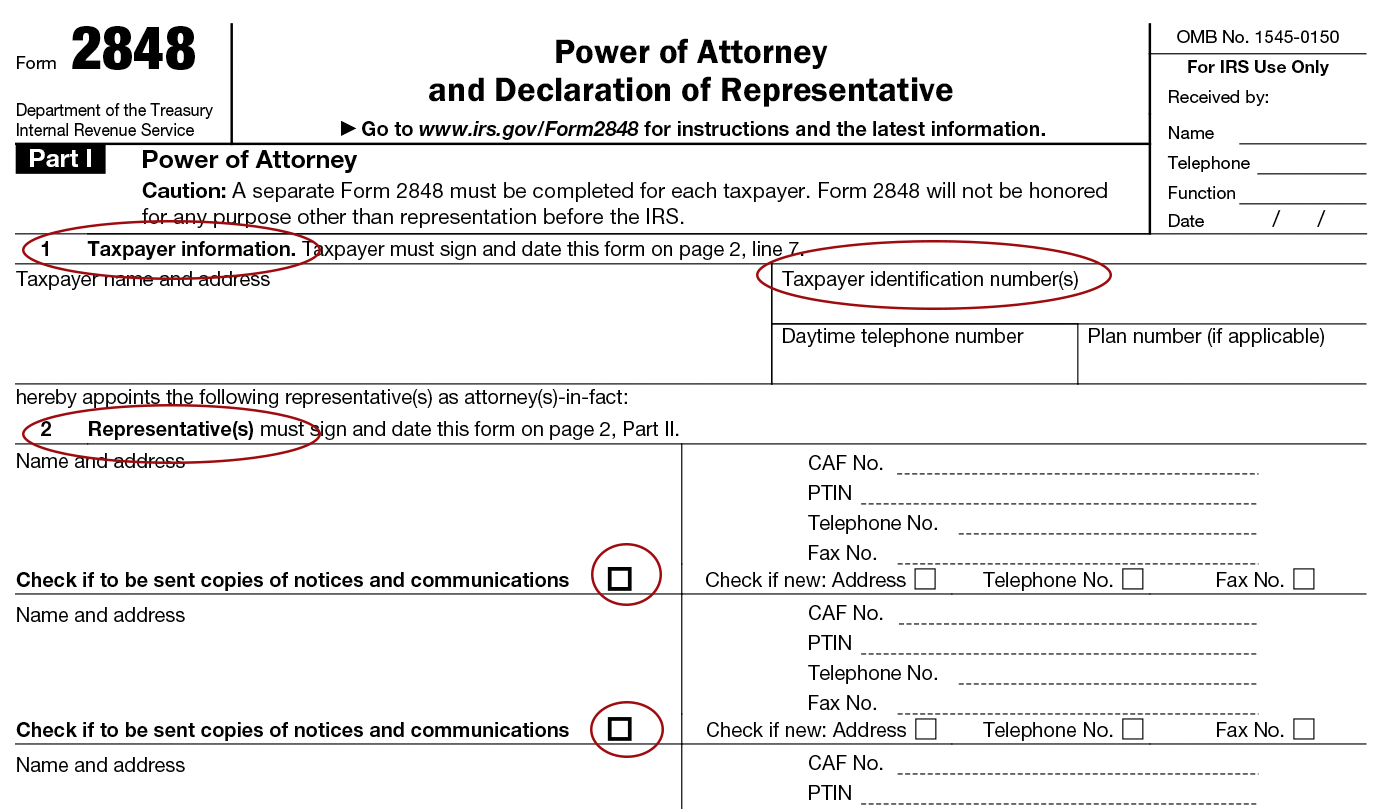

2848 Form - Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on.

Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the.

Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the.

