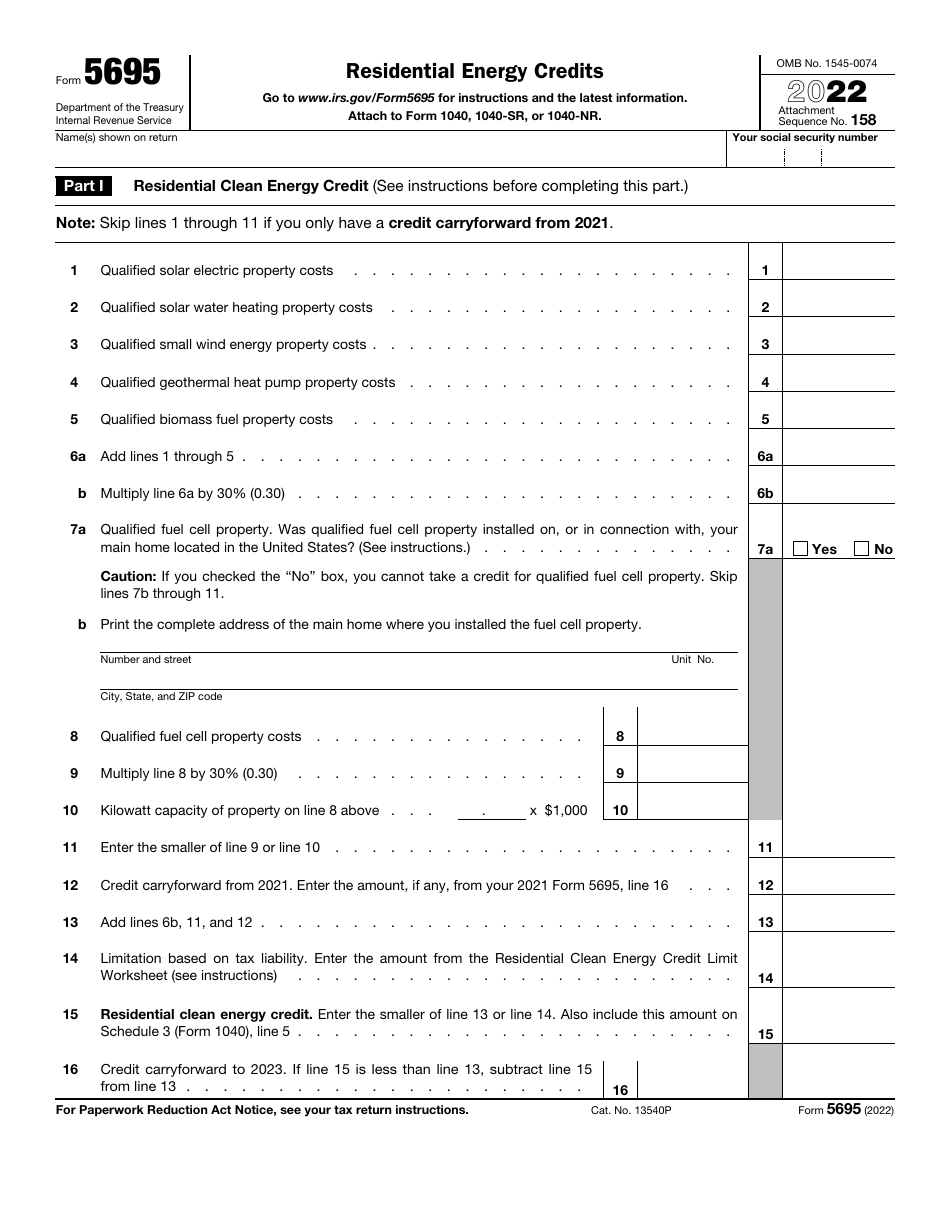

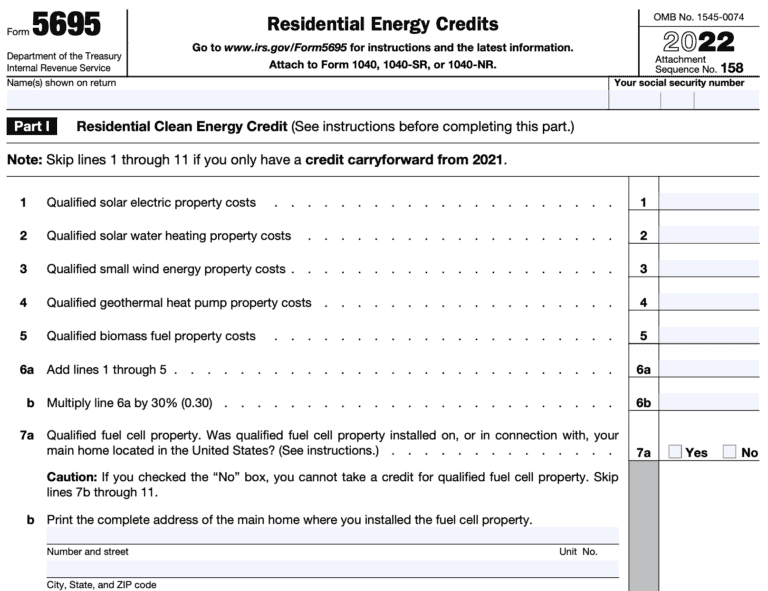

5695 Form 2022 - However, this credit is limited as follows. Part i residential energy efficient. Add lines 6b, 11, and 12. Go to www.irs.gov/form5695 for instructions and the latest information. Any residential energy property costs paid or incurred in 2022. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Enter the amount, if any, from your 2021 form 5695, line 16. A total combined credit limit of $500 for. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. 14 limitation based on tax.

However, this credit is limited as follows. Enter the amount, if any, from your 2021 form 5695, line 16. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. A total combined credit limit of $500 for. 14 limitation based on tax. Any residential energy property costs paid or incurred in 2022. Go to www.irs.gov/form5695 for instructions and the latest information. Add lines 6b, 11, and 12. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Part i residential energy efficient.

Part i residential energy efficient. Any residential energy property costs paid or incurred in 2022. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Go to www.irs.gov/form5695 for instructions and the latest information. Enter the amount, if any, from your 2021 form 5695, line 16. A total combined credit limit of $500 for. 14 limitation based on tax. Add lines 6b, 11, and 12. However, this credit is limited as follows.

