Dividend Tax Form - Dividends are how companies distribute their earnings to shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. When a company pays a dividend, each share of stock of. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares. The most comprehensive dividend stock destination on the web. Any amount not distributed is taken. You can earn a dividend if you own stock in a company that pays dividends,. A dividend is a payment from a company to its investors.

The most comprehensive dividend stock destination on the web. Any amount not distributed is taken. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. When a company pays a dividend, each share of stock of. Dividends are how companies distribute their earnings to shareholders. A dividend is a payment from a company to its investors. You can earn a dividend if you own stock in a company that pays dividends,. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares.

The most comprehensive dividend stock destination on the web. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares. You can earn a dividend if you own stock in a company that pays dividends,. When a company pays a dividend, each share of stock of. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Dividends are how companies distribute their earnings to shareholders. Any amount not distributed is taken. A dividend is a payment from a company to its investors.

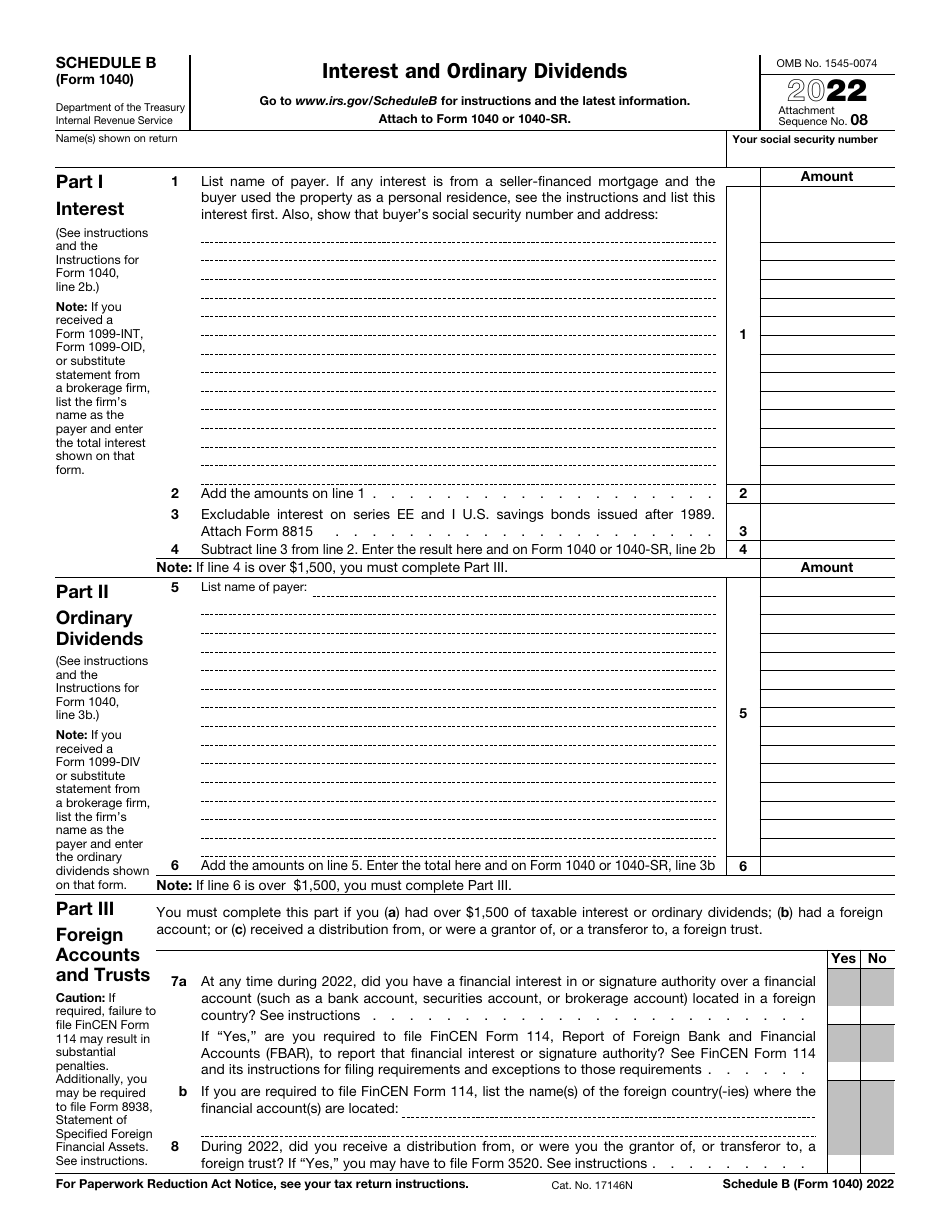

Form 1040, Schedules A & BItemized Deductions & Interest and Dividen…

You can earn a dividend if you own stock in a company that pays dividends,. A dividend is a payment from a company to its investors. Dividends are how companies distribute their earnings to shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. A dividend.

Irs Qualified Dividends And Capital Gain Tax

The most comprehensive dividend stock destination on the web. Any amount not distributed is taken. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Dividends.

