Amt Form - It ensures they pay a. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. The alternative minimum tax (amt) is a tax levied by the u.s. Government on entities with significantly high incomes. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative.

Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. The alternative minimum tax (amt) is a tax levied by the u.s. It ensures they pay a. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. Government on entities with significantly high incomes.

Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. The alternative minimum tax (amt) is a tax levied by the u.s. Government on entities with significantly high incomes. It ensures they pay a.

AMT Delirium Screening Form PDF Clinical Psychology

The alternative minimum tax (amt) is a tax levied by the u.s. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. It ensures they pay a. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Government on entities with significantly high incomes.

Alternative Minimum Tax (AMT) on LongTerm Contracts

The alternative minimum tax (amt) is a tax levied by the u.s. Government on entities with significantly high incomes. It ensures they pay a. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative.

Form 6251 2024 2025

It ensures they pay a. Government on entities with significantly high incomes. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. The alternative minimum tax (amt) is a tax levied by the u.s. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso.

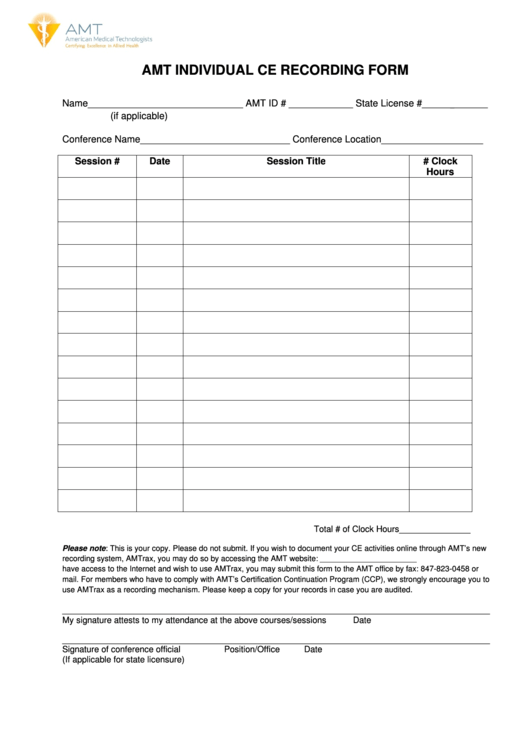

Amt Individual Ce Recording Form printable pdf download

Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. It ensures they pay a. The alternative minimum tax (amt) is a tax levied by the u.s. Government on entities with significantly high incomes. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso.

