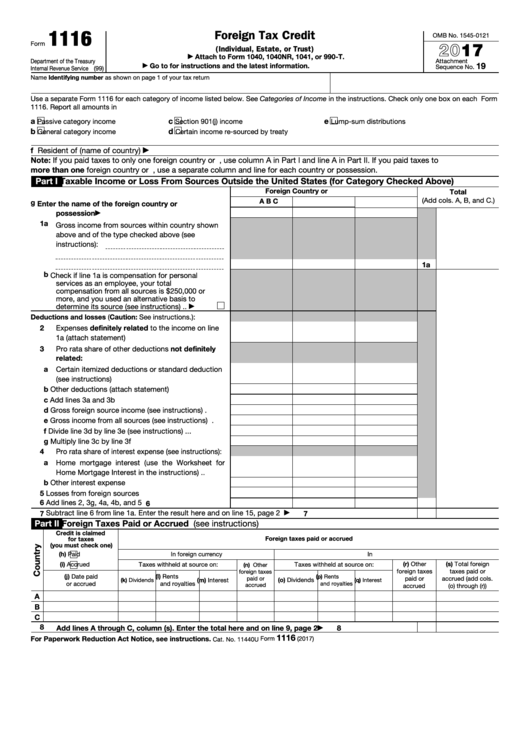

Form 1116 Instruction - For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after. Check only one box on each form. See categories of income in the instructions. Use a separate form 1116 for each category of income listed below. You will need to convert all amounts to u.s. To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate.

Check only one box on each form. Use a separate form 1116 for each category of income listed below. Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate. You will need to convert all amounts to u.s. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after. See categories of income in the instructions. To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as.

Use a separate form 1116 for each category of income listed below. You will need to convert all amounts to u.s. Check only one box on each form. Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate. To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as. See categories of income in the instructions. For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate. To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as. Use a separate form 1116 for each category of income listed below. You will need to convert all.