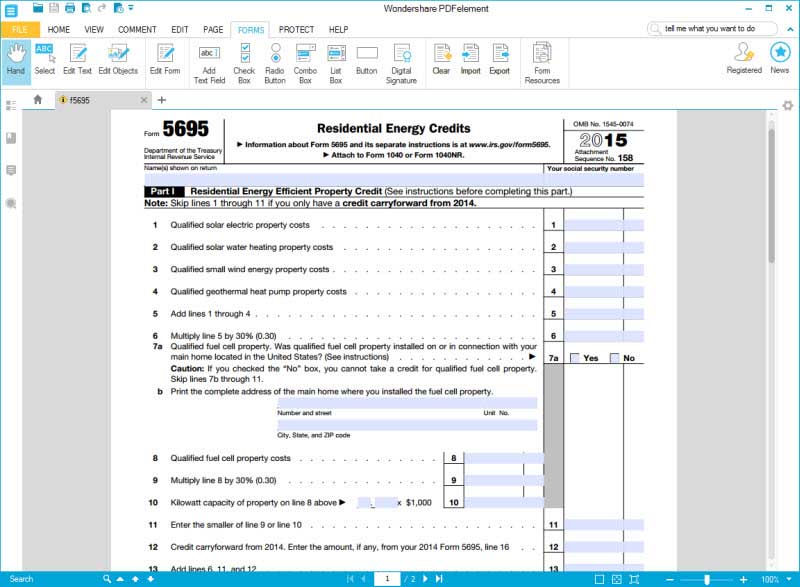

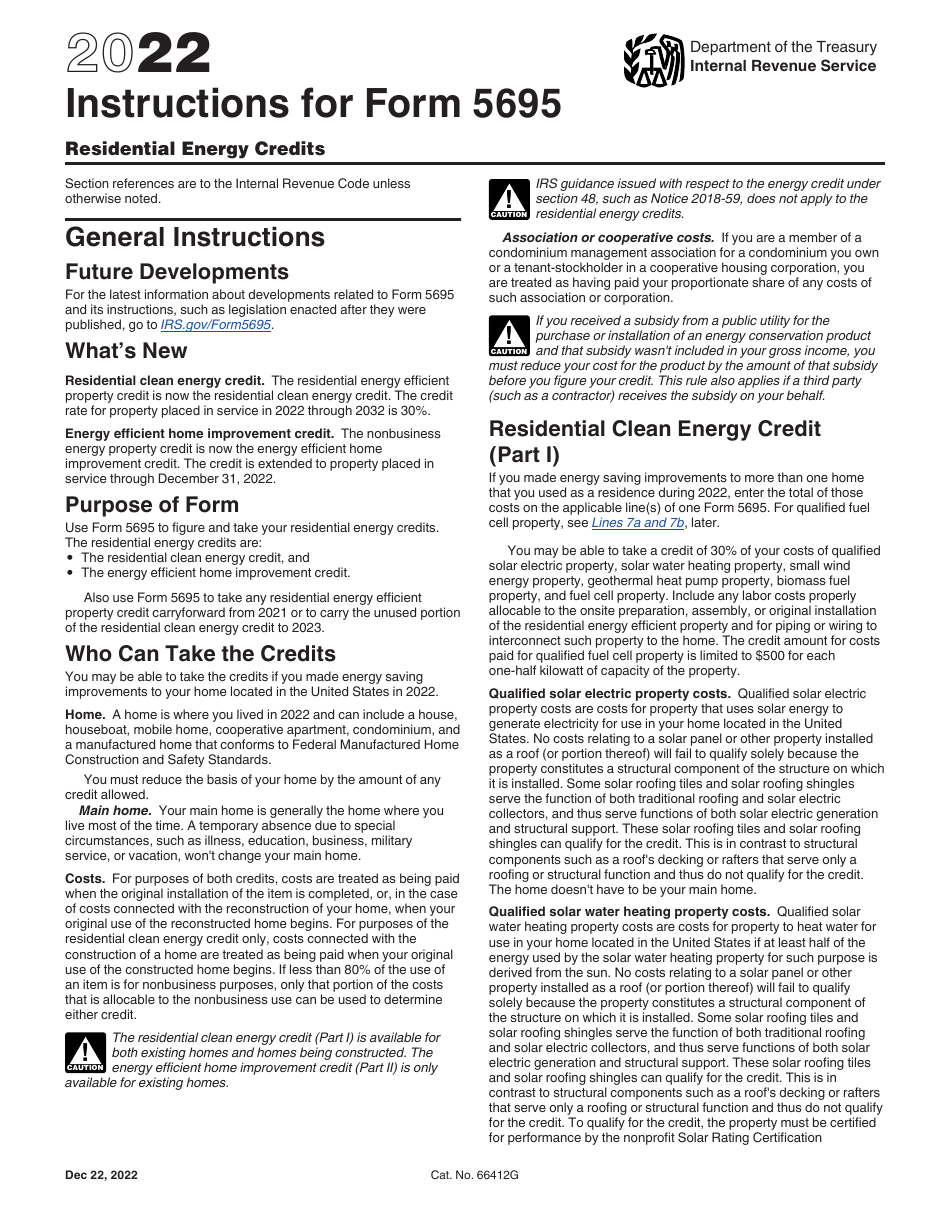

Instructions for How to IRS Form 5695

Any residential energy property costs paid or incurred in 2022. However, this credit is limited as follows. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Enter the amount, if any, from your 2021 form 5695, line 16. Information about form 5695, residential energy credits, including recent.

IRS Form 5695 Download Fillable PDF or Fill Online Residential Energy

14 limitation based on tax. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Enter the amount, if any, from your 2021 form 5695, line 16. A total combined credit limit of $500 for. Part i residential energy efficient.

