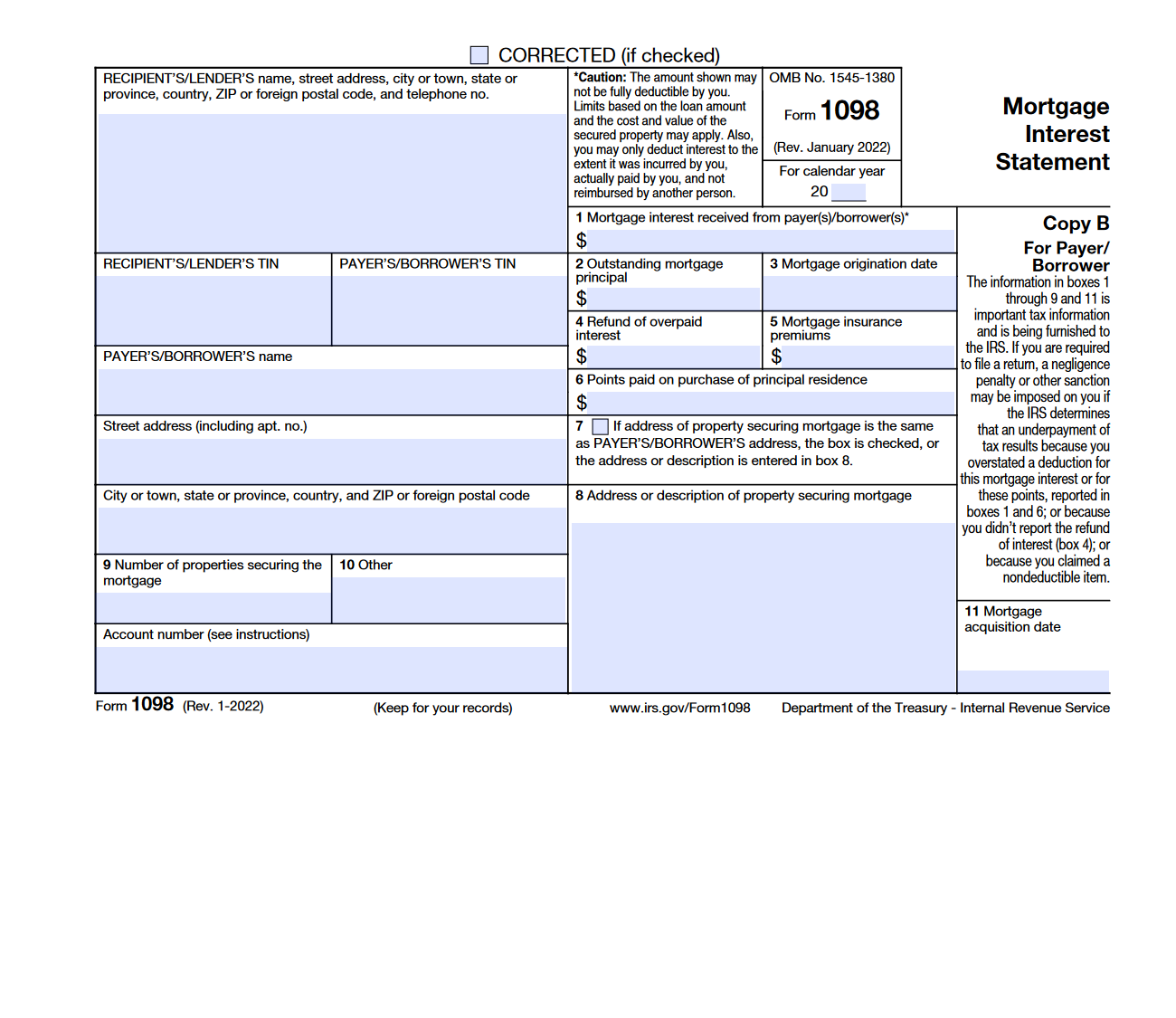

2024 Form 1098 - Irs form 1098 is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the. Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. We last updated federal form 1098 in. Do i have to file form 1098? Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes.

Do i have to file form 1098? Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Irs form 1098 is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the. We last updated federal form 1098 in.

If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Irs form 1098 is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the. Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. Do i have to file form 1098? We last updated federal form 1098 in. Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file.