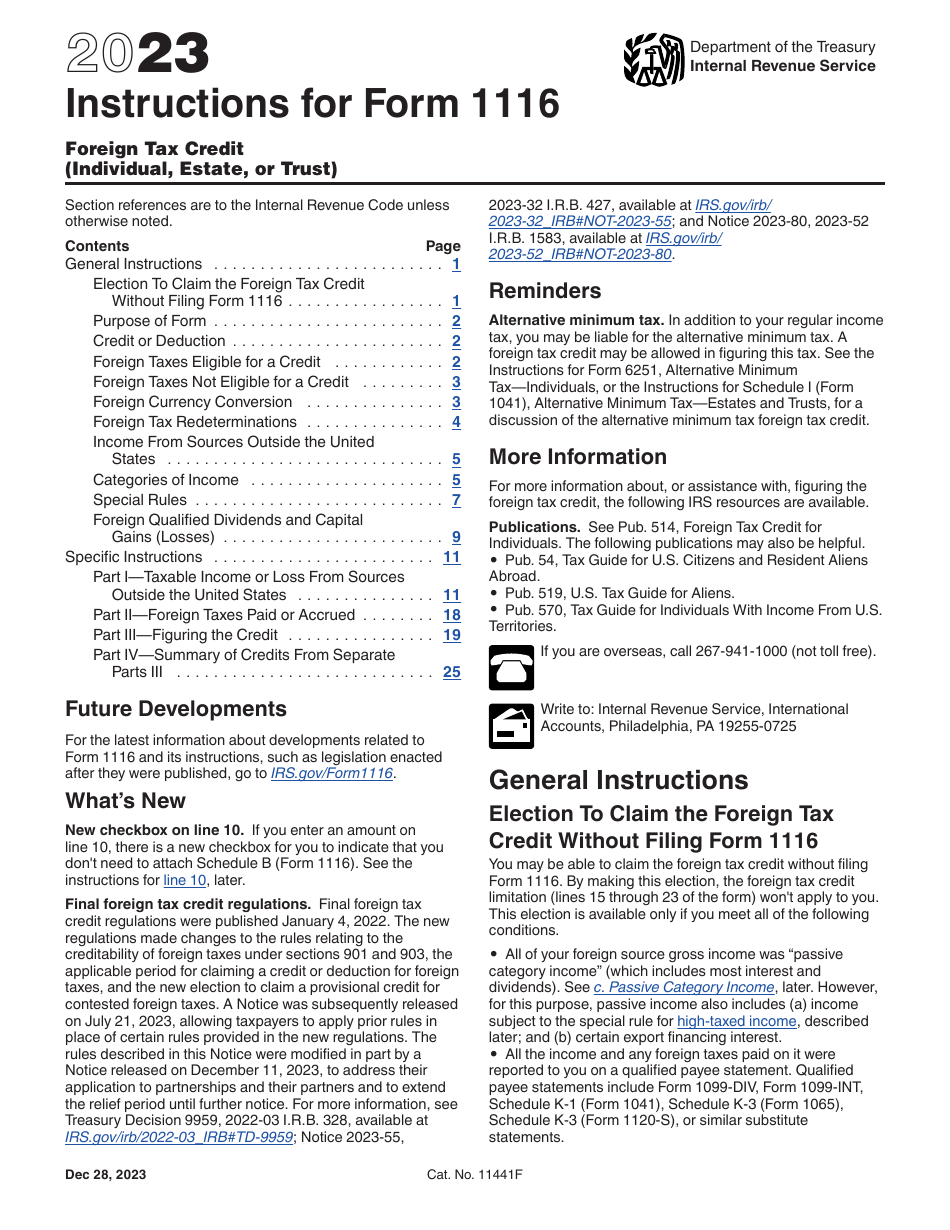

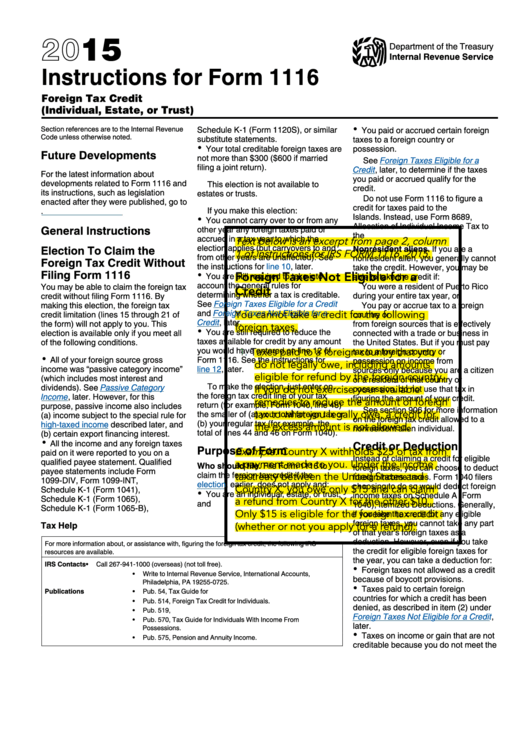

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Check only one box on each form. See categories of income in the instructions. To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such.

