8828 Form - What is the 8828 form and when do you need to file it? Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. What is irs form 8828? In this guide, we will break down how to file and complete form 8828 line by line, ensuring you meet irs compliance requirements while minimizing. Understand the purpose of the 8828 form, its filing requirements, necessary. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a.

Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. Understand the purpose of the 8828 form, its filing requirements, necessary. In this guide, we will break down how to file and complete form 8828 line by line, ensuring you meet irs compliance requirements while minimizing. Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. What is irs form 8828? What is the 8828 form and when do you need to file it?

In this guide, we will break down how to file and complete form 8828 line by line, ensuring you meet irs compliance requirements while minimizing. Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. What is the 8828 form and when do you need to file it? What is irs form 8828? Understand the purpose of the 8828 form, its filing requirements, necessary.

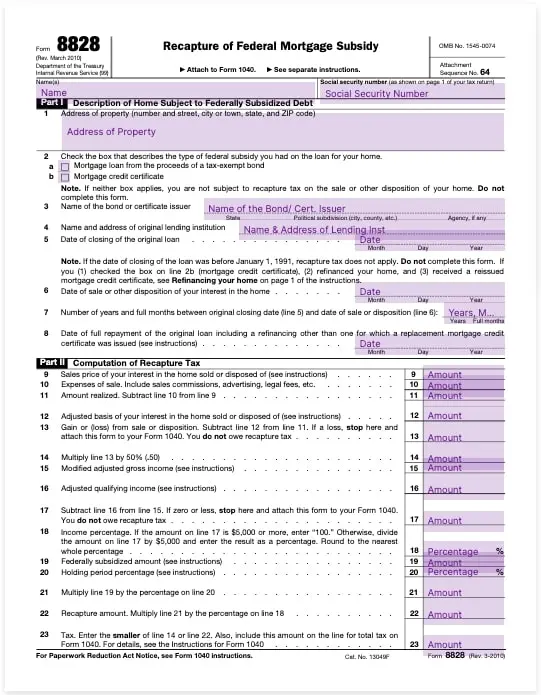

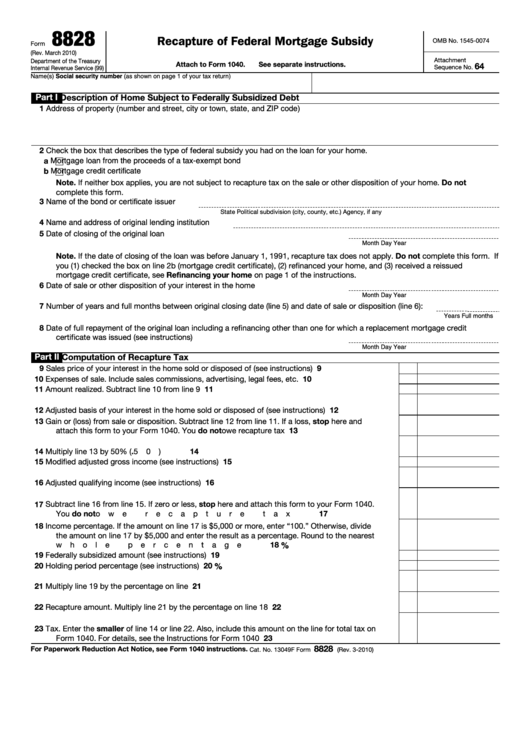

Complete Form 8828 with Confidence Free Editable Template

Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. What is irs form 8828? What is the 8828 form and when do you need to file it?.