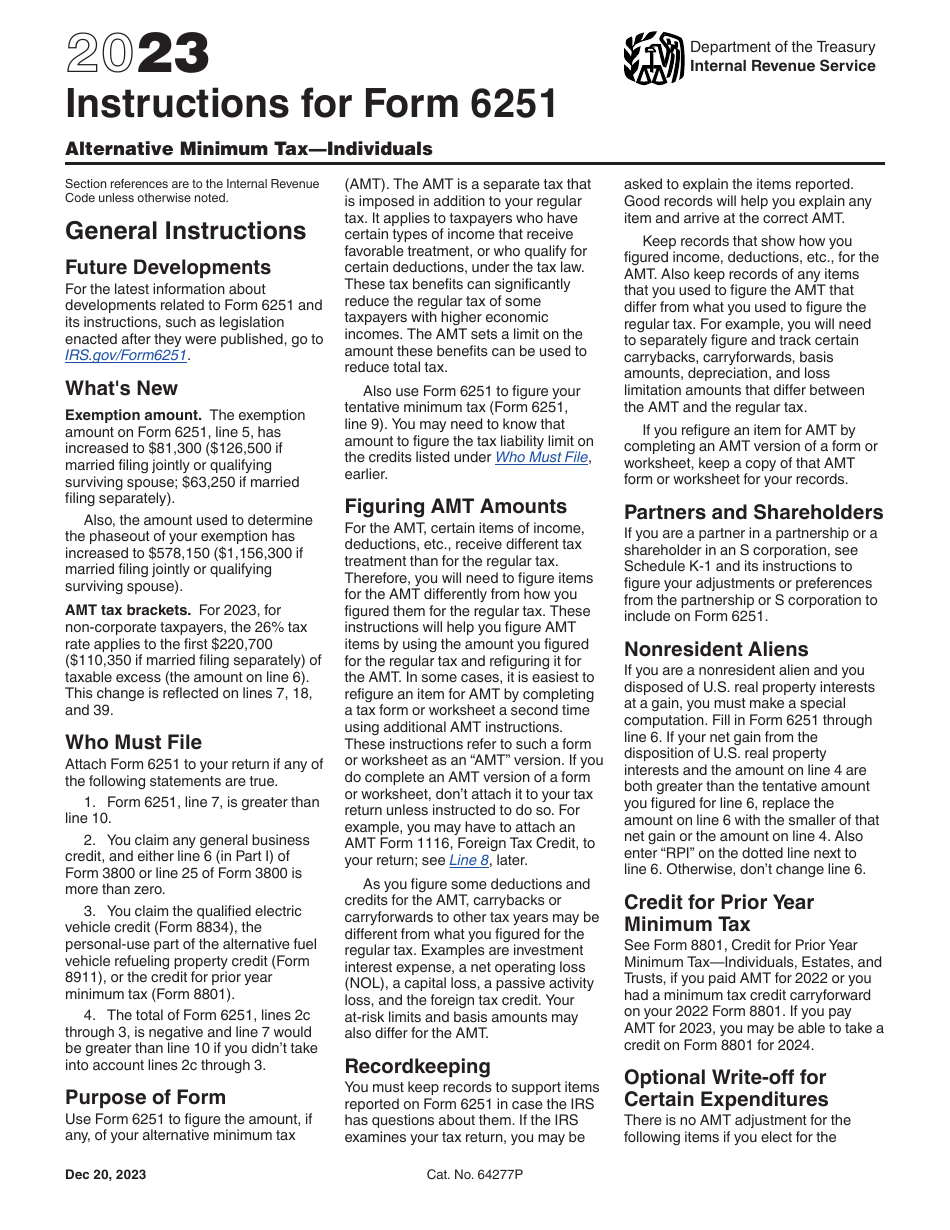

Download Instructions for IRS Form 6251 Alternative Minimum Tax

It ensures they pay a. The alternative minimum tax (amt) is a tax levied by the u.s. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Government on entities with significantly high incomes.