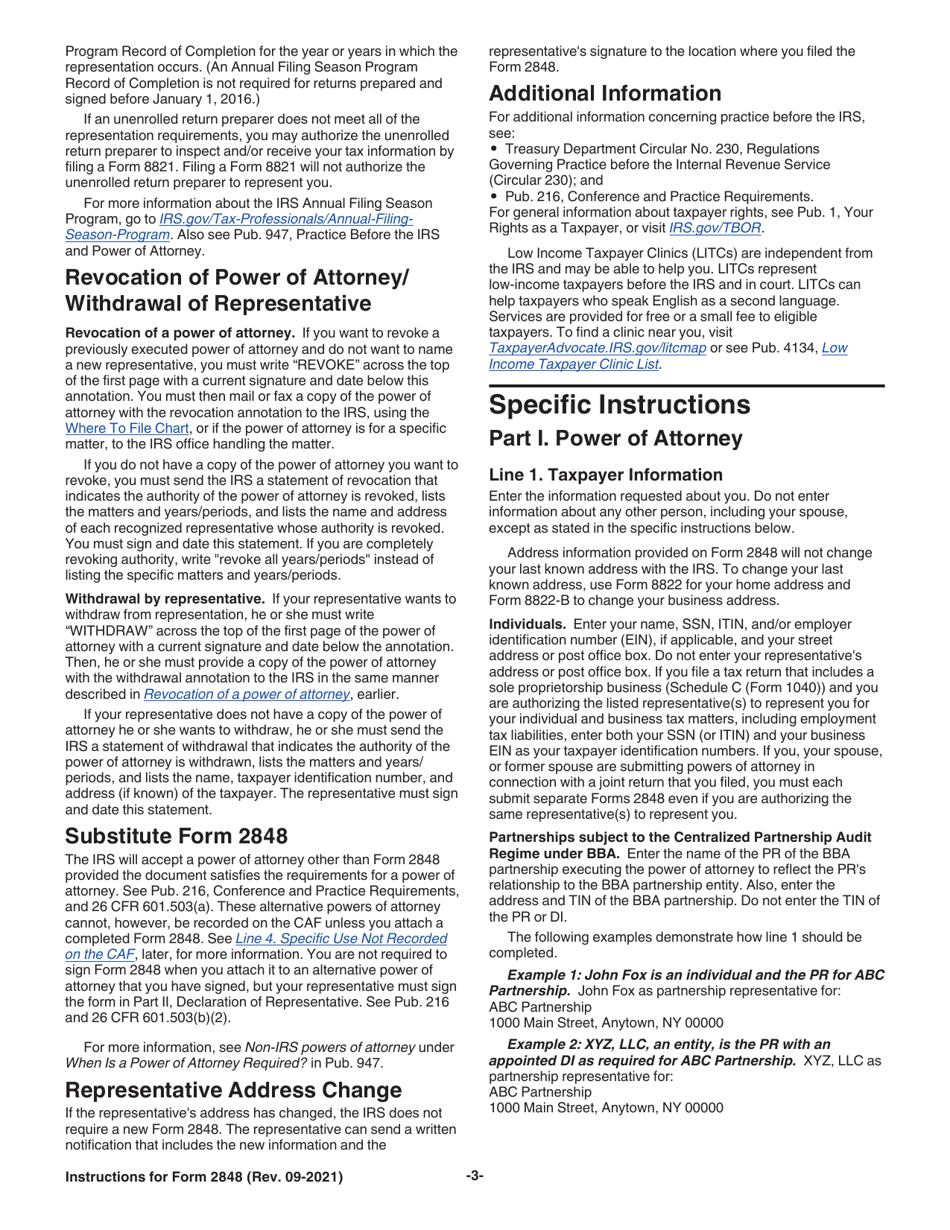

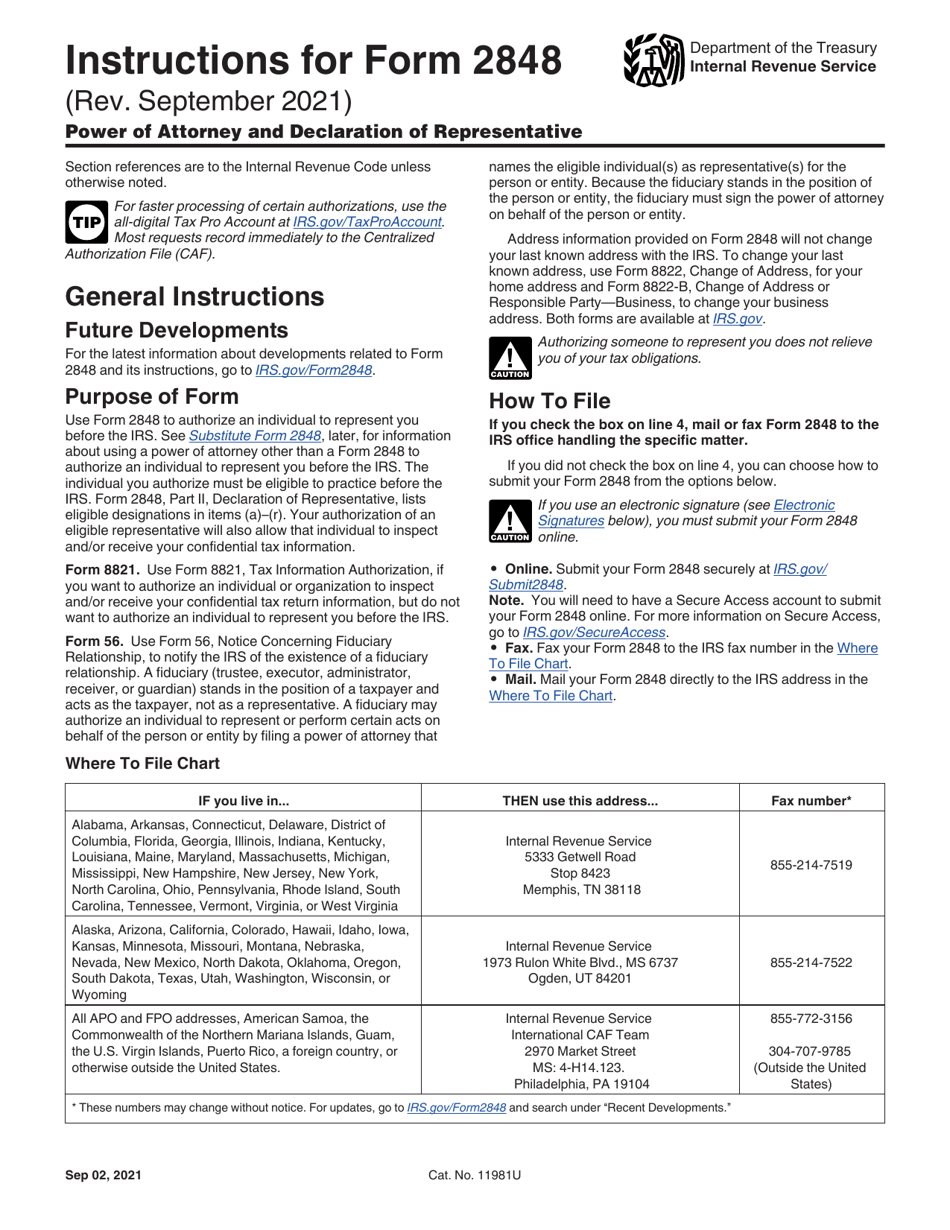

Download Instructions for IRS Form 2848 Power of Attorney and

Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. In.