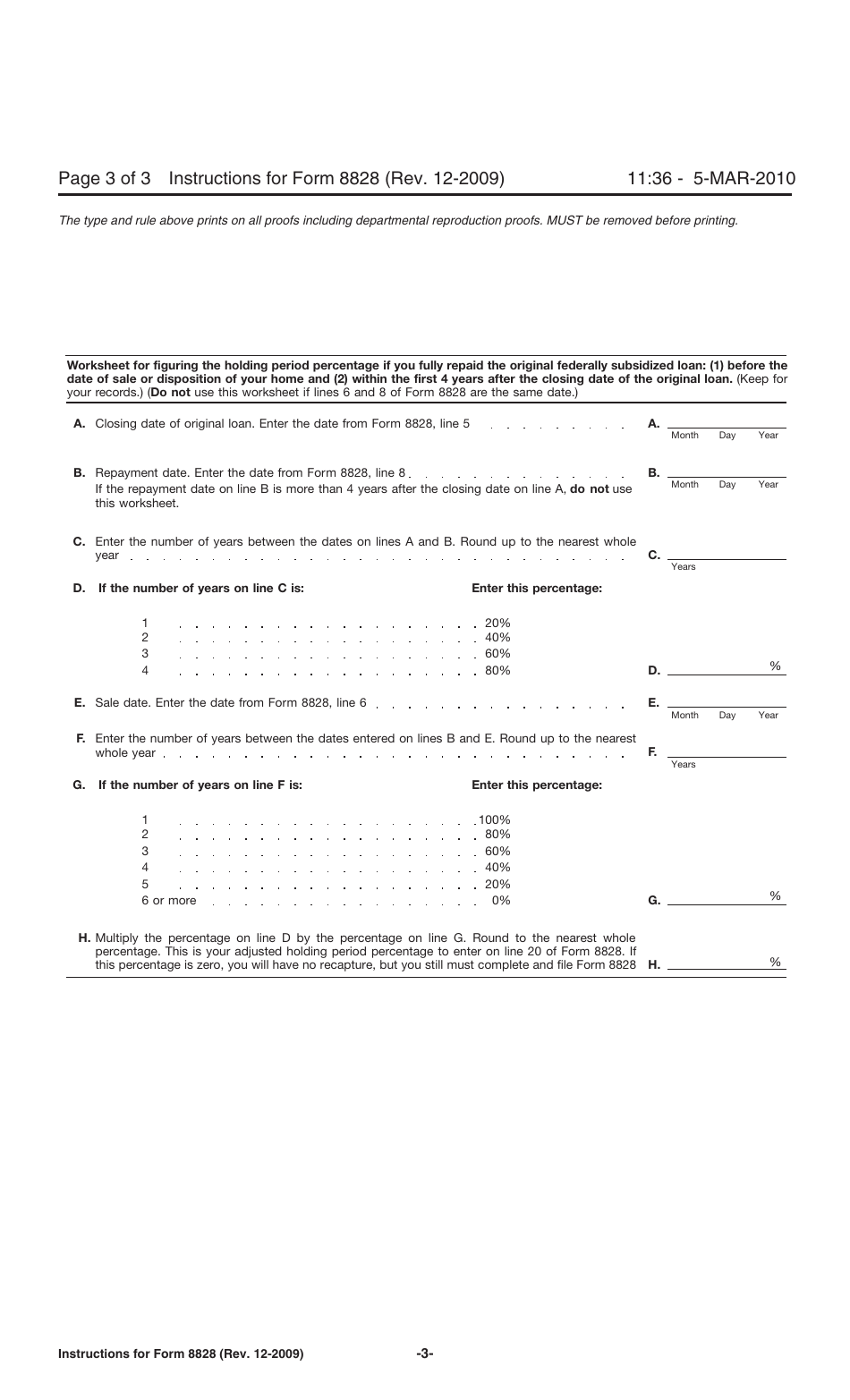

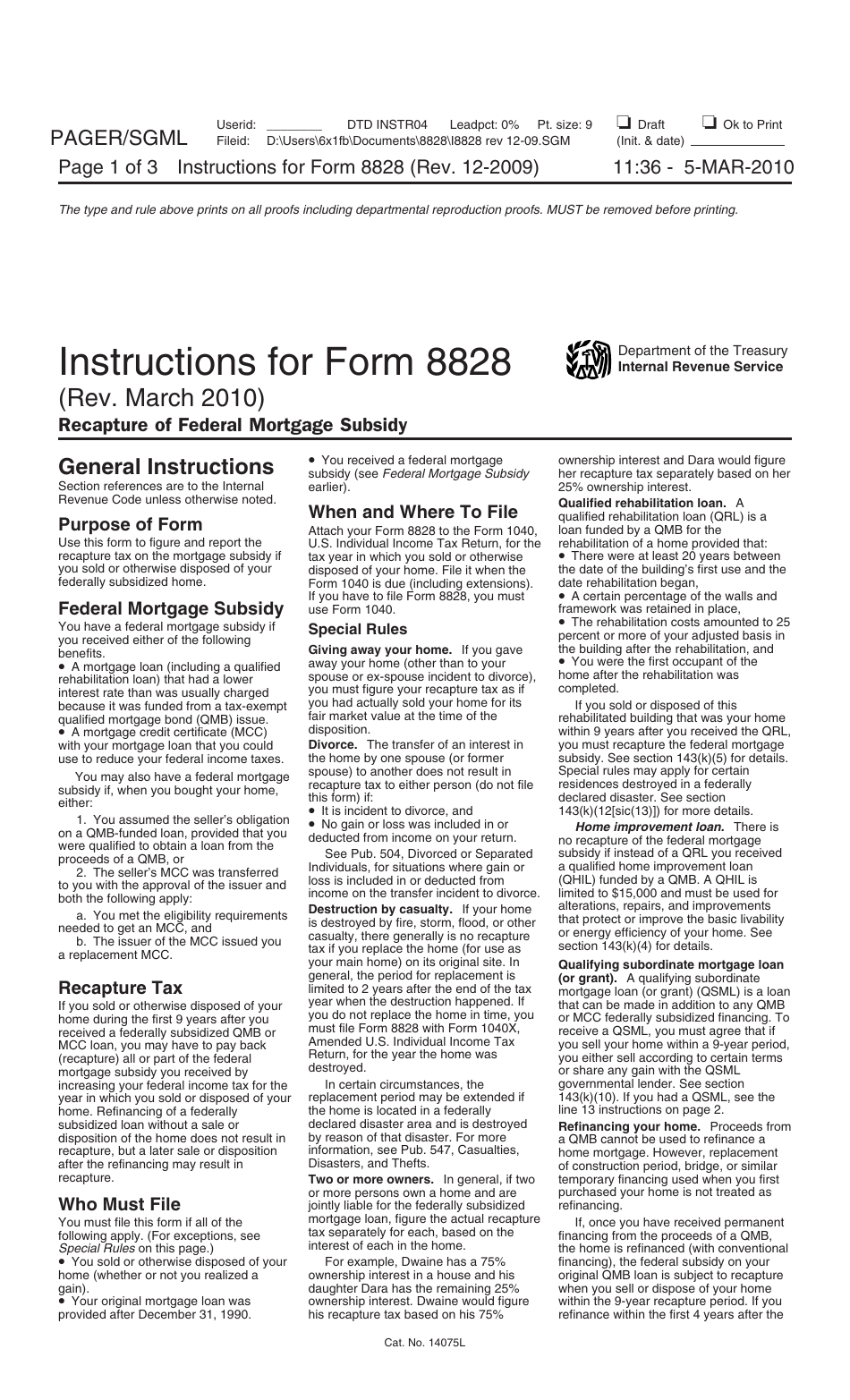

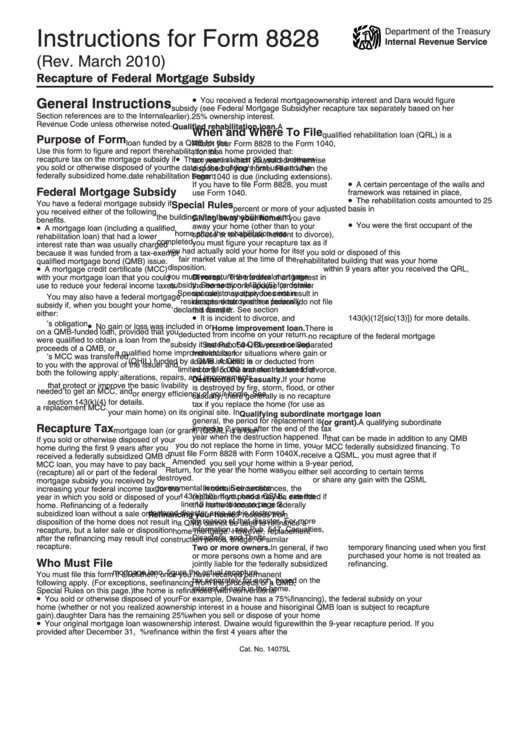

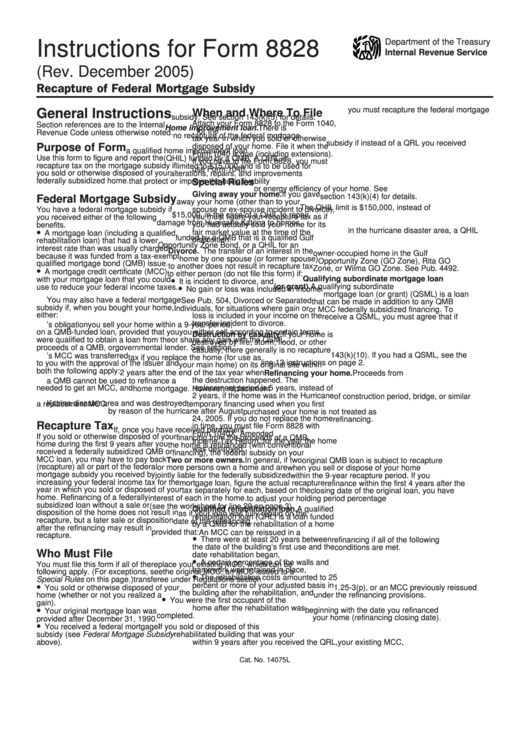

Download Instructions for IRS Form 8828 Recapture of Federal Mortgage

In this guide, we will break down how to file and complete form 8828 line by line, ensuring you meet irs compliance requirements while minimizing. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. Irs form 8828 is the tax form that taxpayers file to calculate any federal.

IRS Form 8828 walkthrough (Recapture of Federal Mortgage Subsidy) YouTube

Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. What.

Download Instructions for IRS Form 8828 Recapture of Federal Mortgage

In this guide, we will break down how to file and complete form 8828 line by line, ensuring you meet irs compliance requirements while minimizing. What is irs form 8828? Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. Irs form 8828 is the tax form that taxpayers file to calculate any.

