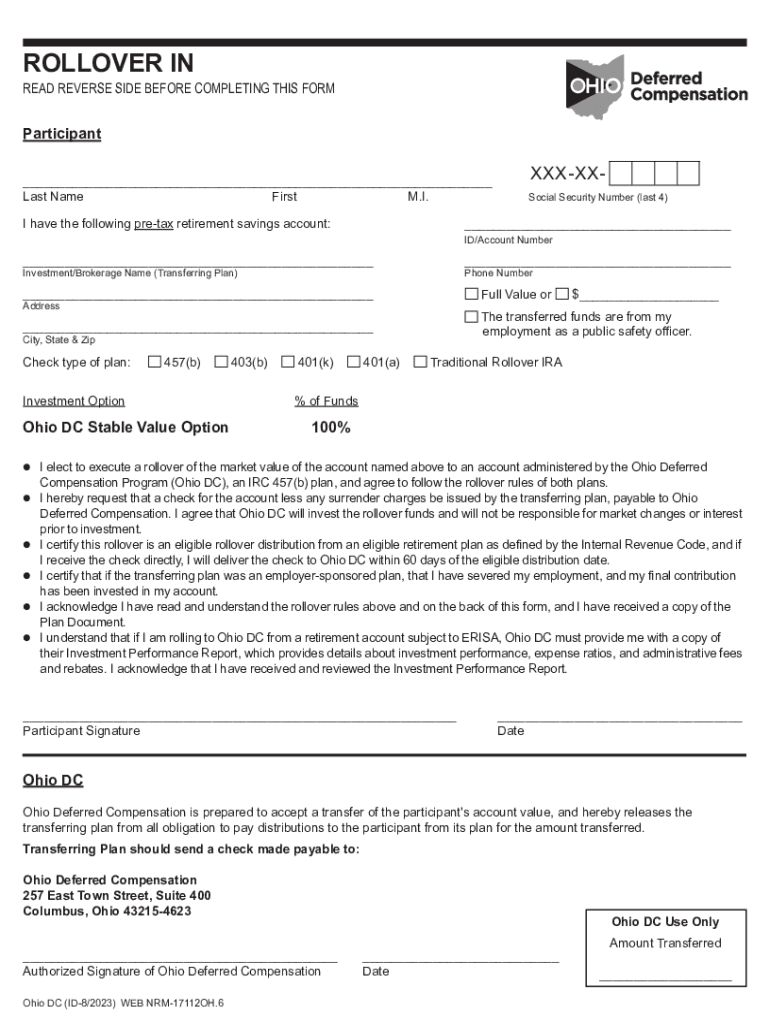

Empower Rollover Form - Learn how to roll over an empower 401 (k) to an ira retirement account, including an empower ira, and get tips on where to move your 401 (k). Rollover contributions received before transaction approval will not be. The document outlines the process for an incoming direct rollover into a 401 (a) plan, detailing participant information requirements, rollover. Make sure the check is payable to the financial services. Inform your former employer that you want to roll over your 401 (k) funds into an ira. A rollover of your designated roth. This form must arrive at empower retirement prior to the transaction proceeds. Direct rollover information current plan administrator must authorize by signing in the required signatures section. Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement.

Learn how to roll over an empower 401 (k) to an ira retirement account, including an empower ira, and get tips on where to move your 401 (k). This form must arrive at empower retirement prior to the transaction proceeds. The document outlines the process for an incoming direct rollover into a 401 (a) plan, detailing participant information requirements, rollover. A rollover of your designated roth. Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement. Direct rollover information current plan administrator must authorize by signing in the required signatures section. Make sure the check is payable to the financial services. Rollover contributions received before transaction approval will not be. Inform your former employer that you want to roll over your 401 (k) funds into an ira.