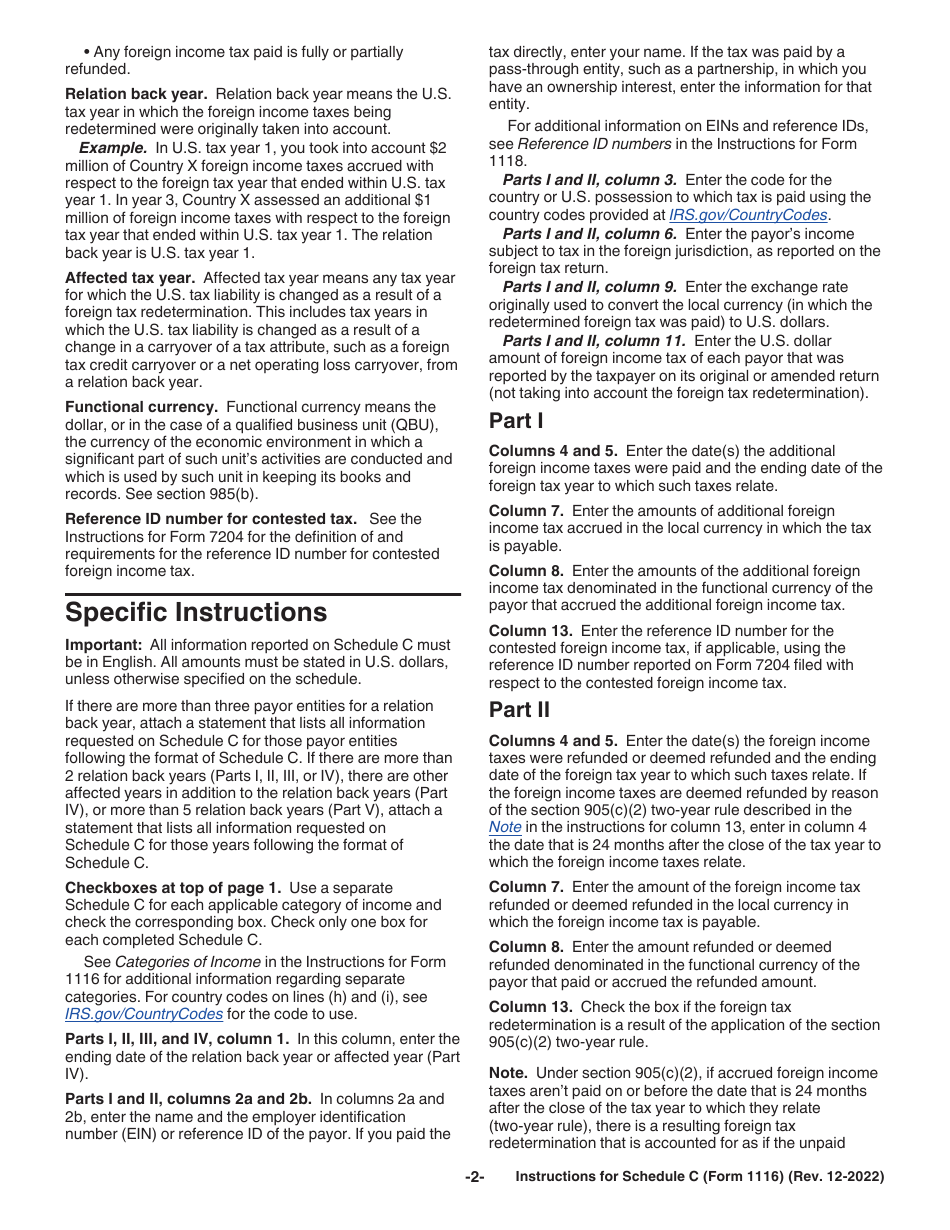

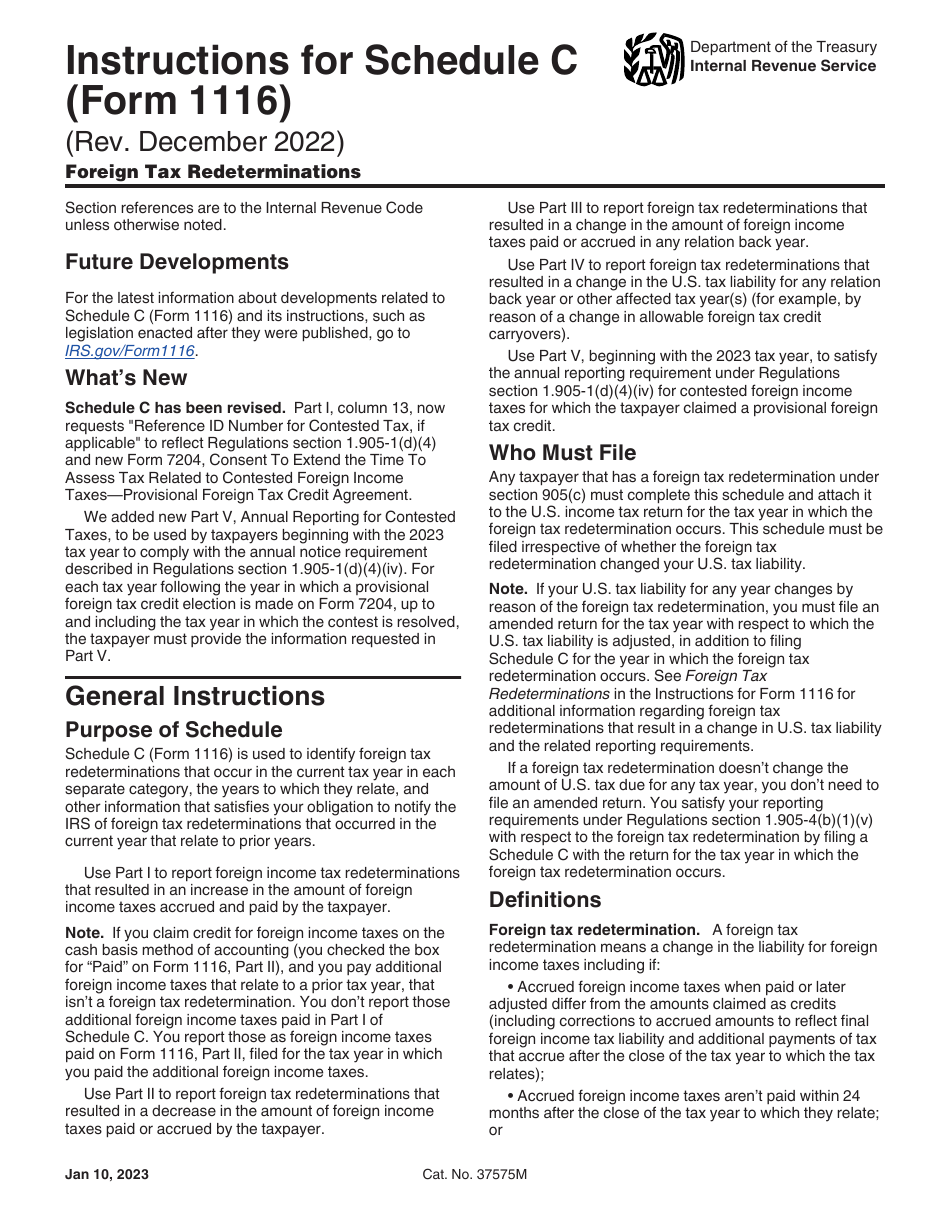

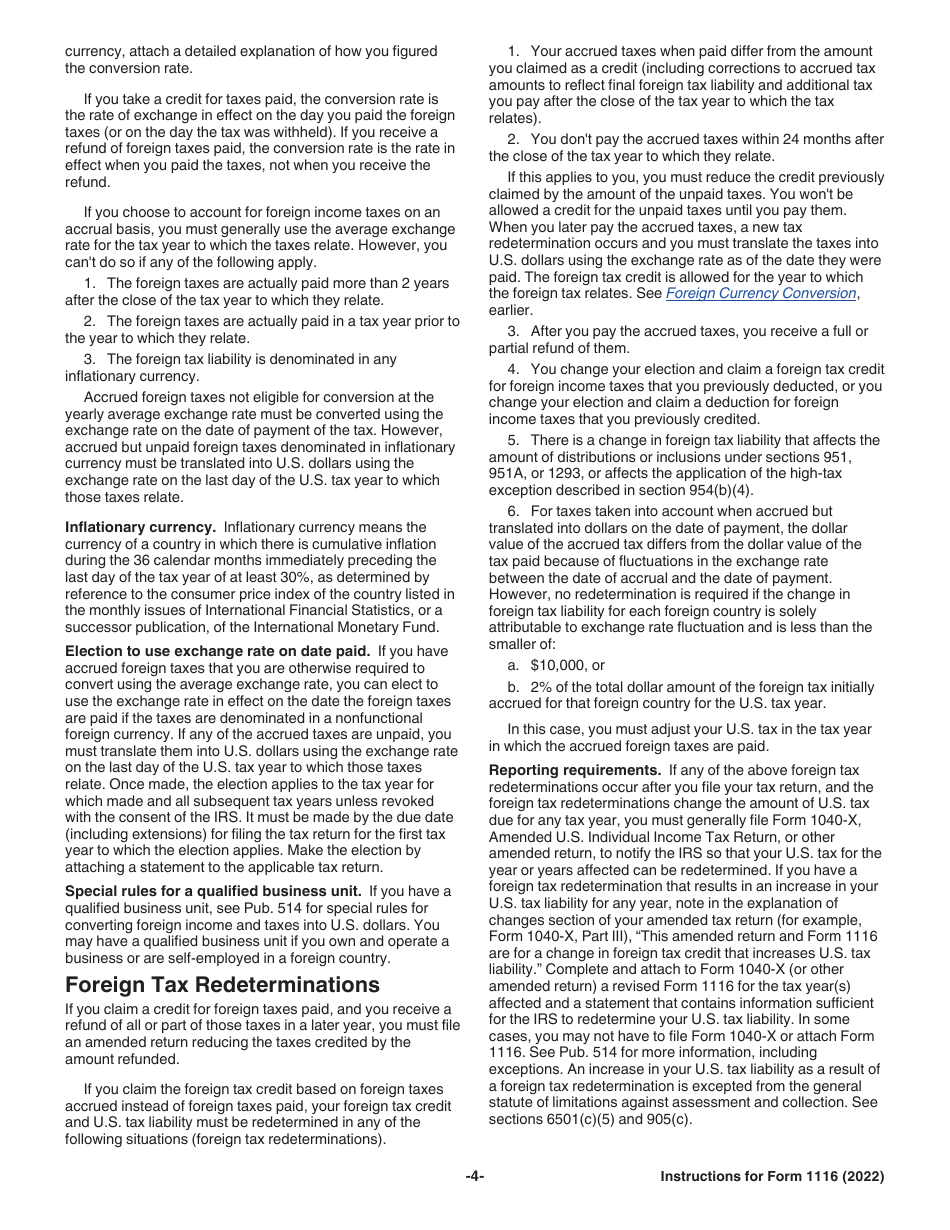

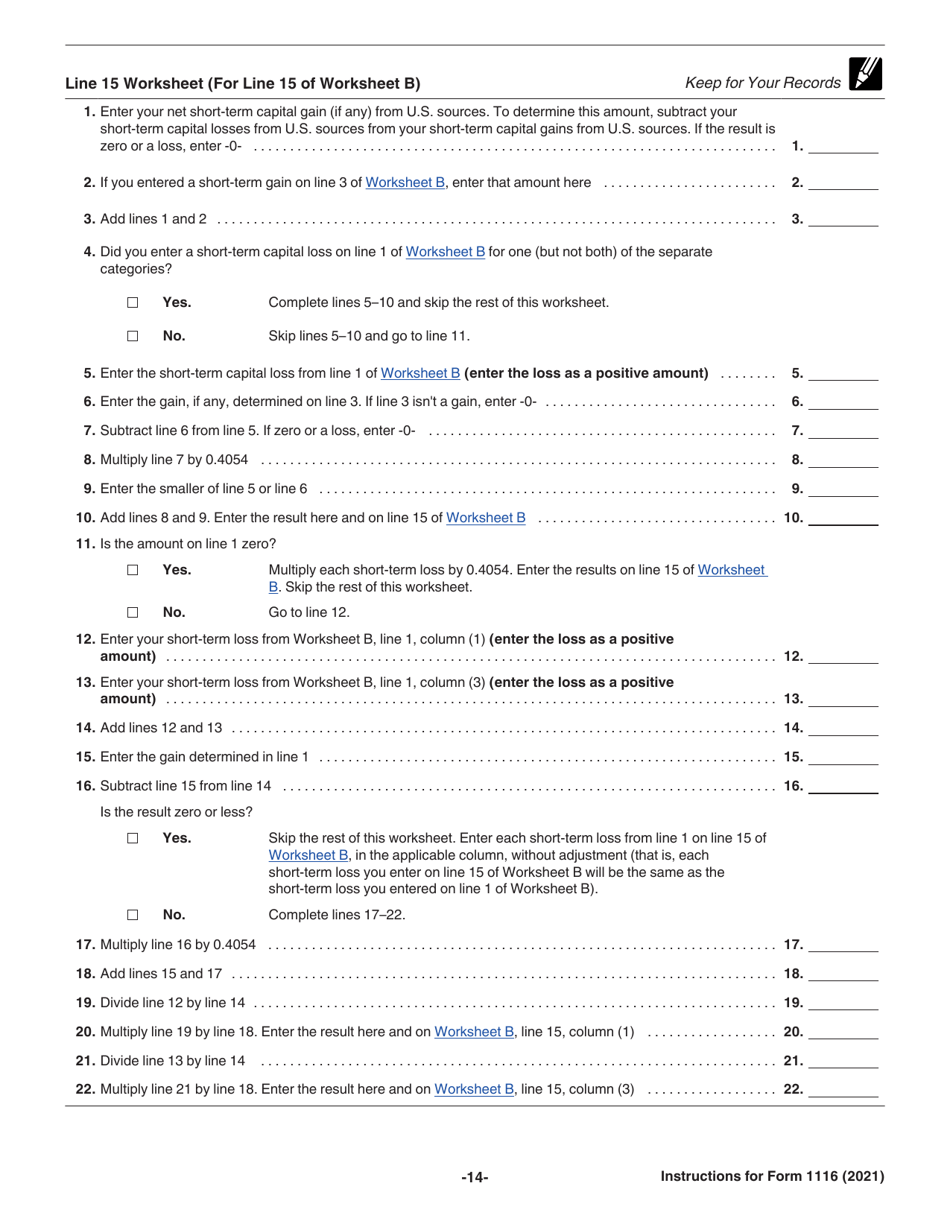

Download Instructions for IRS Form 1116 Schedule C Foreign Tax

To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Use a separate form 1116 for each category of income listed below. See.

Download Instructions for IRS Form 1116 Schedule C Foreign Tax

Use a separate form 1116 for each category of income listed below. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Check only one box on each form. For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after. You will.