5 Dividend Tax Voucher Template SampleTemplatess SampleTemplatess

Any amount not distributed is taken. You can earn a dividend if you own stock in a company that pays dividends,. The most comprehensive dividend stock destination on the web. When a company pays a dividend, each share of stock of. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as.

Bir Form 2306 PDF Withholding Tax Dividend

Any amount not distributed is taken. The most comprehensive dividend stock destination on the web. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares. Dividends are how companies distribute their earnings to shareholders. You can earn a dividend if you own stock in a company that pays dividends,.

Fillable Online DIVIDEND TAX Fax Email Print pdfFiller

The most comprehensive dividend stock destination on the web. When a company pays a dividend, each share of stock of. You can earn a dividend if you own stock in a company that pays dividends,. Any amount not distributed is taken. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as.

IRS Form 1040 Schedule B Download Fillable PDF or Fill Online Interest

Dividends are how companies distribute their earnings to shareholders. You can earn a dividend if you own stock in a company that pays dividends,. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. A dividend is a distribution of earnings, often quarterly, to a company's shareholders.

Qualified Dividends Capital Gain Tax Ws

When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. You can earn a dividend if you own stock in a company that pays dividends,. A dividend is a payment from a company to its investors. When a company pays a dividend, each share of stock of..

Dividend Withholding Tax Declaration Form

Any amount not distributed is taken. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares. You can earn a dividend if you own stock in a company that pays dividends,. A dividend is a payment from a company to its investors. Dividends are how companies distribute their earnings.

