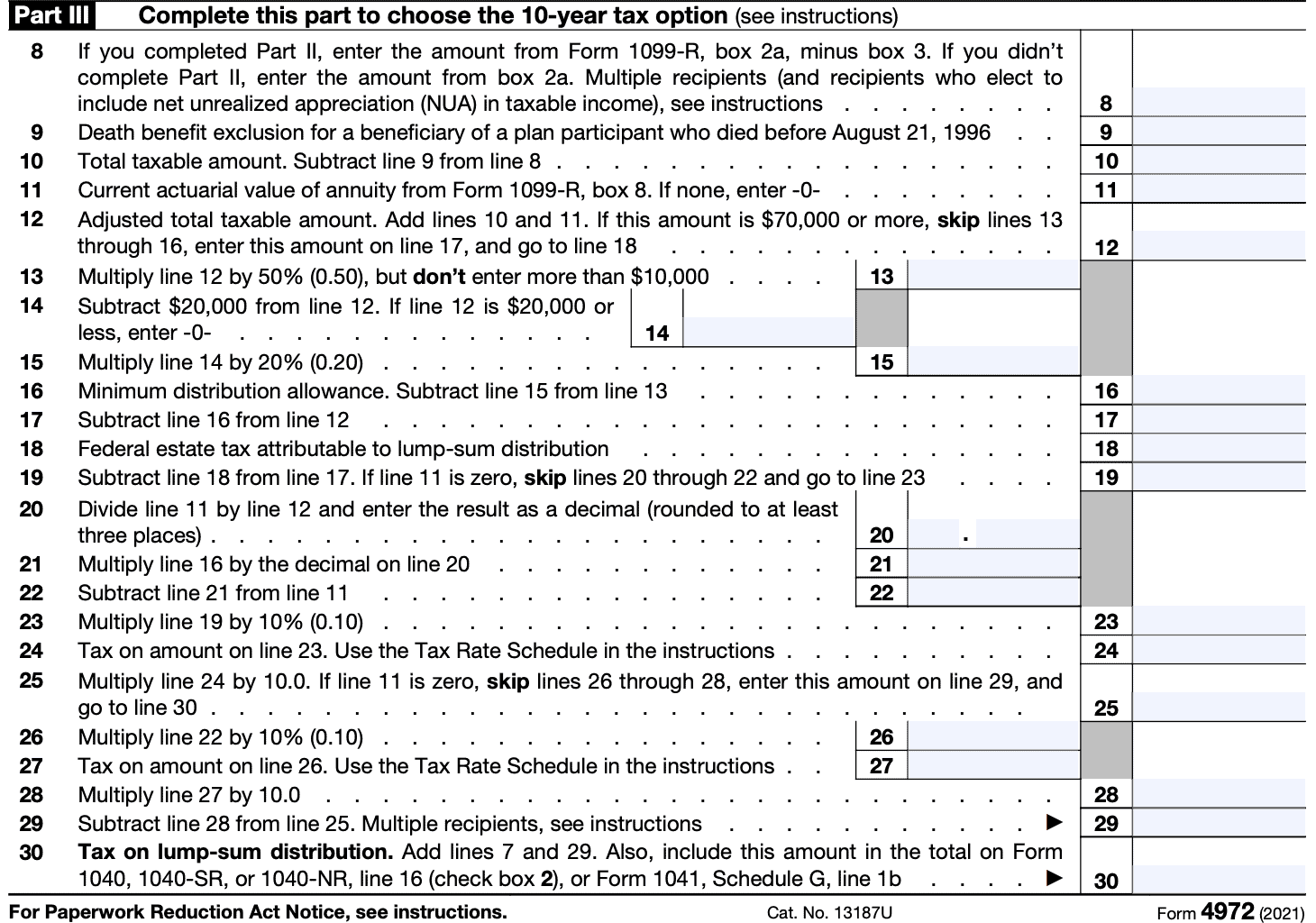

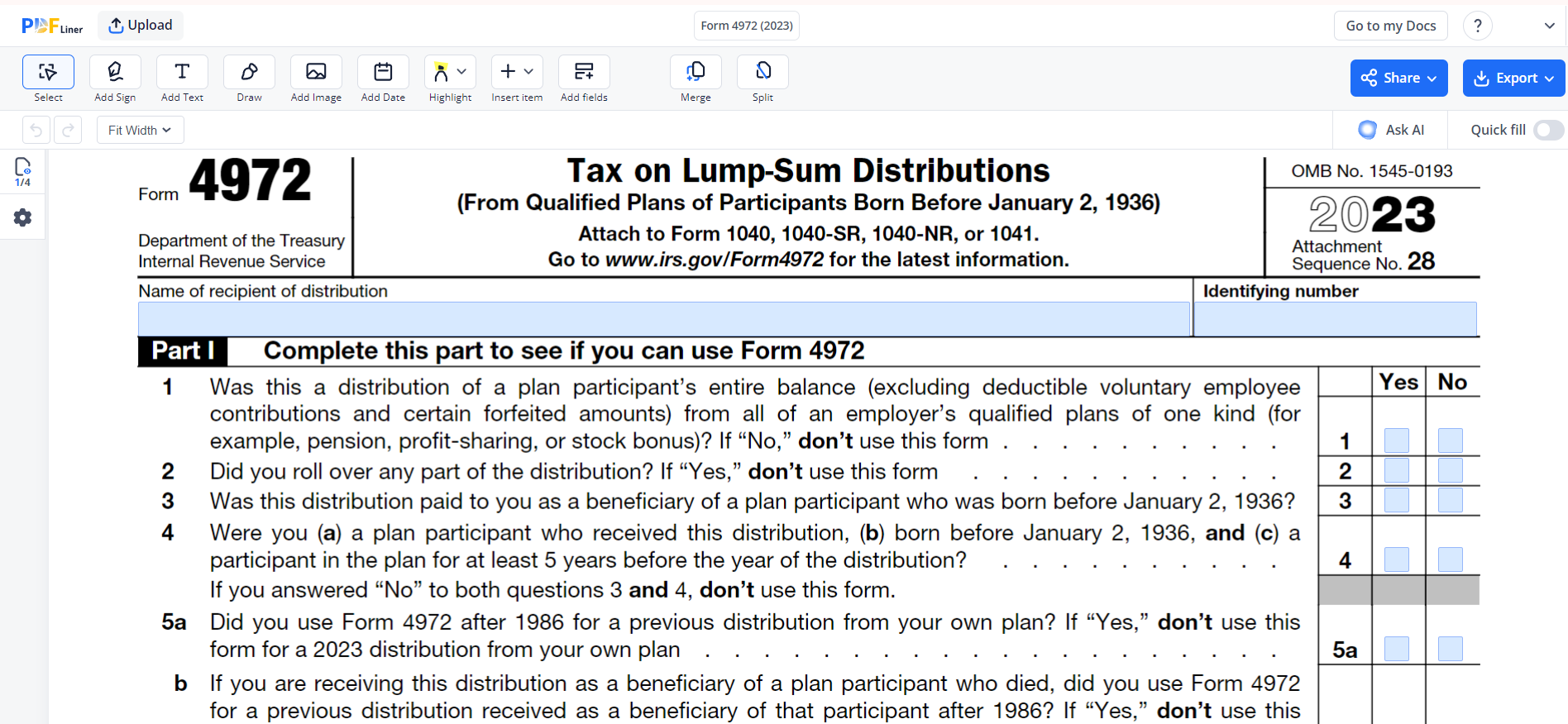

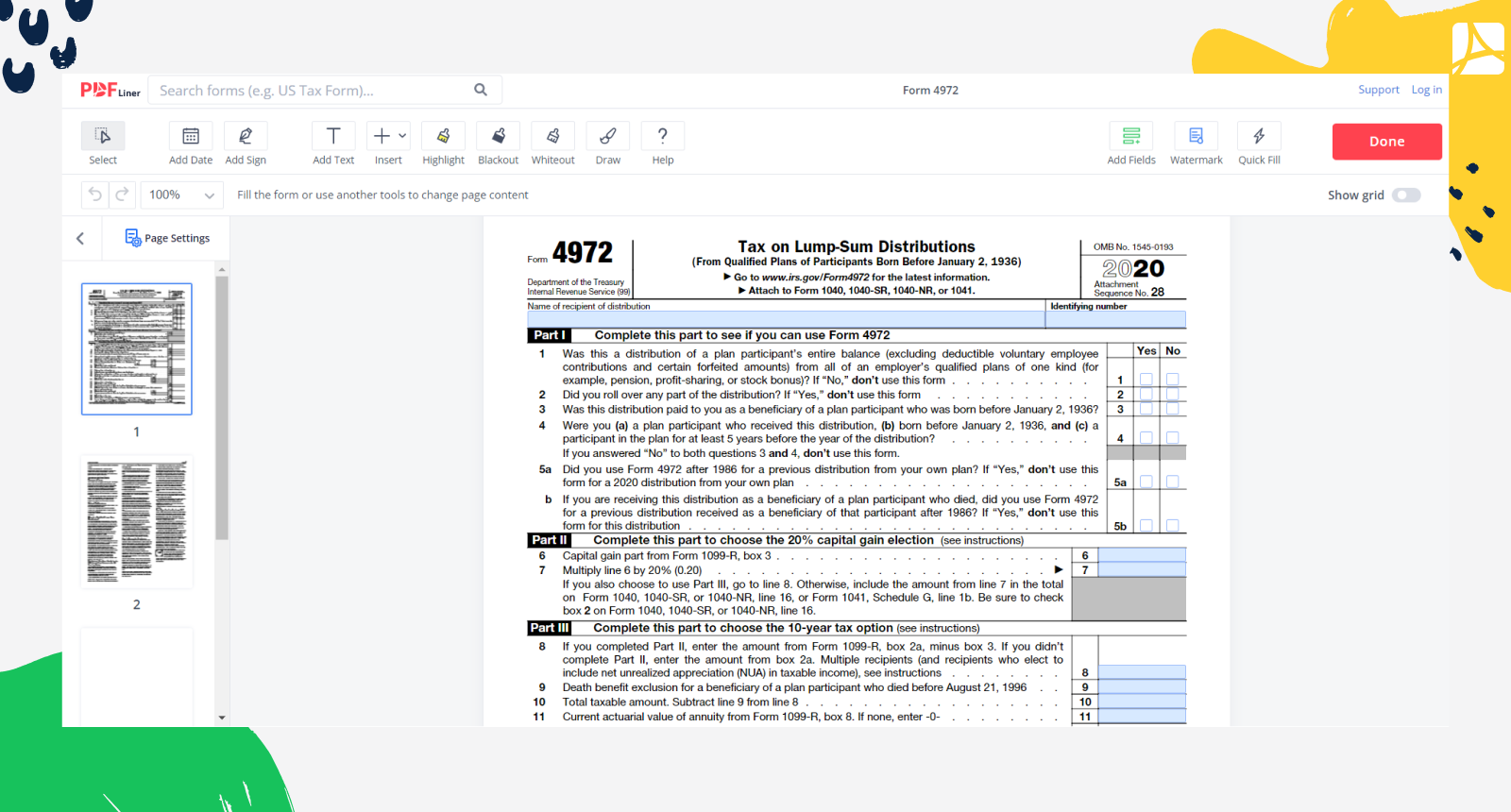

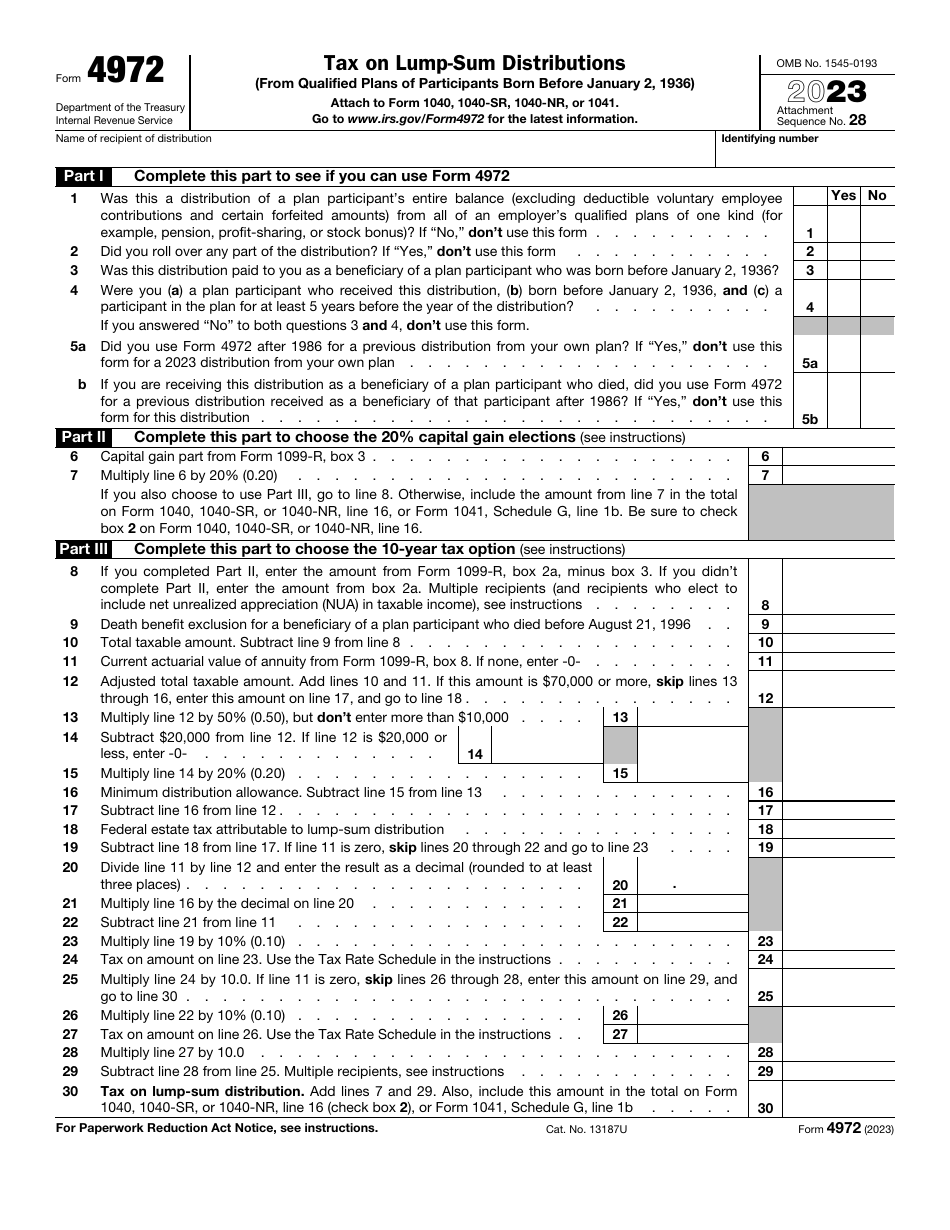

4972 Irs Form - Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. Were you (a) a plan participant who. Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. What is irs form 4972 used for? This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to.

In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. What is irs form 4972 used for? Were you (a) a plan participant who. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to.

What is irs form 4972 used for? In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to. Were you (a) a plan participant who. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the.

IRS Form 8958 Instructions Community Property Allocation

Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. What is irs form 4972 used for? Were you (a) a plan participant who. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. Was this distribution.

IRS Form 4972A Guide to Tax on LumpSum Distributions

In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. Were you (a) a plan participant who. What is irs form 4972 used for? This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its.

Irs Form 4972 Fillable Printable Forms Free Online

Were you (a) a plan participant who. Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. In the case of any qualified employer plan, there is hereby imposed a tax equal.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of.

IRS Form 4972 Instructions Lump Sum Distributions

This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to. Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? What is irs form 4972 used for? In the case of any qualified employer plan, there is.

Publication 575 Pension and Annuity Taxation of Nonperiodic

In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? What is irs form 4972 used for? Taxpayers may use irs form 4972 to calculate.

Irs Form 4972 Fillable Printable Forms Free Online

Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. Were you (a) a plan participant who. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. What is irs form 4972 used for? This comprehensive guide.

Form 4972 Tax Form printable

Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to. What is irs form 4972 used for? In the case of any qualified employer plan, there is.

IRS Form 4972 Instructions Lump Sum Distributions

What is irs form 4972 used for? This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to. Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? Were you (a) a plan participant who. Taxpayers may use.

Form 4972 2024 2025

Were you (a) a plan participant who. This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to. What is irs form 4972 used for? Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. Was this distribution paid to.

Were You (A) A Plan Participant Who.

Was this distribution paid to you as a beneficiary of a plan participant who was born before january 2, 1936? In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of the nondeductible contributions under the plan. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the. This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to.