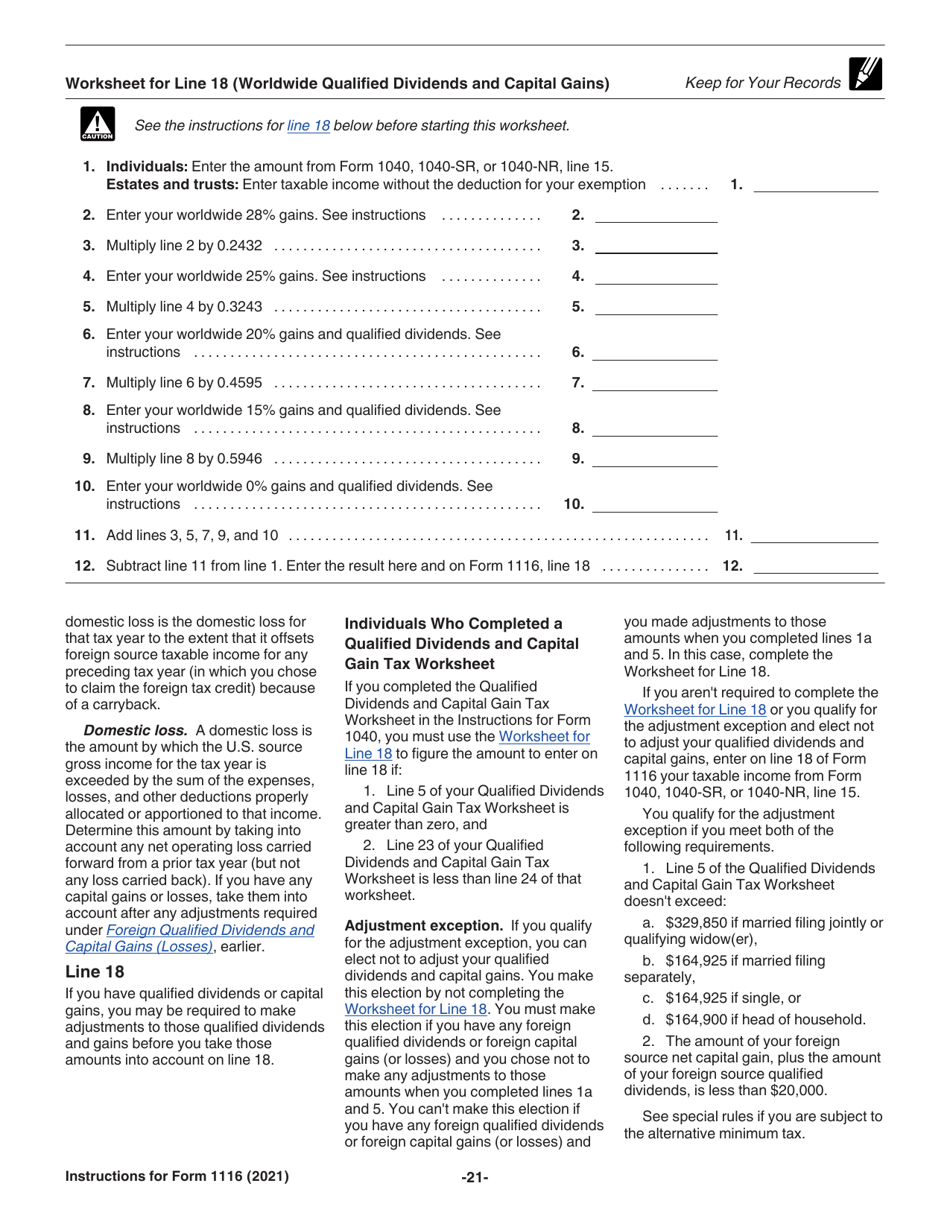

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after. Check only one box on each form. Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate. See categories of income in the instructions. Use a separate form 1116 for each category of income listed below.

Fillable Form 1116 Foreign Tax Credit (Individual, Estate, Or Trust

Use a separate form 1116 for each category of income listed below. Check only one box on each form. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after. See categories.

2015 Instructions For Form 1116 printable pdf download

To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as. Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year.

Download Instructions for IRS Form 1116 Schedule C Foreign Tax

Check only one box on each form. See categories of income in the instructions. You will need to convert all amounts to u.s. Use a separate form 1116 for each category of income listed below. For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate. Use a separate form 1116 for each category of income listed below. For the latest information about developments related to form 1116 and.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate. See categories of income in the instructions. You will need to convert all amounts to u.s. For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after. Check only one box on each form.

Use A Separate Form 1116 For Each Category Of Income Listed Below.

To be eligible for this election, qualified foreign taxes must be $300 ($600 if mfj) or less, all foreign source income is passive category (such as. You will need to convert all amounts to u.s. See categories of income in the instructions. For the latest information about developments related to form 1116 and its instructions, such as legislation enacted after.

Schedule B (Form 1116) Is Used To Reconcile Your Prior Year Foreign Tax Carryover With Your Current Year Foreign Tax Carryover.

Check only one box on each form. Dollars using the appropriate exchange rate and complete the four parts of form 1116 to calculate.