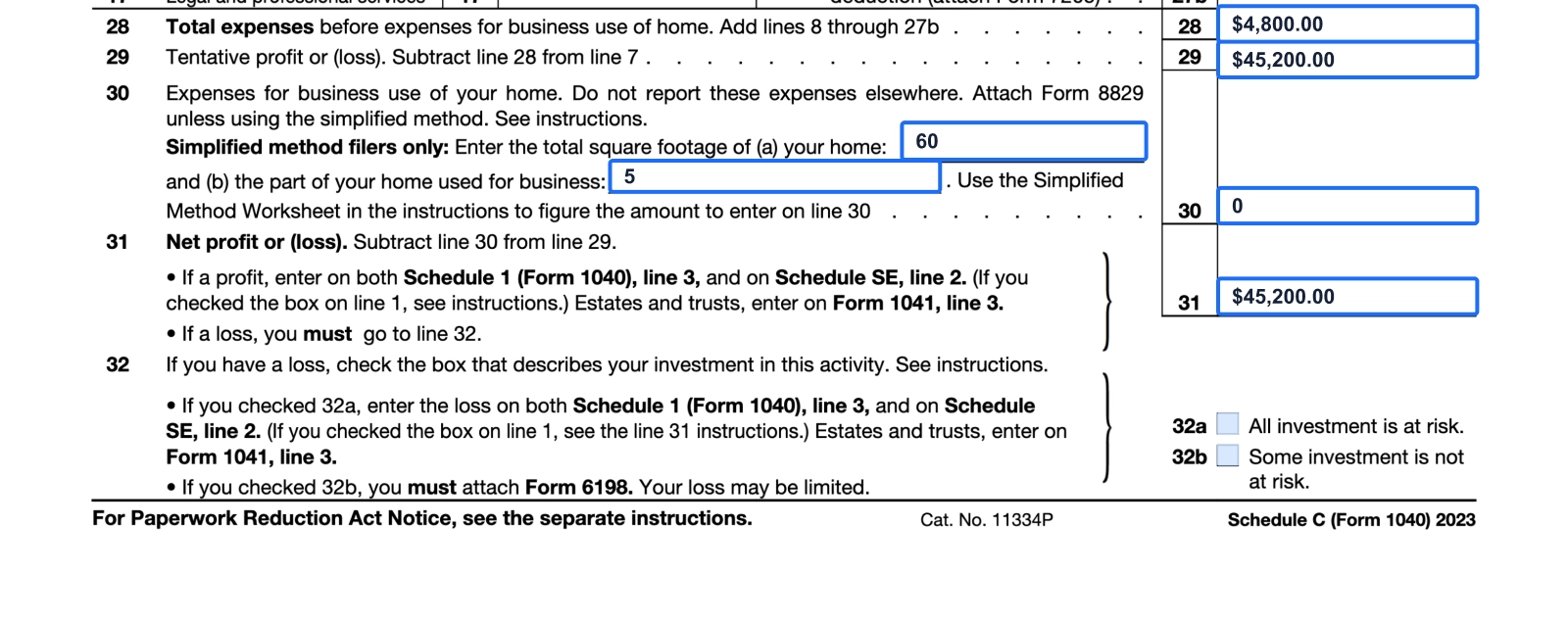

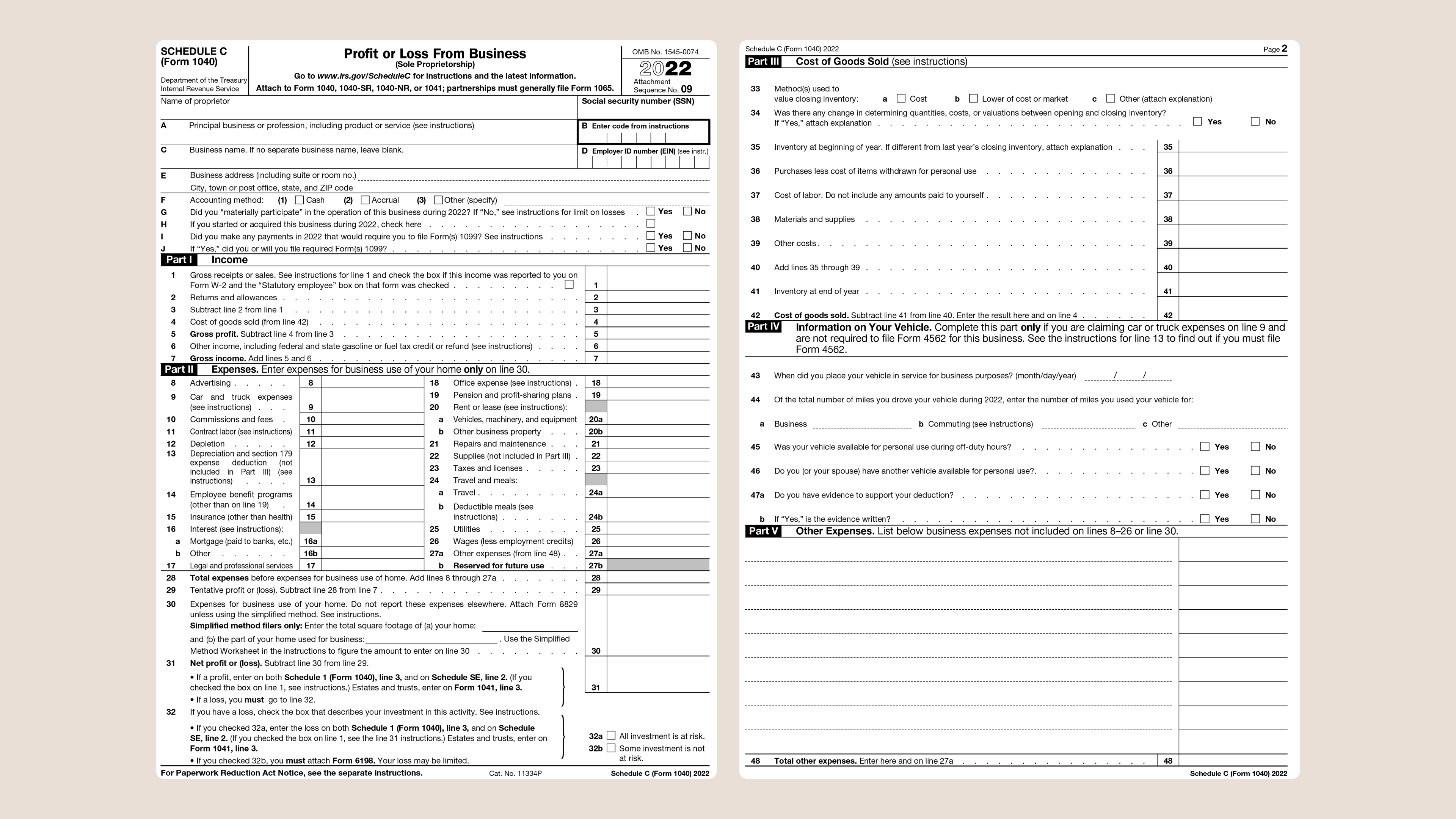

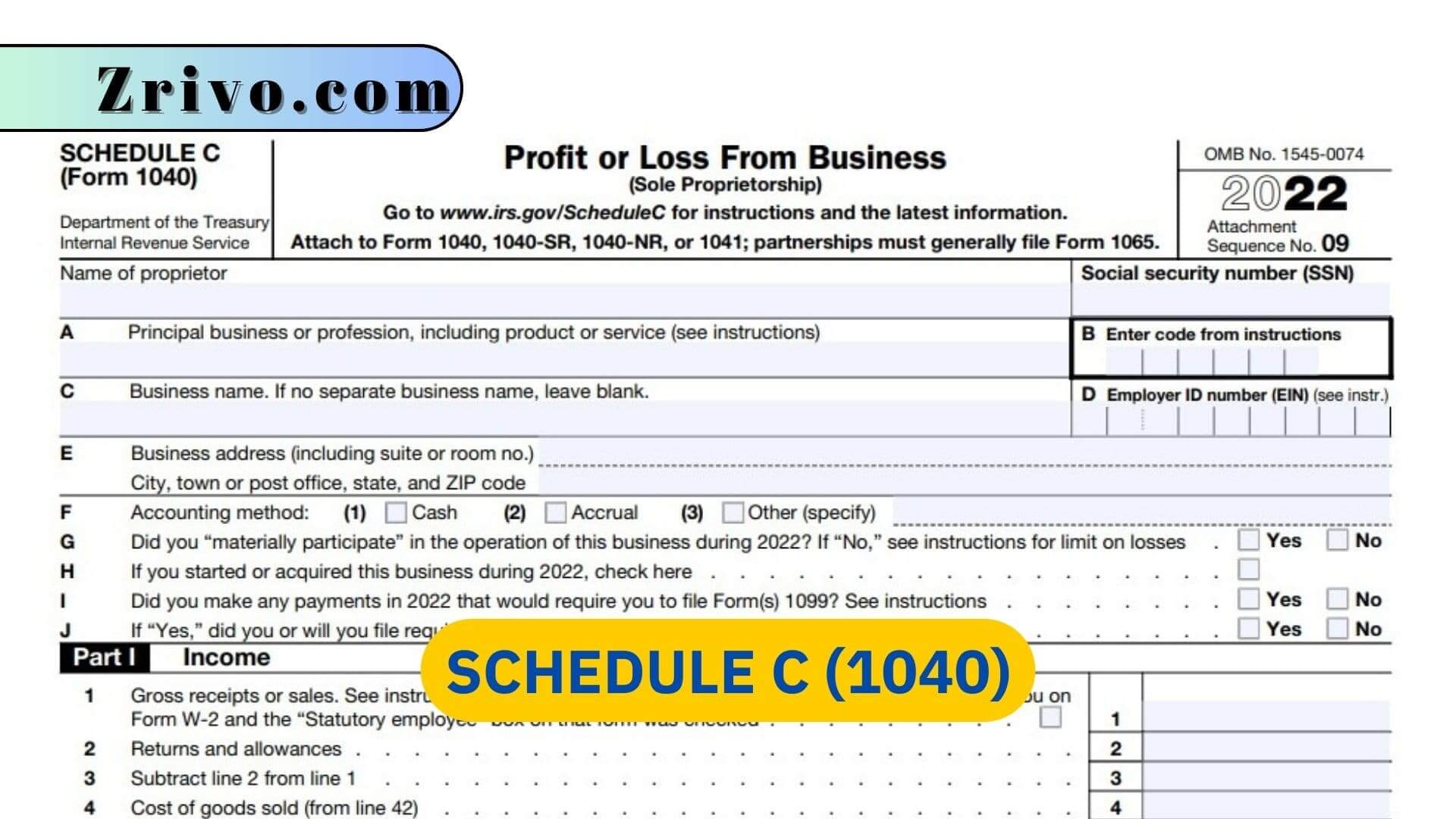

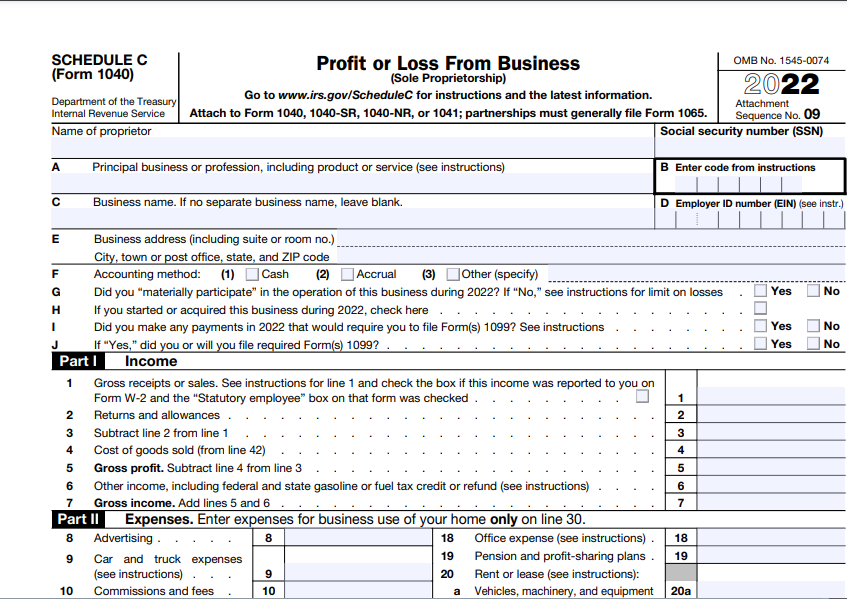

2023 Schedule C Form - Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. (if you checked the box on line 1, see the line 31. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Each of you must file a separate schedule c or f.

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on line 1, see the line 31. Each of you must file a separate schedule c or f. Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Each of you must file a separate schedule c or f. (if you checked the box on line 1, see the line 31. Each of you must file a separate schedule c or f.

Free Printable Schedule C Tax Form FREE Printables

Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Each of you must file a separate schedule c or f. (if you checked the box on line 1, see the line 31. • if.

Schedule C Tax Calculator

Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. (if you checked the box on line 1, see the line 31. Each of you must file a separate schedule c or f. • if.

Schedule C 2023 Form Printable Forms Free Online

Each of you must file a separate schedule c or f. Each of you must file a separate schedule c or f. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form 1040), profit or loss from business, used to report income or.

How to Fill Out Schedule C Form 1040 for 2023 Taxes 2024 Money

Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Each of you must file a separate schedule c or f. (if you checked the box on line 1, see the line 31. • if.

Schedule C (1040) 2023 2024

Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. Each of you must file a separate schedule c or f. • if you checked 32a, enter the loss on both schedule 1 (form 1040),.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

(if you checked the box on line 1, see the line 31. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Each of.

Schedule C Tax Form A Complete Guide for Small Businesses

Each of you must file a separate schedule c or f. Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. (if you checked the box on line 1, see the line 31. • if.

Schedule C (Form 1040) 2023 Instructions

(if you checked the box on line 1, see the line 31. Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. • if you checked 32a, enter the loss on both schedule 1 (form.

Business Schedule C Worksheet

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Each of you must file a separate schedule c or f. Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or.

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

(if you checked the box on line 1, see the line 31. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income.

(If You Checked The Box On Line 1, See The Line 31.

Each of you must file a separate schedule c or f. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Each of you must file a separate schedule c or f.