Make sure the check is payable to the financial services. This form must arrive at empower retirement prior to the transaction proceeds. Inform your former employer that you want to roll over your 401 (k) funds into an ira. Learn how to roll over an empower 401 (k) to an ira retirement account, including an empower ira, and get tips on where to move your 401 (k). A rollover of your designated roth. Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement. Direct rollover information current plan administrator must authorize by signing in the required signatures section. The document outlines the process for an incoming direct rollover into a 401 (a) plan, detailing participant information requirements, rollover. Rollover contributions received before transaction approval will not be.

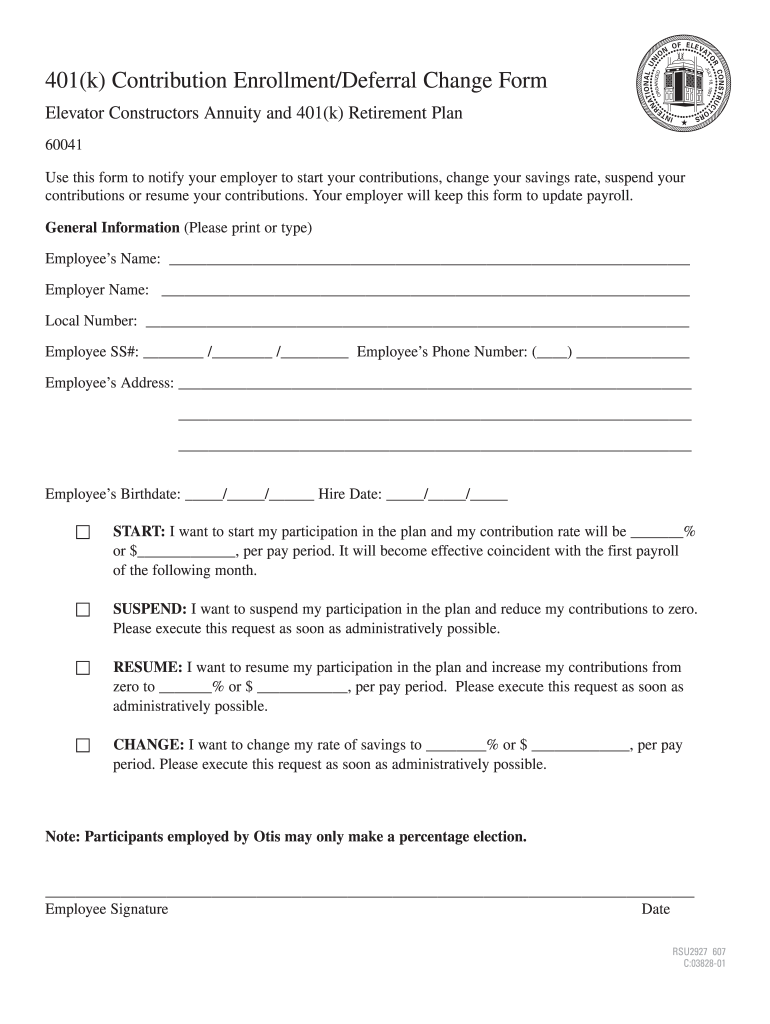

401(k) for Employers Justworks Help Center

Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement. This form must arrive at empower retirement prior to the transaction proceeds. Make sure the check is payable to the financial services. Inform your former employer that you want to roll over your 401 (k) funds into an ira. A rollover of your.

401(k) Justworks Help Center

Rollover contributions received before transaction approval will not be. Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement. Learn how to roll over an empower 401 (k) to an ira retirement account, including an empower ira, and get tips on where to move your 401 (k). The document outlines the process for.

Milliman 401k Rollover Form Fill and Sign Printable Template Online

Direct rollover information current plan administrator must authorize by signing in the required signatures section. A rollover of your designated roth. Inform your former employer that you want to roll over your 401 (k) funds into an ira. Learn how to roll over an empower 401 (k) to an ira retirement account, including an empower ira, and get tips on.