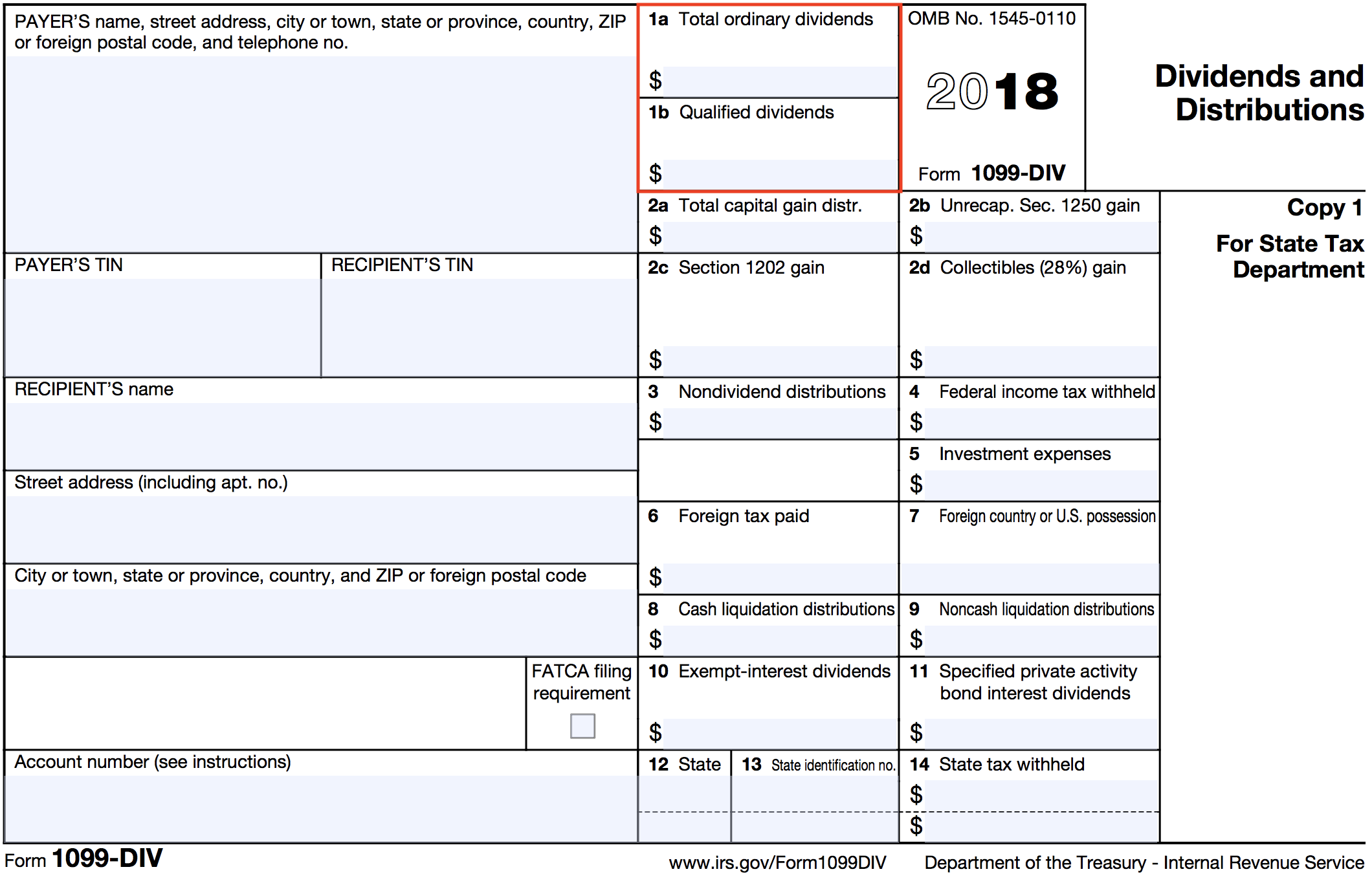

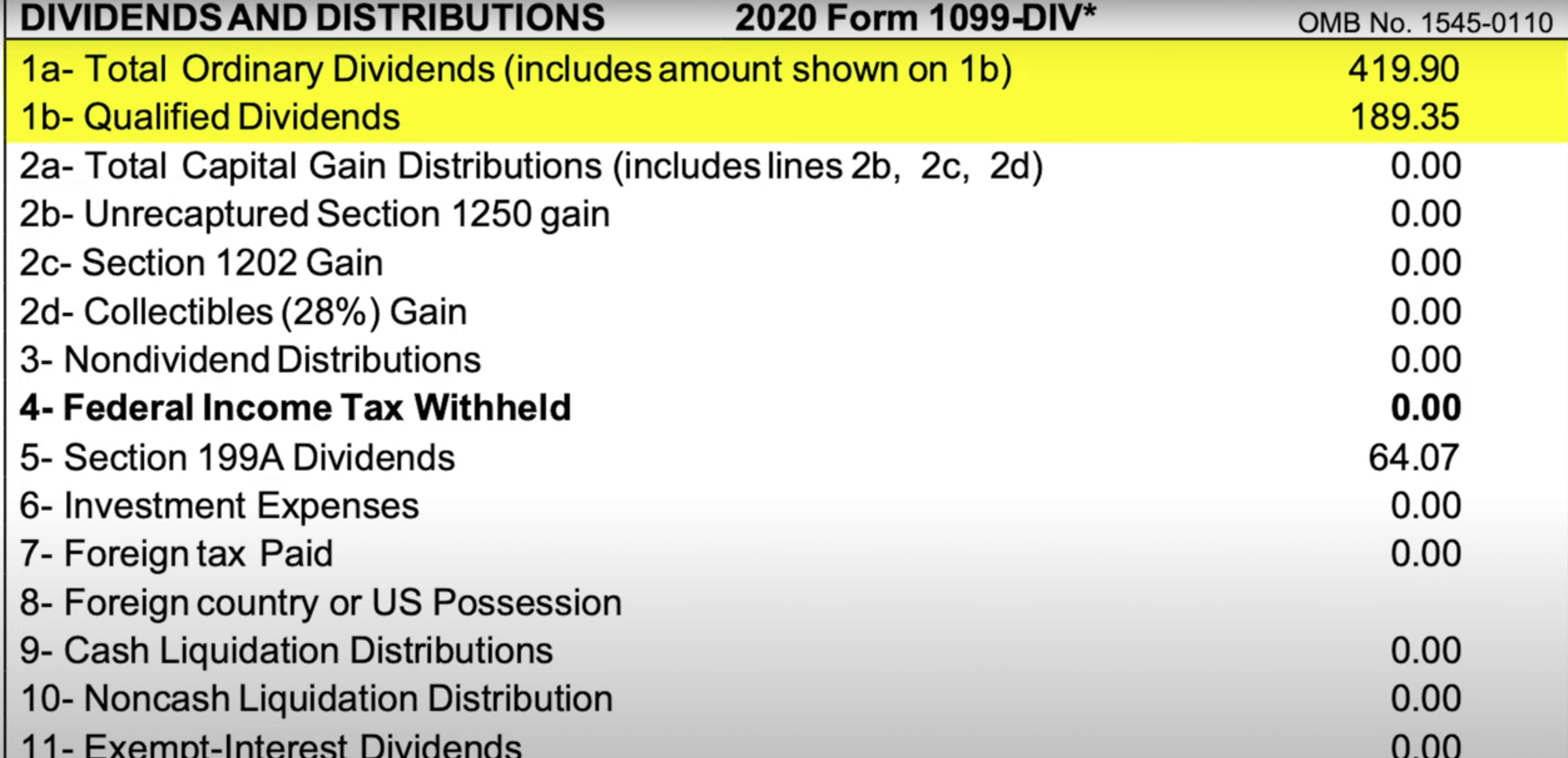

What Is a 1099DIV? Understanding 1099 Div Form for Tax Filing

You can earn a dividend if you own stock in a company that pays dividends,. When a company pays a dividend, each share of stock of. The most comprehensive dividend stock destination on the web. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount.

How Dividends are Taxed

Dividends are how companies distribute their earnings to shareholders. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares. You can earn a dividend if you own stock in a company that pays dividends,. A dividend is a payment from a company to its investors. When a corporation earns.

When A Company Pays A Dividend, Each Share Of Stock Of.

The most comprehensive dividend stock destination on the web. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. You can earn a dividend if you own stock in a company that pays dividends,. Any amount not distributed is taken.

Dividends Are How Companies Distribute Their Earnings To Shareholders.

A dividend is a payment from a company to its investors. A dividend is a distribution of earnings, often quarterly, to a company's shareholders in the form of cash or additional shares.