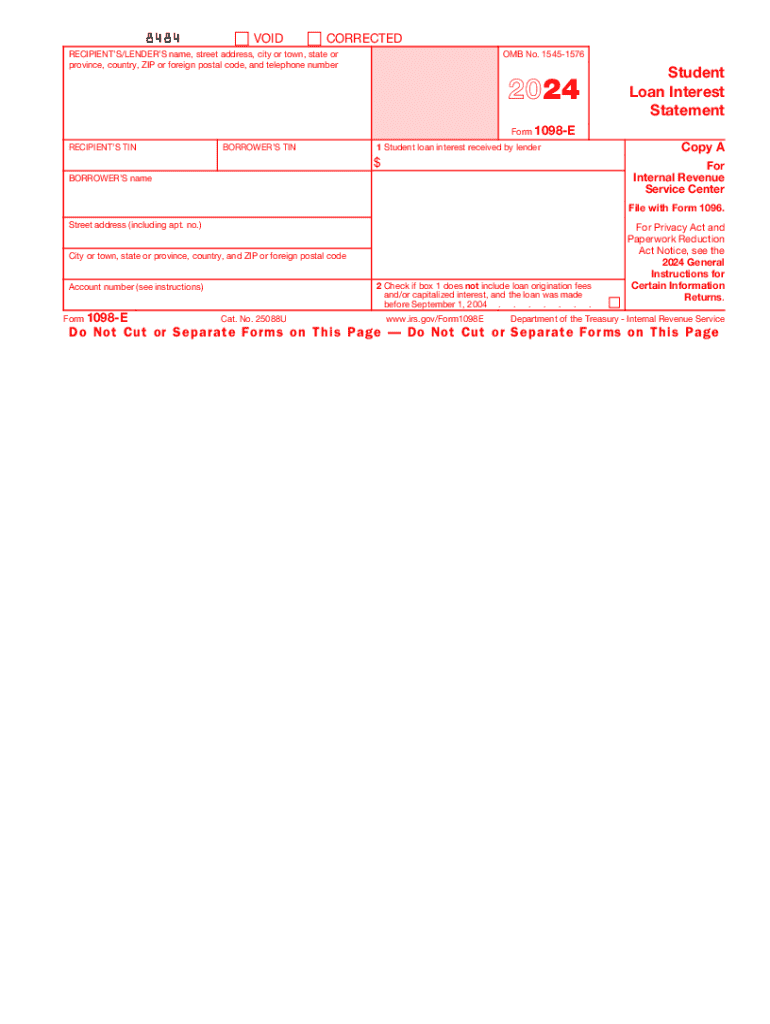

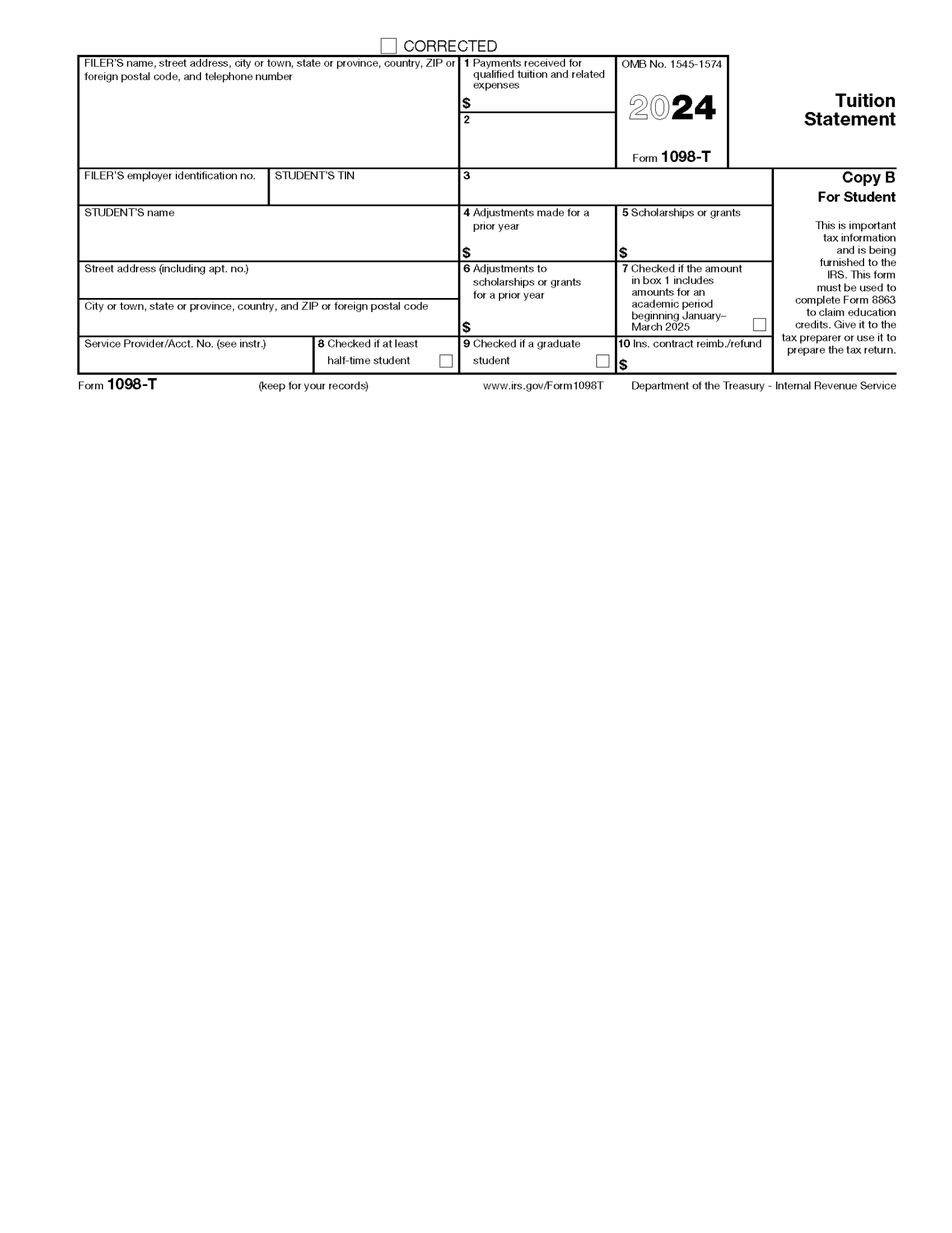

1098 E 20242025 Form Fill Out and Sign Printable PDF Template

If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. Irs form 1098 is used by taxpayers to report the amount of interest and related expenses paid.