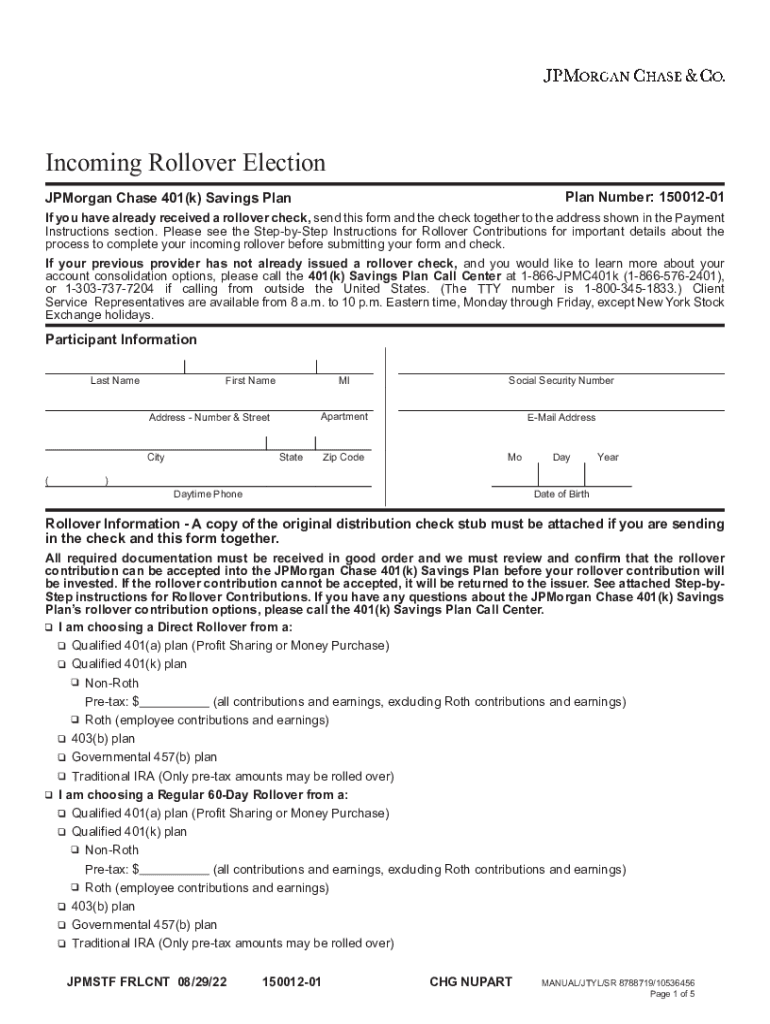

Fillable Online StepbyStep Instructions for Rollover Contributions

Rollover contributions received before transaction approval will not be. Direct rollover information current plan administrator must authorize by signing in the required signatures section. Make sure the check is payable to the financial services. This form must arrive at empower retirement prior to the transaction proceeds. The document outlines the process for an incoming direct rollover into a 401 (a).

Fillable Online 401k Rollover Form Fax Email Print pdfFiller

Direct rollover information current plan administrator must authorize by signing in the required signatures section. This form must arrive at empower retirement prior to the transaction proceeds. The document outlines the process for an incoming direct rollover into a 401 (a) plan, detailing participant information requirements, rollover. Rollover contributions received before transaction approval will not be. Make sure the check.