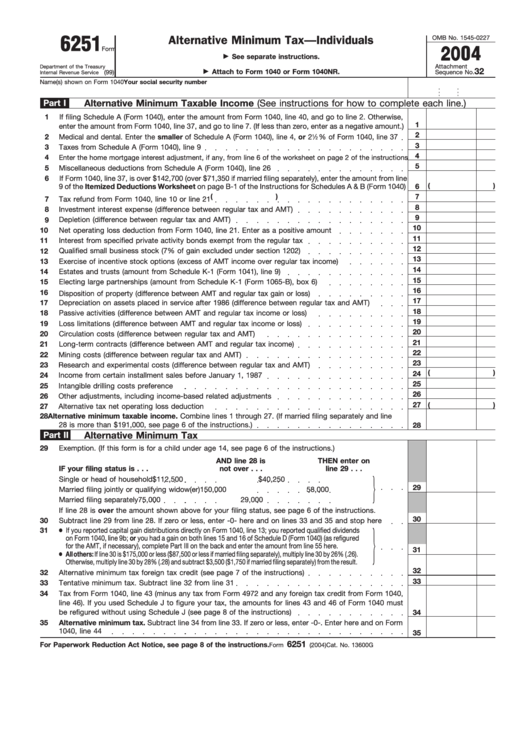

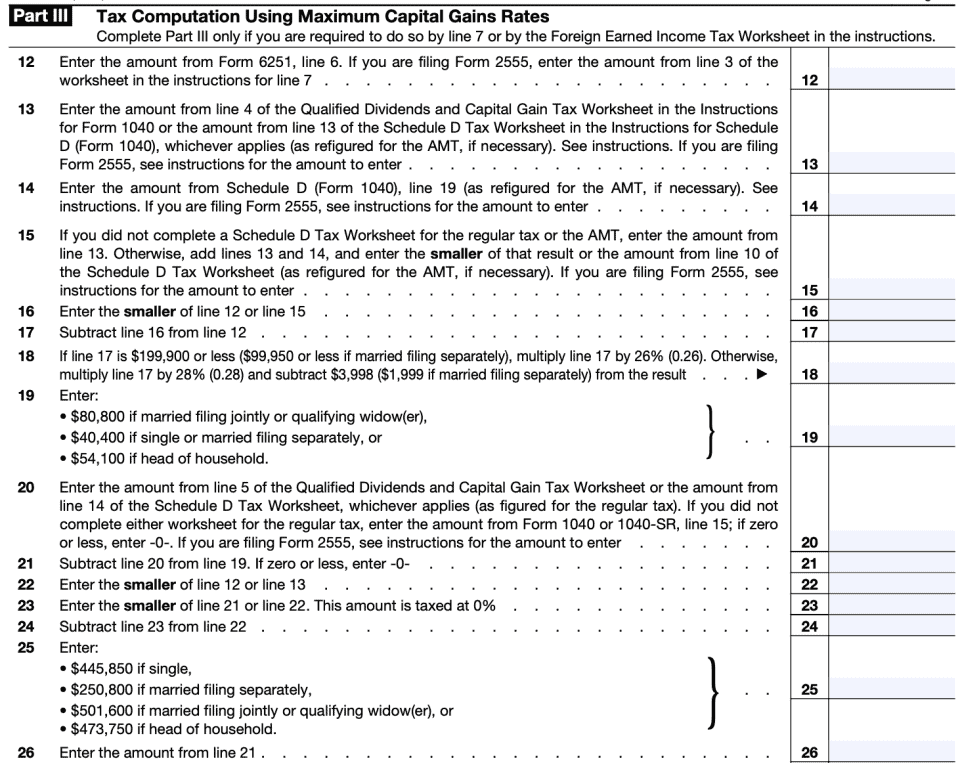

Fillable Form 6251 Alternative Minimum Tax Individuals printable

Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. The alternative minimum tax (amt) is a tax levied by the u.s. Government on entities with significantly high incomes. It ensures they pay a.

IRS Form 6251 A Guide to Alternative Minimum Tax For Individuals

The alternative minimum tax (amt) is a tax levied by the u.s. It ensures they pay a. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. Government on entities with significantly high incomes.

How to File IRS Form 6251 for AMT Adjustments for Private Activity Bond

Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. It ensures they pay a. The alternative minimum tax (amt) is a tax levied by the u.s. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. Government on entities with significantly high incomes.