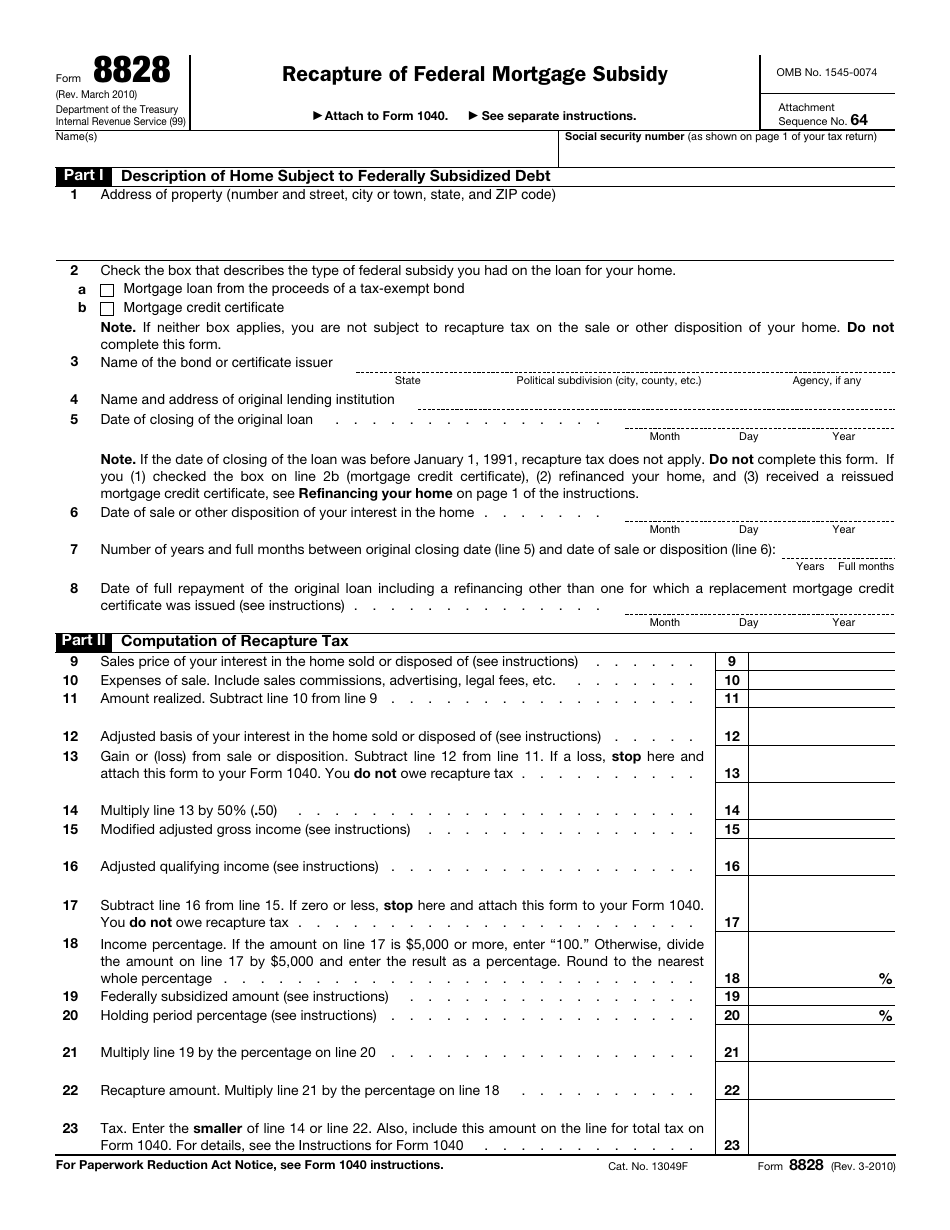

Form 8828 Recapture of Federal Mortgage Subsidy (2010) Free Download

What is the 8828 form and when do you need to file it? Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. What is irs form 8828?.

IRS Form 8828 Fill Out, Sign Online and Download Fillable PDF

What is the 8828 form and when do you need to file it? Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. Understand the purpose of the 8828 form, its filing requirements, necessary. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to.

Fillable Form 8828 Recapture Of Federal Mortgage Subsidy printable

Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. What is irs form 8828? Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the. What is the 8828 form and when do you need to file it? In this guide, we.

Instructions For Form 8828 Recapture Of Federal Mortgage Subsidy

What is irs form 8828? Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. In this guide, we will break down how to file and complete form 8828 line by line, ensuring you meet irs compliance requirements while minimizing. What is the 8828 form and when do you need to file it?.

IRS Form 8828 Instructions Federal Mortgage Subsidy Recapture

What is the 8828 form and when do you need to file it? What is irs form 8828? Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. Understand the purpose of.

Instructions For Form 8828 Recapture Of Federal Mortgage Subsidy

What is the 8828 form and when do you need to file it? Understand the purpose of the 8828 form, its filing requirements, necessary. Information about form 8828, recapture of federal mortgage subsidy, including recent updates, related forms, and instructions on. Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe.

Information About Form 8828, Recapture Of Federal Mortgage Subsidy, Including Recent Updates, Related Forms, And Instructions On.

In this guide, we will break down how to file and complete form 8828 line by line, ensuring you meet irs compliance requirements while minimizing. Federal form 8828, officially titled recapture of federal mortgage subsidy, is used by taxpayers to report and potentially pay back a. What is the 8828 form and when do you need to file it? Understand the purpose of the 8828 form, its filing requirements, necessary.

What Is Irs Form 8828?

Irs form 8828 is the tax form that taxpayers file to calculate any federal subsidy recapture they might owe on the.