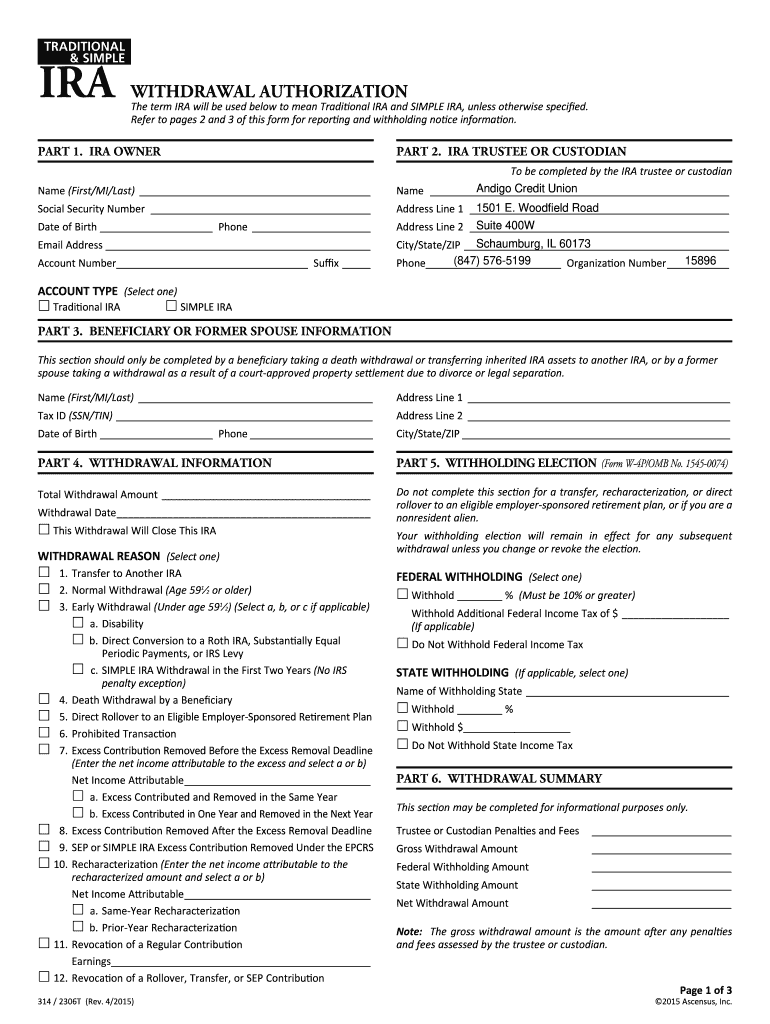

Ascensus Withdrawal Form Complete with ease airSlate SignNow

The document outlines the process for an incoming direct rollover into a 401 (a) plan, detailing participant information requirements, rollover. Rollover contributions received before transaction approval will not be. Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement. Make sure the check is payable to the financial services. This form must arrive.

Fillable Online OUTGOING ROLLOVER REQUEST WaState529 Fax Email Print

A rollover of your designated roth. Make sure the check is payable to the financial services. Rollover contributions received before transaction approval will not be. The document outlines the process for an incoming direct rollover into a 401 (a) plan, detailing participant information requirements, rollover. Get professional, unbiased help you need to consolidate your retirement assets into one account with.

Empower rollover form pdf Fill out & sign online DocHub

Inform your former employer that you want to roll over your 401 (k) funds into an ira. Learn how to roll over an empower 401 (k) to an ira retirement account, including an empower ira, and get tips on where to move your 401 (k). Rollover contributions received before transaction approval will not be. Make sure the check is payable.

Application Form Empower to Plan 202425 Charity 1114109

This form must arrive at empower retirement prior to the transaction proceeds. Inform your former employer that you want to roll over your 401 (k) funds into an ira. Direct rollover information current plan administrator must authorize by signing in the required signatures section. A rollover of your designated roth. Learn how to roll over an empower 401 (k) to.

Nationwide outgoing rollover request form Fill out & sign online DocHub

Make sure the check is payable to the financial services. Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement. This form must arrive at empower retirement prior to the transaction proceeds. Direct rollover information current plan administrator must authorize by signing in the required signatures section. Learn how to roll over an.

Make Sure The Check Is Payable To The Financial Services.

This form must arrive at empower retirement prior to the transaction proceeds. A rollover of your designated roth. The document outlines the process for an incoming direct rollover into a 401 (a) plan, detailing participant information requirements, rollover. Direct rollover information current plan administrator must authorize by signing in the required signatures section.

Learn How To Roll Over An Empower 401 (K) To An Ira Retirement Account, Including An Empower Ira, And Get Tips On Where To Move Your 401 (K).

Rollover contributions received before transaction approval will not be. Get professional, unbiased help you need to consolidate your retirement assets into one account with empower retirement. Inform your former employer that you want to roll over your 401 (k) funds into an ira.