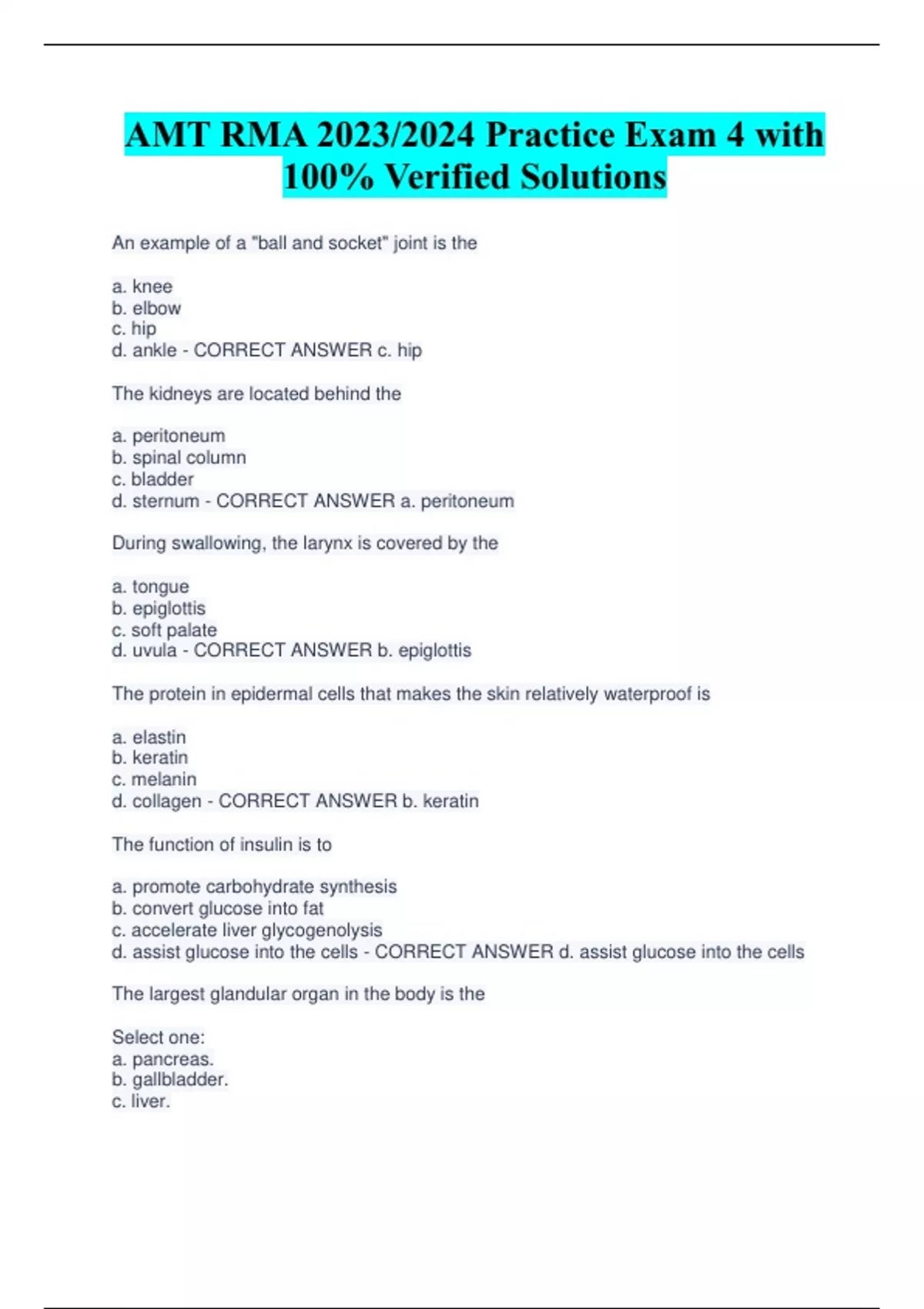

AMT RMA 2023/2024 Practice Exam 4 with 100 Verified Solutions

Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Government on entities with significantly high incomes. The alternative minimum tax (amt) is a tax levied by the u.s. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. It ensures they pay a.

Learn How to Fill the Form 6251 Alternative Minimum Tax by Individual

Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative. It ensures they pay a. Government on entities with significantly high incomes. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. The alternative minimum tax (amt) is a tax levied by the u.s.

The Alternative Minimum Tax (Amt) Is A Tax Levied By The U.s.

It ensures they pay a. Government on entities with significantly high incomes. Exemptions, phaseouts, and rates the 2025 amt applies to taxpayers with large salt, iso. Irs form 6251, alternative minimum tax, is the tax form that individual taxpayers may use to calculate and report their alternative.