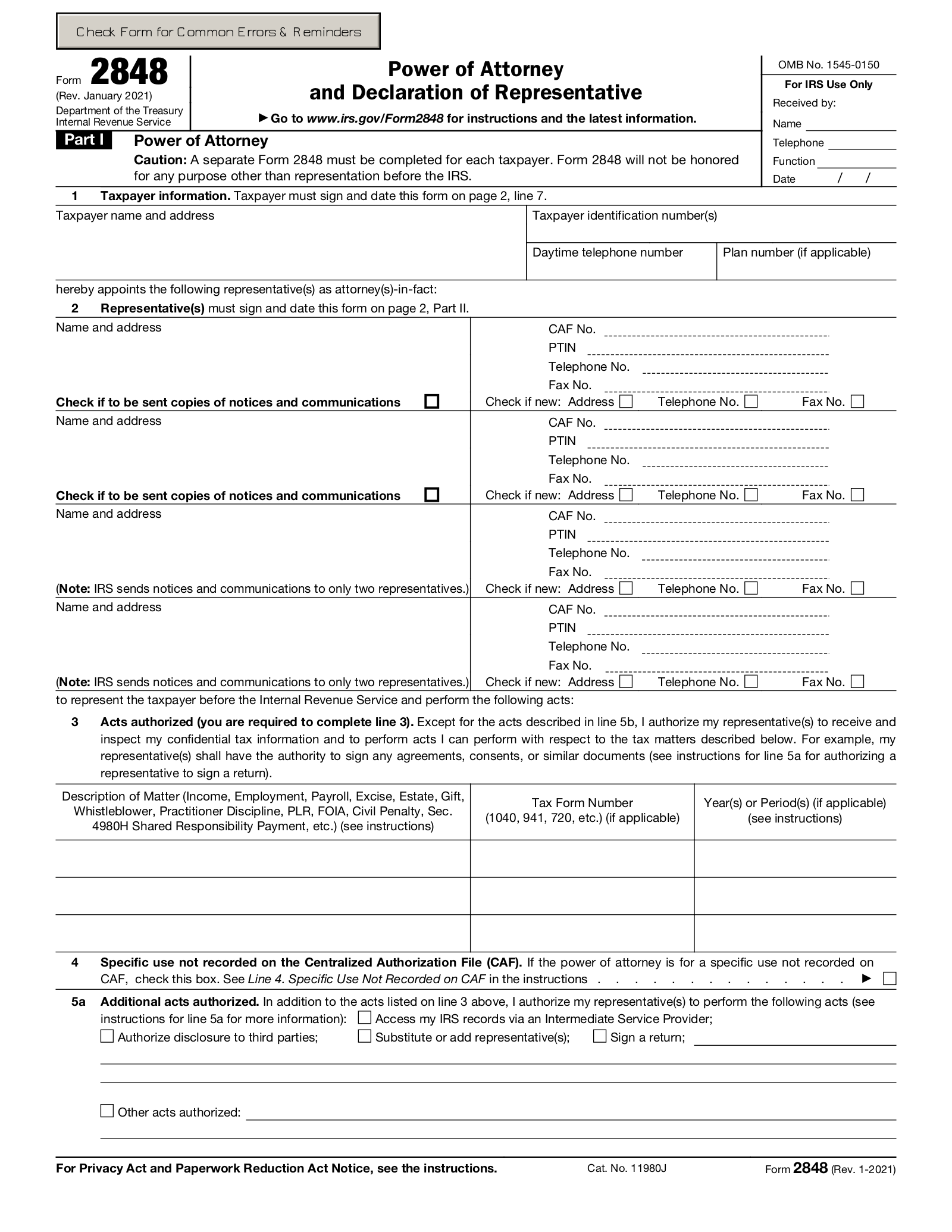

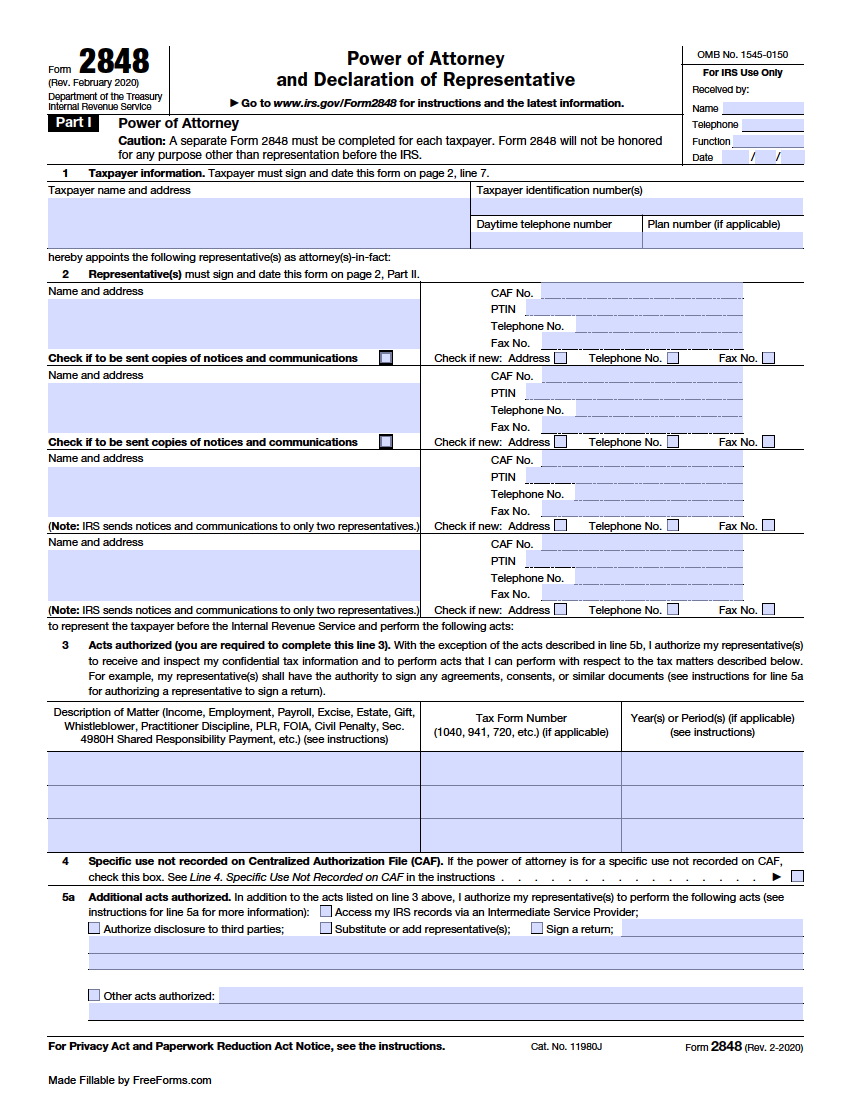

Free IRS Power of Attorney Form 2848 Revised Jan. 2021 PDF eForms

Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on. In.

Download Instructions for IRS Form 2848 Power of Attorney and

Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. In.

Form 2848 Power of Attorney and Declaration of Representative IRS

Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Irs power of attorney form 2848 is a document that allows an individual, such as.

Form 2848 Power of Attorney and Declaration of Representative IRS

Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it.

IRS Power of Attorney Form 2848 Revised Jan. 2021 IRS Power of

Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Properly completing form 2848 requires specific information related to.

USSAAN Form 2848 Power of Attorney Internal Revenue Service Taxation

Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. In.

Free IRS Power of Attorney (Form 2848) PDF

Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Information about form 2848, power of attorney and declaration.

Download Instructions For IRS Form 2848 Power Of Attorney Power Of

In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a. Information about form 2848, power of attorney and declaration.

IRS Form 2848 Instructions IRS Power of Attorney Form

Information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on. In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Irs power of attorney form 2848 is a document that allows an individual,.

Information About Form 2848, Power Of Attorney And Declaration Of Representative, Including Recent Updates, Related Forms, And Instructions On.

In this guide, you’ll learn how to file form 2848, when it makes sense to use it, and what it allows your tax representative to do on your. Properly completing form 2848 requires specific information related to the deceased taxpayer, the appointed representative, and the. Irs power of attorney form 2848 is a document that allows an individual, such as an accountant or tax preparer, to represent a.