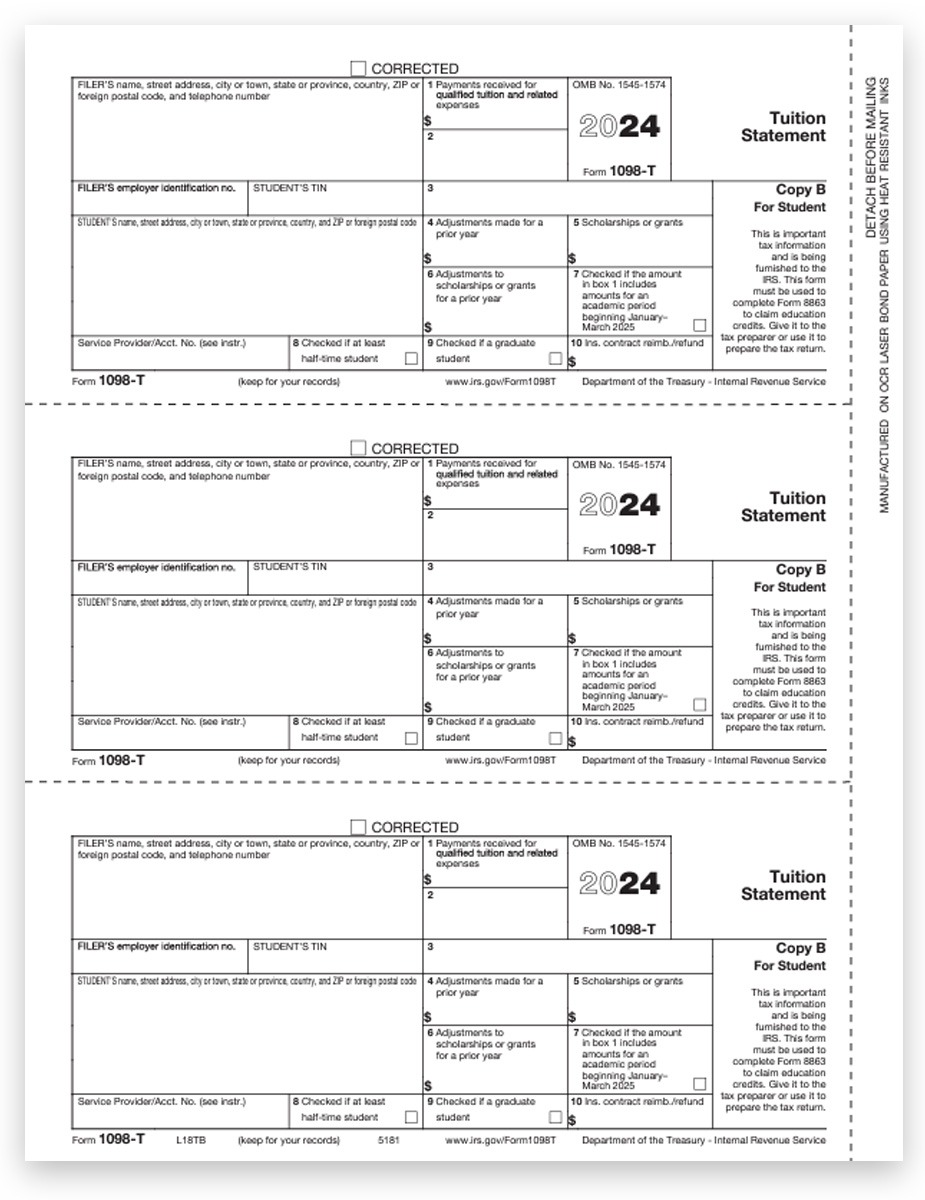

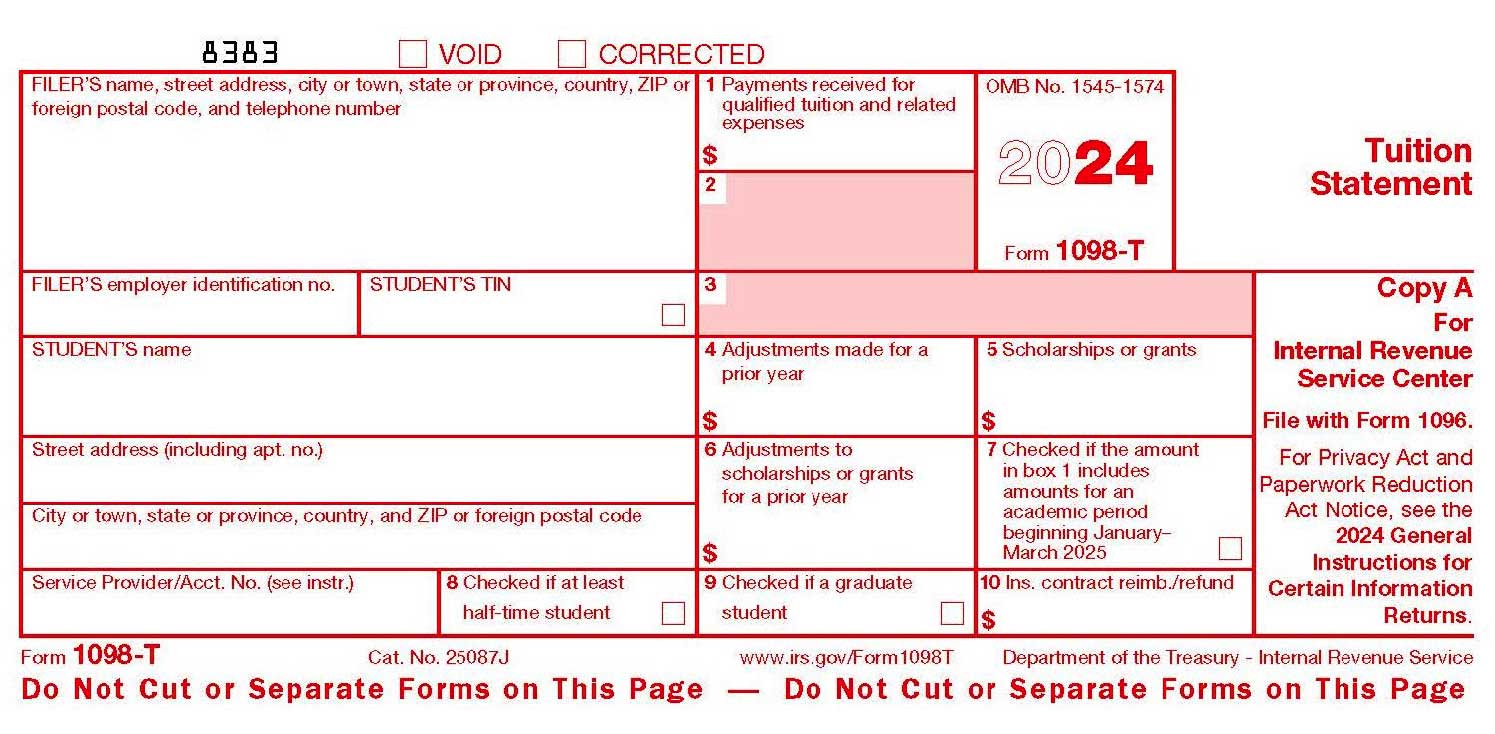

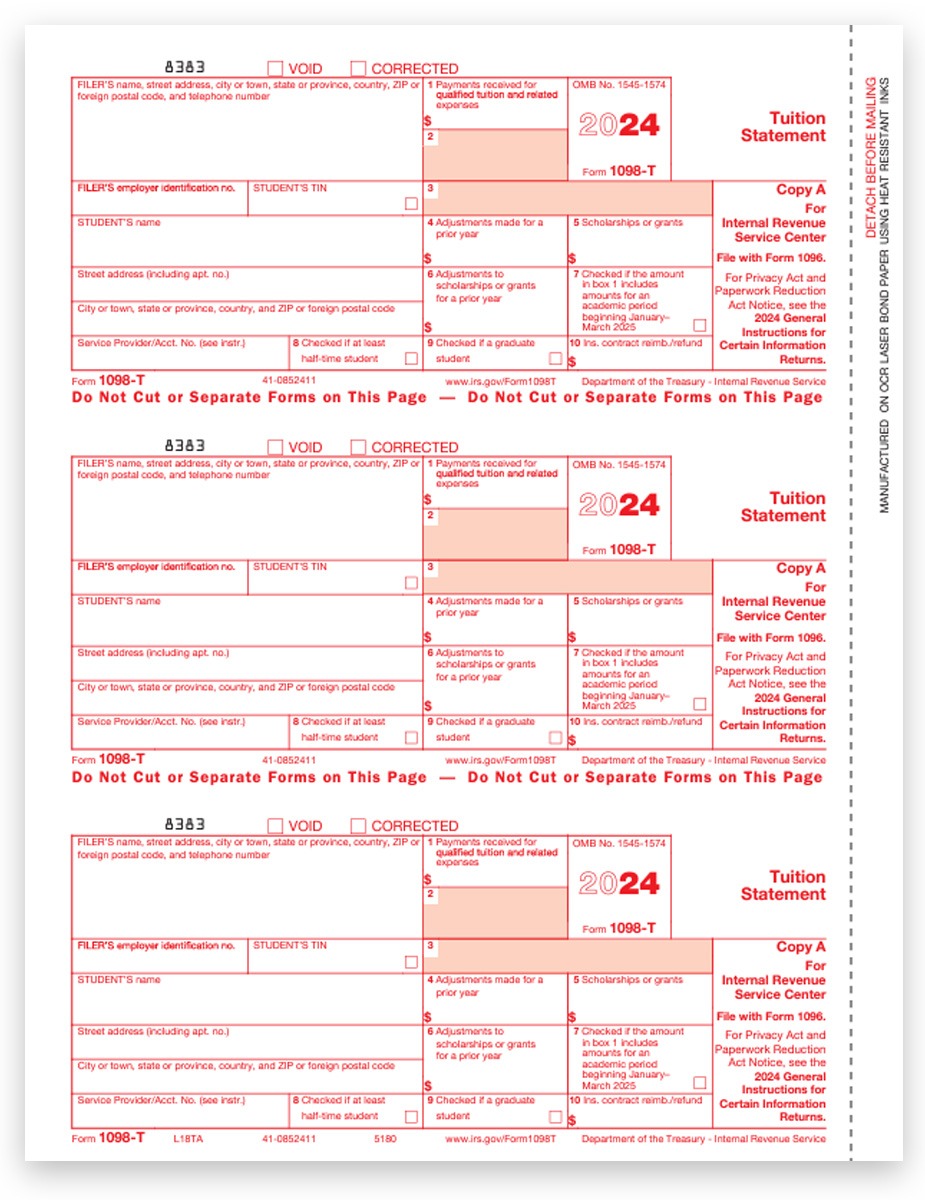

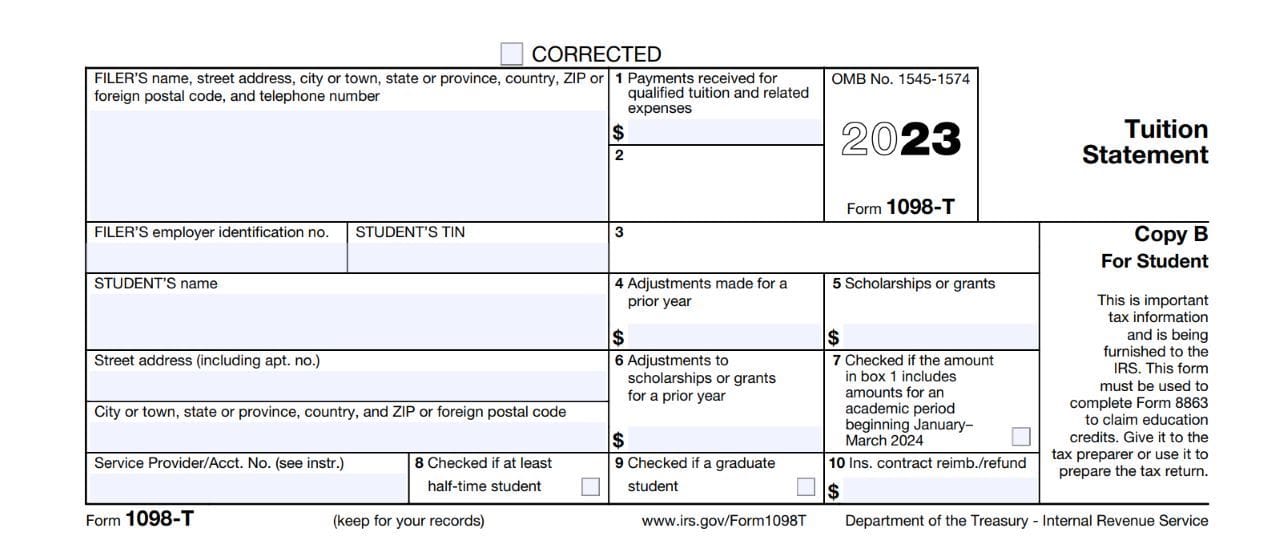

What Is a 1098T? A Guide to Understanding this Tax Form

We last updated federal form 1098 in. Irs form 1098 is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the. Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. Do i have to.

Form 1098 Instructions 2024 Gayle Johnath

If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. We last updated federal form 1098 in. Irs form 1098 is used by taxpayers to report the amount of interest and related.

Free IRS Form 1098T PDF eForms

Irs form 1098 is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the. We last updated federal form 1098 in. Do i have to file form 1098? If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes..

Form 1098 and Your Mortgage Interest Statement

We last updated federal form 1098 in. If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Irs form 1098 is a tax form used to report mortgage interest received in the.

Form 1098 Mortgage Interest Statement and How to File

We last updated federal form 1098 in. Do i have to file form 1098? If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Irs form 1098 is a tax form used.

Free Printable 1098 T Form Free Printables Hub

If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Do i have to file form 1098? Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. Information about form 1098, mortgage interest statement, including recent updates,.

Bursar 1098T Tuition Statement Reporting Hofstra University

Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Do i have to file form 1098? Irs form 1098 is used by taxpayers to report the amount of interest and related.

Free Printable 1098 T Form Free Printables Hub

If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Irs form 1098 is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the. Irs form 1098 is a tax form used to report mortgage interest received in.

Form 1098 Instructions 2024 Sonni Olympe

Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. We last updated federal form 1098 in. Irs form 1098 is used by taxpayers to report the amount of.

We Last Updated Federal Form 1098 In.

If you want to claim your mortgage interest as a deduction, you must use form 1098 to file your taxes. Information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Irs form 1098 is a tax form used to report mortgage interest received in the course of trade or business within a year. Do i have to file form 1098?

/Form1098-5c57730f46e0fb00013a2bee.jpg)