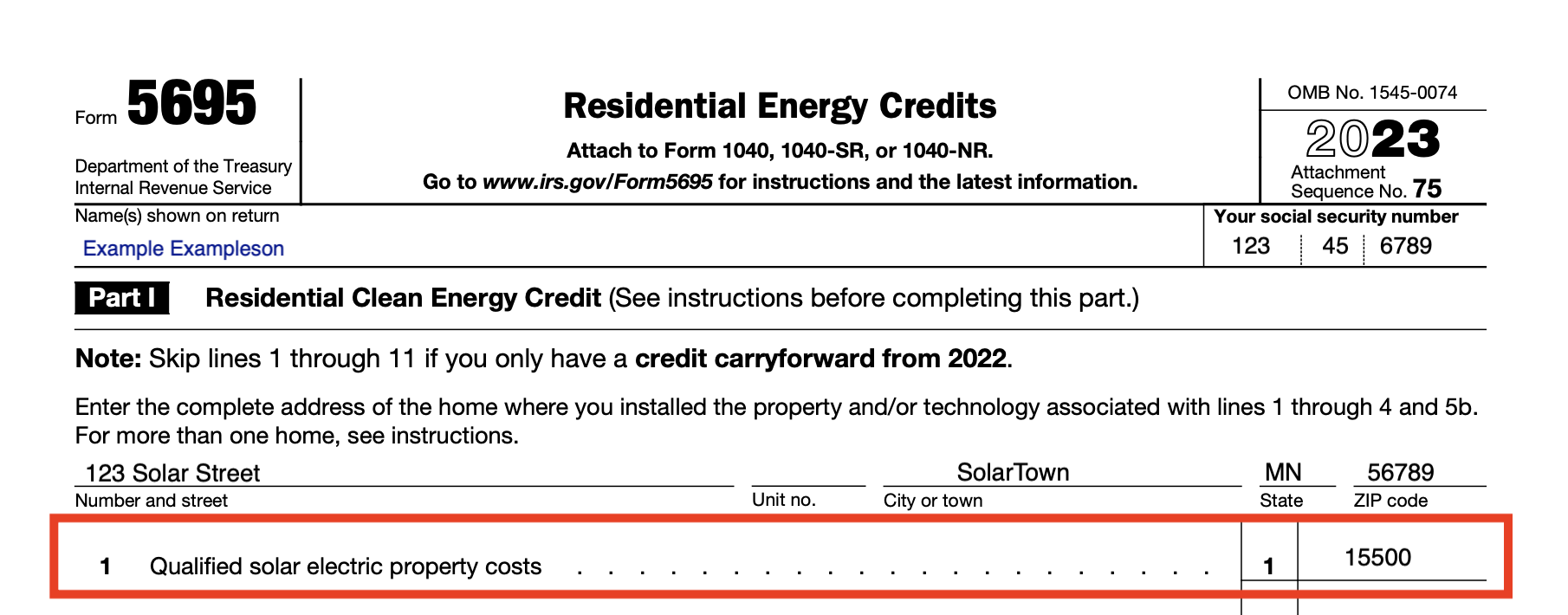

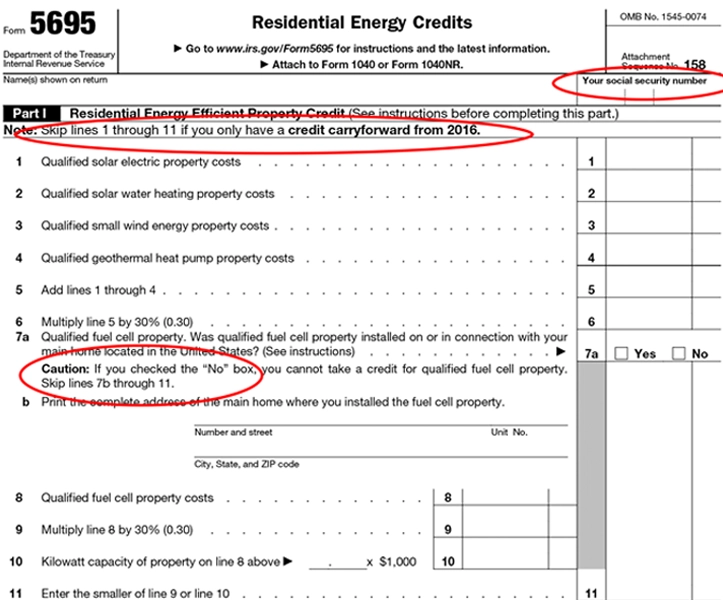

How To Claim The Solar Tax Credit IRS Form 5695 Instructions (2024 tax

However, this credit is limited as follows. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Enter the amount, if any, from your 2021 form 5695, line 16. A total combined credit limit of $500 for. Information about form 5695, residential energy credits, including recent updates, related.

How To Fill Out IRS Form 5695 to Claim the Solar Tax Credit

14 limitation based on tax. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Any residential energy property costs paid or incurred in 2022. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. A total combined credit limit.

Form 5695 Instructions & Information Community Tax

Part i residential energy efficient. Add lines 6b, 11, and 12. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Any residential energy property costs paid or incurred in 2022. Go to www.irs.gov/form5695 for instructions and the latest information.

Form 5695 2021 2022 IRS Forms TaxUni

Enter the amount, if any, from your 2021 form 5695, line 16. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Any residential energy property costs paid or incurred in 2022. Go to www.irs.gov/form5695 for instructions and the latest information. Information about form 5695, residential energy credits,.

IRS Form 5695 Instructions Residential Energy Credits

A total combined credit limit of $500 for. Enter the amount, if any, from your 2021 form 5695, line 16. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Part i residential energy efficient. 14 limitation based on tax.

Steps to Complete IRS Form 5695 LoveToKnow

Go to www.irs.gov/form5695 for instructions and the latest information. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Part i residential energy efficient. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. 14 limitation based on tax.

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

Add lines 6b, 11, and 12. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. Go to www.irs.gov/form5695 for instructions and the latest information. Enter the amount, if any,.

Fillable Online 2022 Instructions for Form 5695. Instructions for Form

However, this credit is limited as follows. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. A total combined credit limit of $500 for. Part i residential energy efficient. Go to www.irs.gov/form5695 for instructions and the latest information.

Any Residential Energy Property Costs Paid Or Incurred In 2022.

Part i residential energy efficient. A total combined credit limit of $500 for. A home is where you lived in 2022 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured. However, this credit is limited as follows.

Enter The Amount, If Any, From Your 2021 Form 5695, Line 16.

Go to www.irs.gov/form5695 for instructions and the latest information. 14 limitation based on tax. Add lines 6b, 11, and 12. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.